Answered step by step

Verified Expert Solution

Question

1 Approved Answer

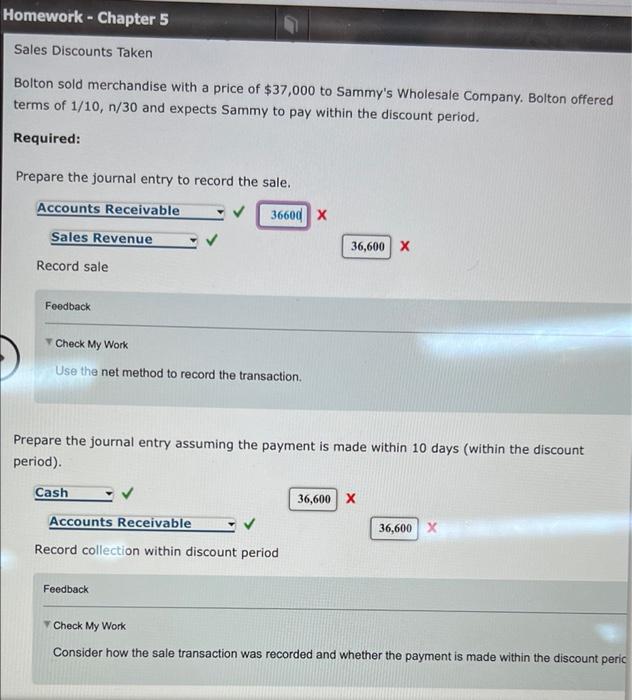

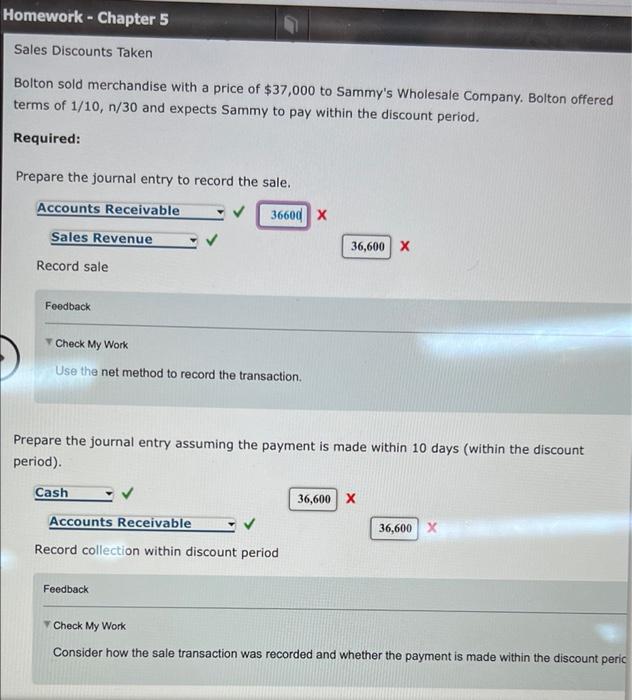

Question 1 Question 2 Question 3 Homework - Chapter 5 Sales Discounts Taken Bolton sold merchandise with a price of $37,000 to Sammy's Wholesale Company.

