Answered step by step

Verified Expert Solution

Question

1 Approved Answer

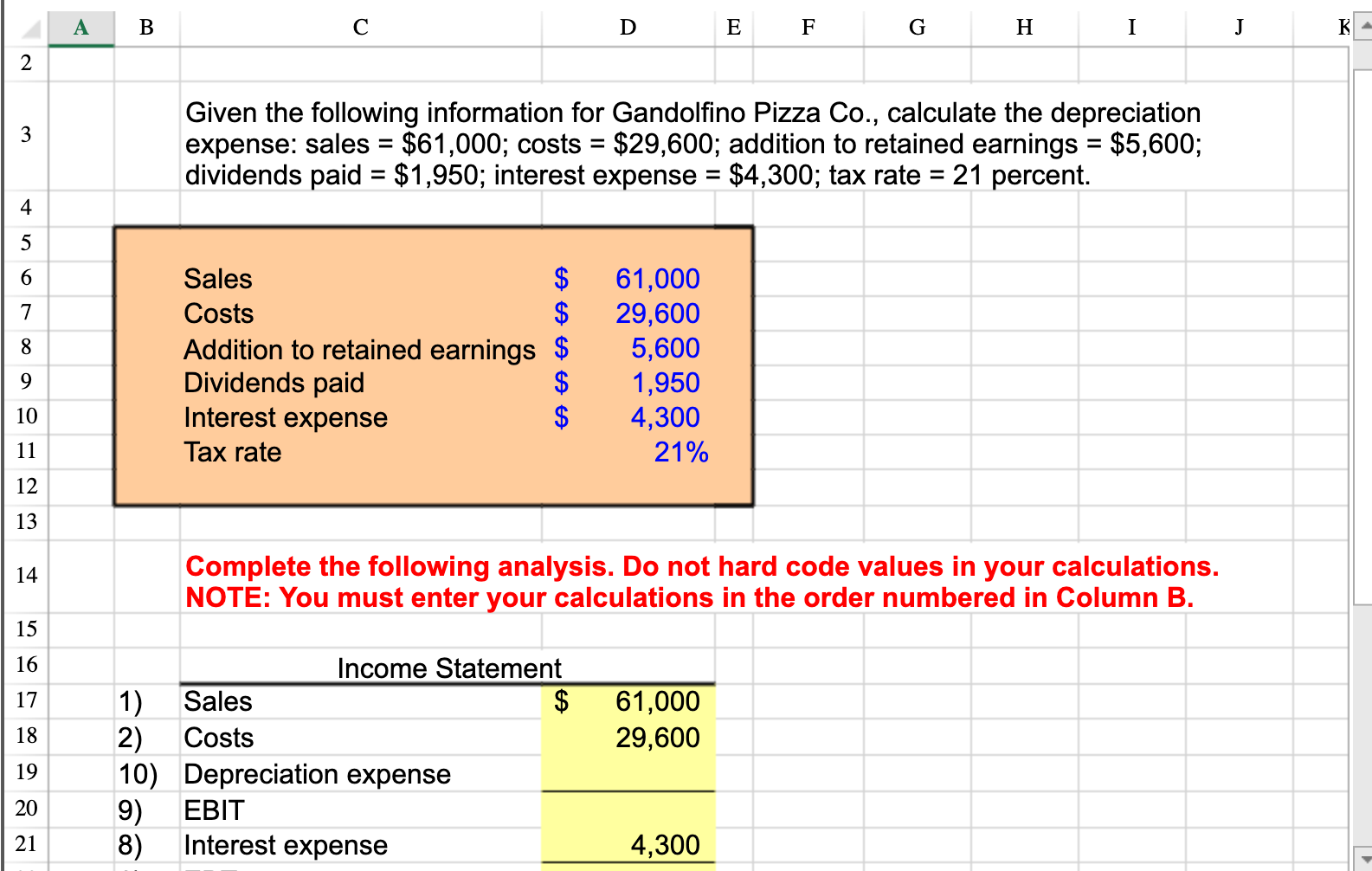

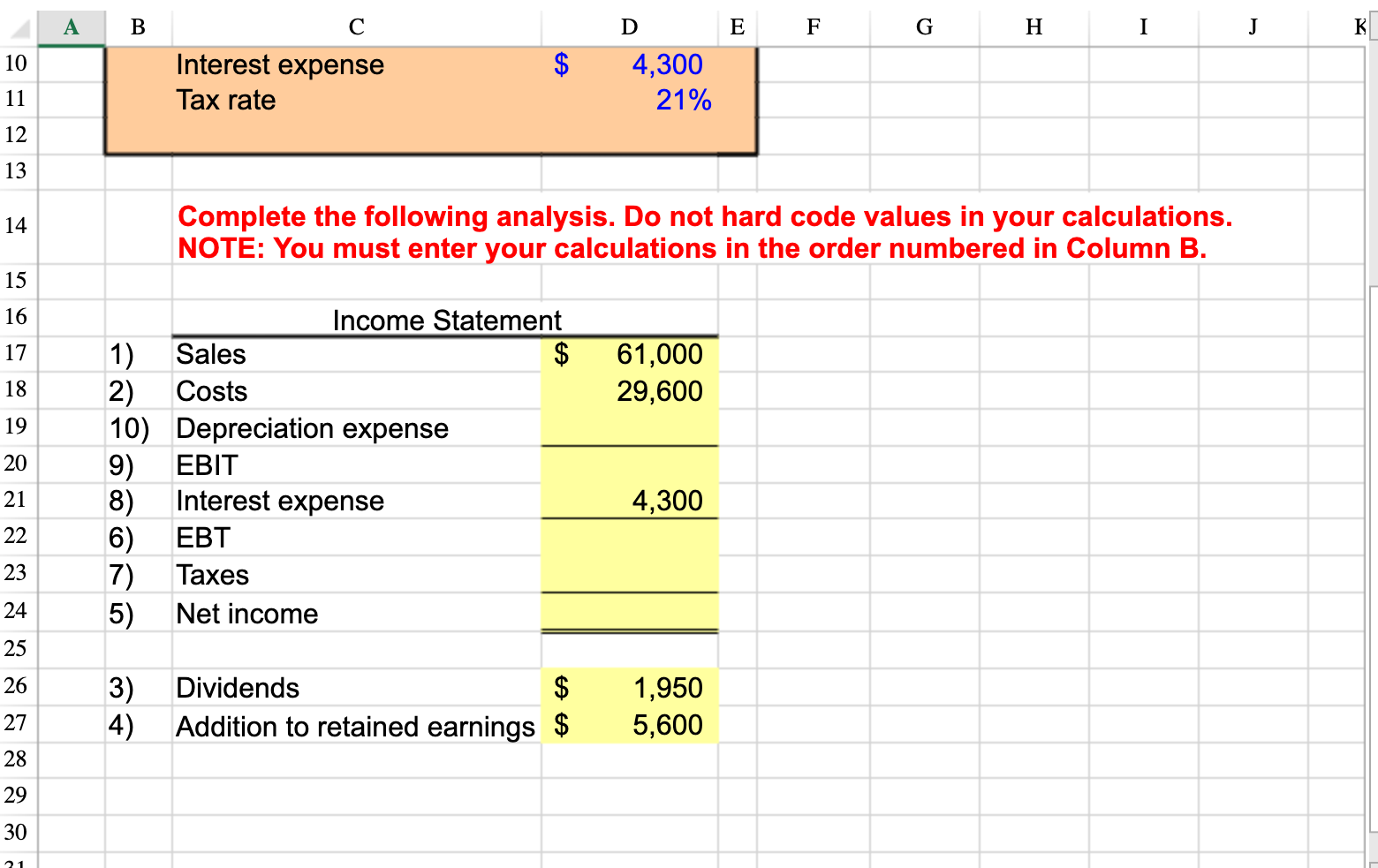