Question 1

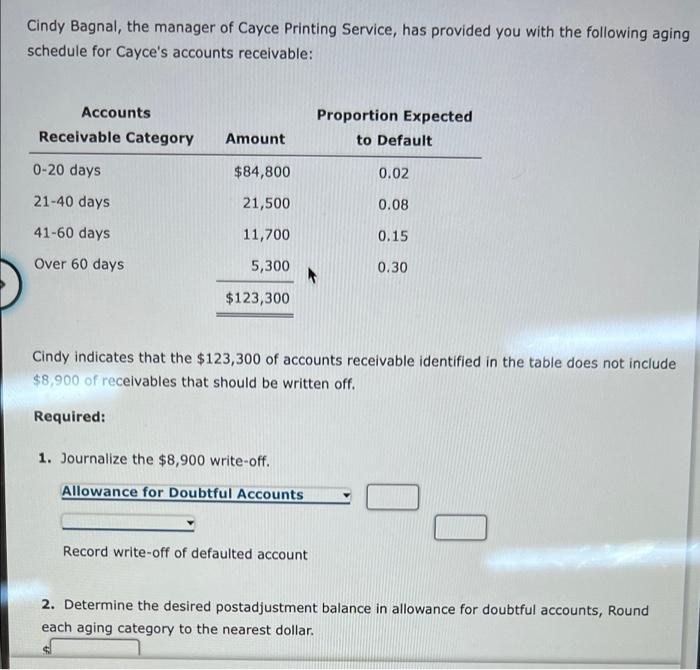

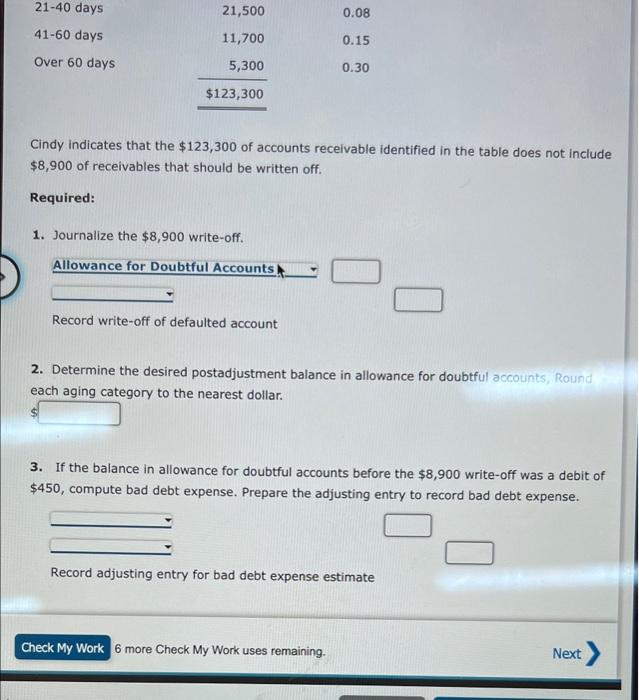

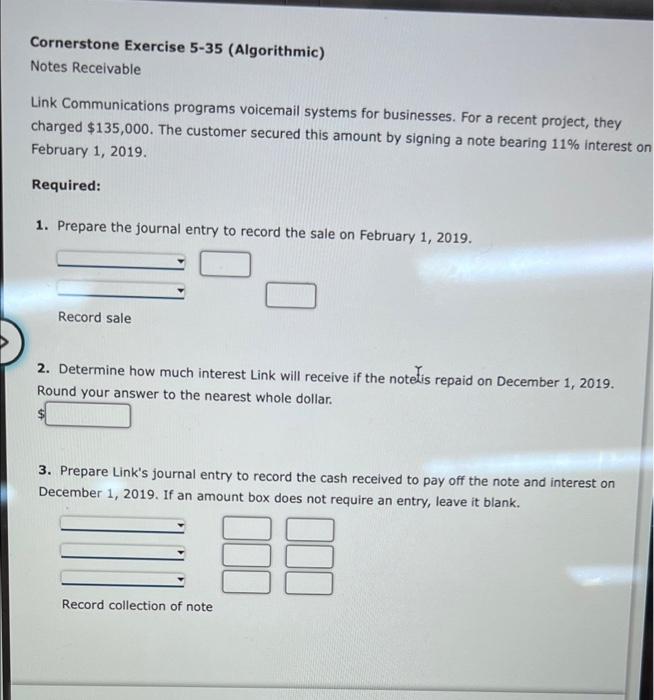

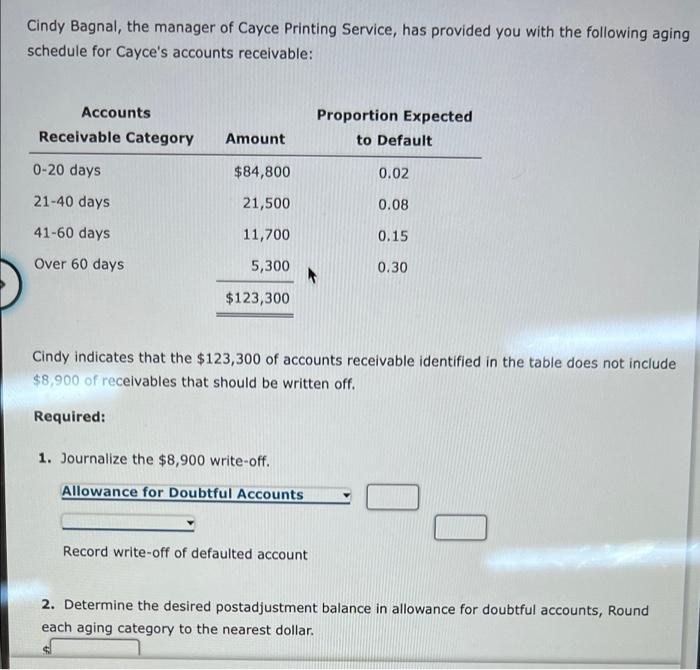

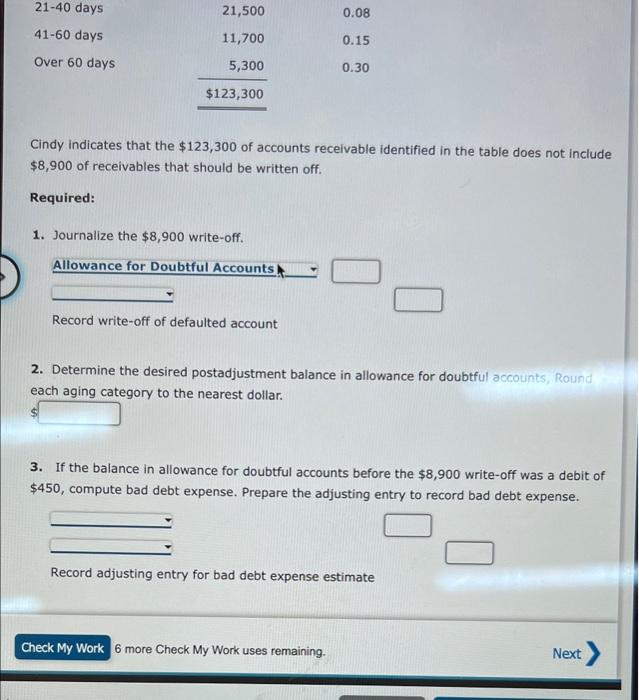

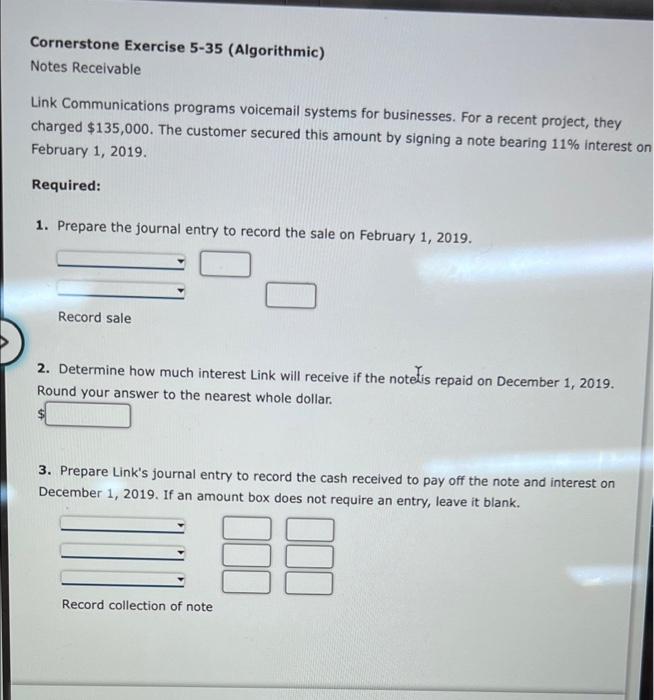

Homework - Chapter 5 Sales Discounts Taken Bolton sold merchandise with a price of $37,000 to Sammy's Wholesale Company. Bolton offered terms of 1/10, n/30 and expects Sammy to pay within the discount period. Required: Prepare the journal entry to record the sale. Accounts Receivable 36600 X Sales Revenue 36,600 X Record sale Feedback Check My Work Use the net method to record the transaction. Prepare the journal entry assuming the payment is made within 10 days (within the discount period). Cash 36,600 X Accounts Receivable 36,600 X Record collection within discount period Feedback Check My Work Consider how the sale transaction was recorded and whether the payment is made within the discount peric Cindy Bagnal, the manager of Cayce Printing Service, has provided you with the following aging schedule for Cayce's accounts receivable: Accounts Receivable Category Proportion Expected to Default Amount 0-20 days $84,800 0.02 21-40 days 21,500 0.08 41-60 days 11,700 0.15 Over 60 days 5,300 0.30 $123,300 Cindy indicates that the $123,300 of accounts receivable identified in the table does not include $8.900 of receivables that should be written off. Required: 1. Journalize the $8,900 write-off. Allowance for Doubtful Accounts Record write-off of defaulted account 2. Determine the desired postadjustment balance in allowance for doubtful accounts, Round each aging category to the nearest dollar. 21-40 days 0.08 21,500 11,700 41-60 days 0.15 Over 60 days 5,300 0.30 $123,300 Cindy indicates that the $123,300 of accounts receivable identified in the table does not include $8,900 of receivables that should be written off Required: 1. Journalize the $8,900 write-off. Allowance for Doubtful Accounts Record write-off of defaulted account 2. Determine the desired postadjustment balance in allowance for doubtful accounts, Round each aging category to the nearest dollar. 3. If the balance in allowance for doubtful accounts before the $8,900 write-off was a debit of $450, compute bad debt expense. Prepare the adjusting entry to record bad debt expense. Record adjusting entry for bad debt expense estimate Check My Work 6 more Check My Work uses remaining. Next Cornerstone Exercise 5-35 (Algorithmic) Notes Receivable Link Communications programs voicemail systems for businesses. For a recent project, they charged $135,000. The customer secured this amount by signing a note bearing 11% interest on February 1, 2019. Required: 1. Prepare the journal entry to record the sale on February 1, 2019. Record sale 2. Determine how much interest Link will receive if the noteris repaid on December 1, 2019. Round your answer to the nearest whole dollar. 3. Prepare Link's journal entry to record the cash received to pay off the note and interest on December 1, 2019. If an amount box does not require an entry, leave it blank. 88 Record collection of

Question 2

Question 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started