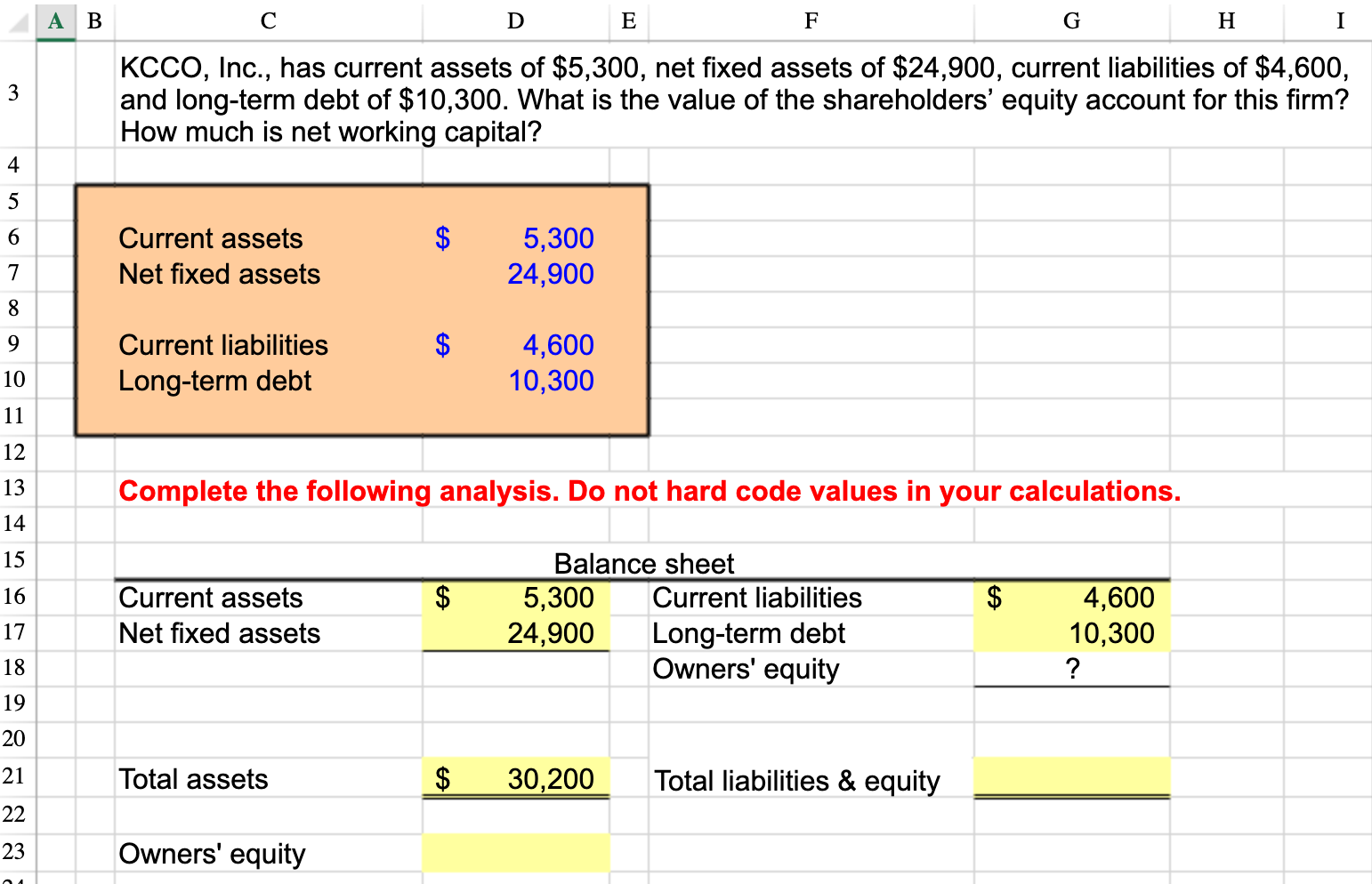

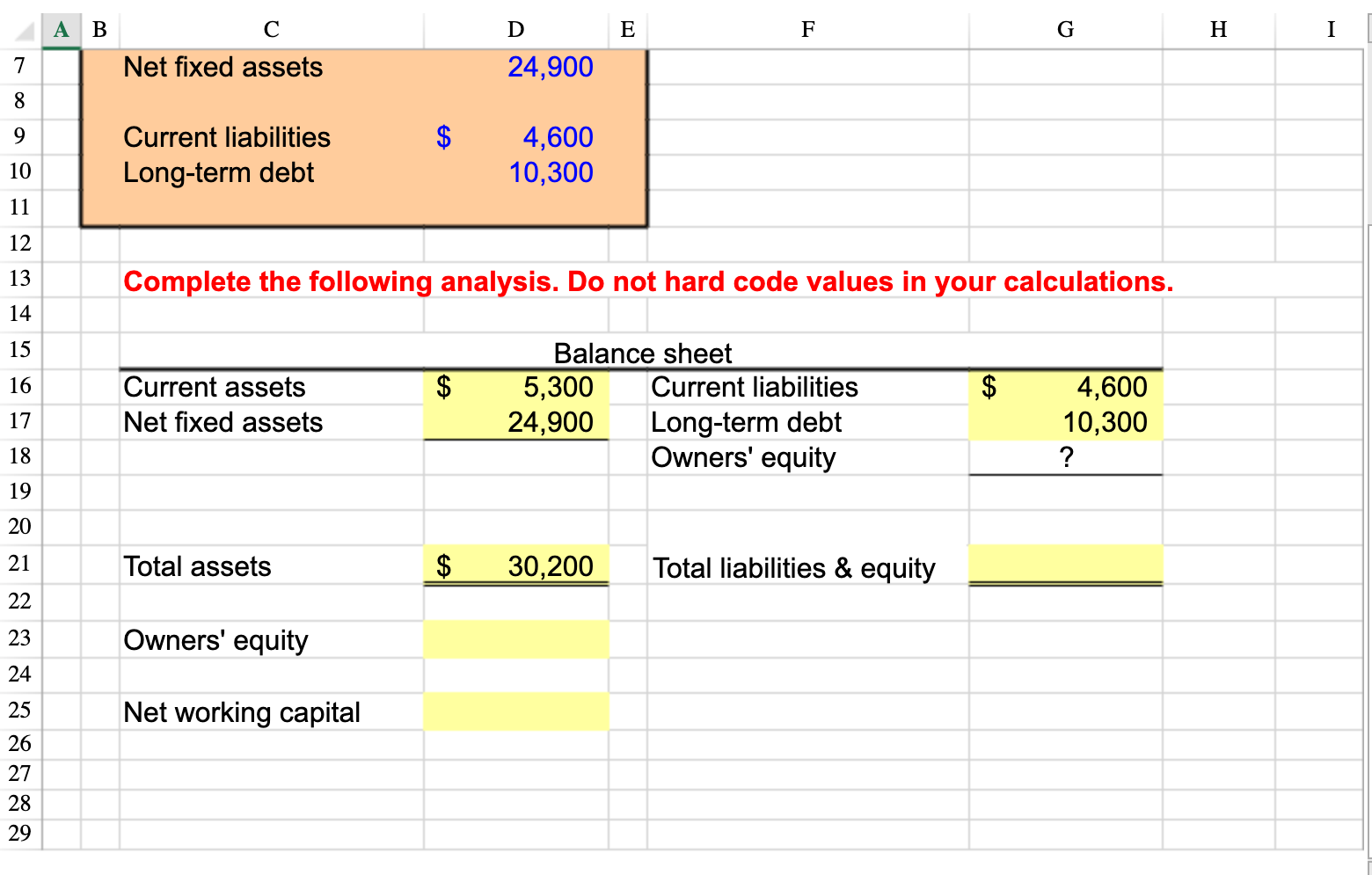

question 1 ^ question 2 ^ question 3 ^ please fill in blanks by using correct formulas :) B D E F G H I

question 1 ^

question 1 ^

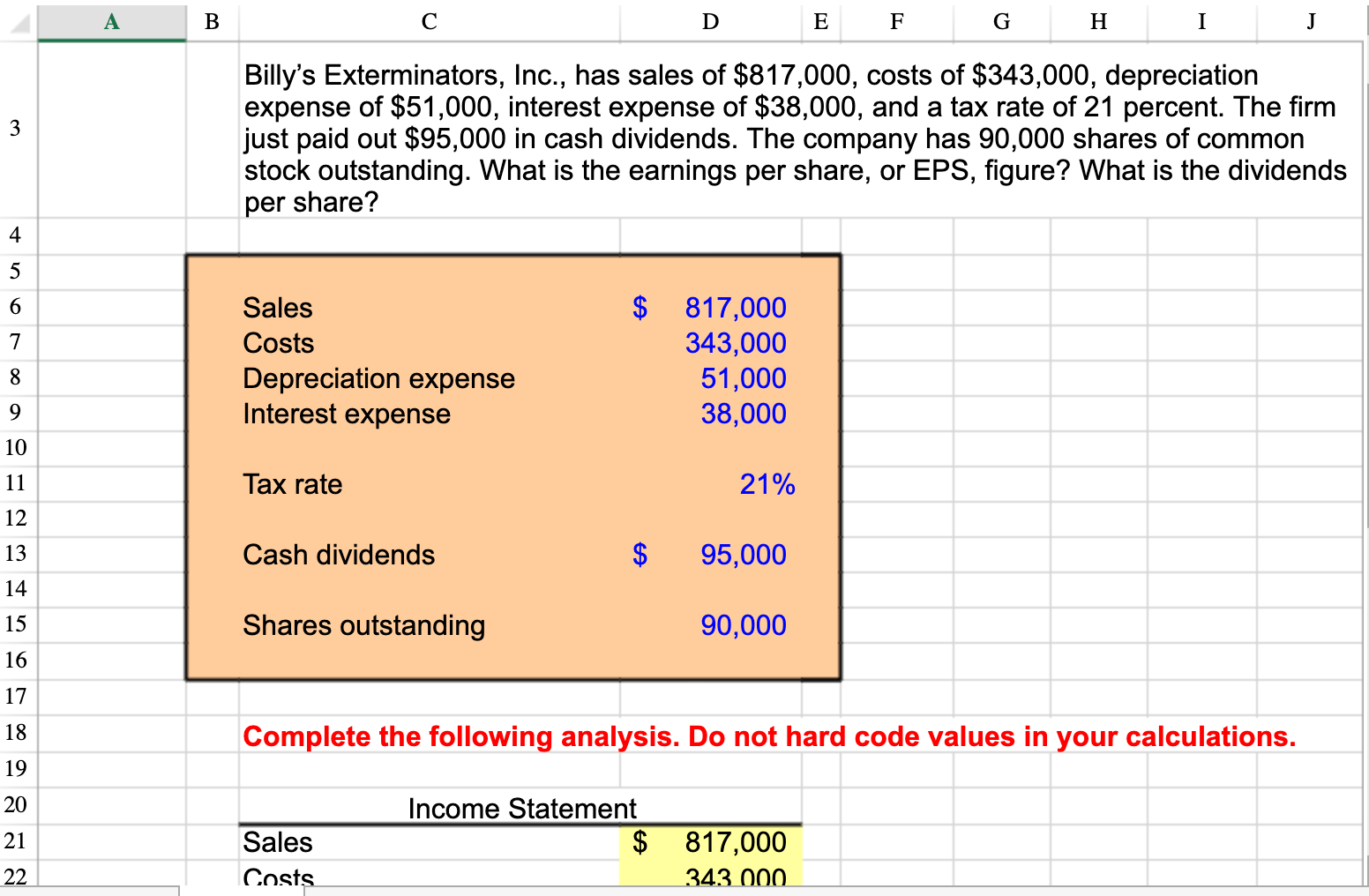

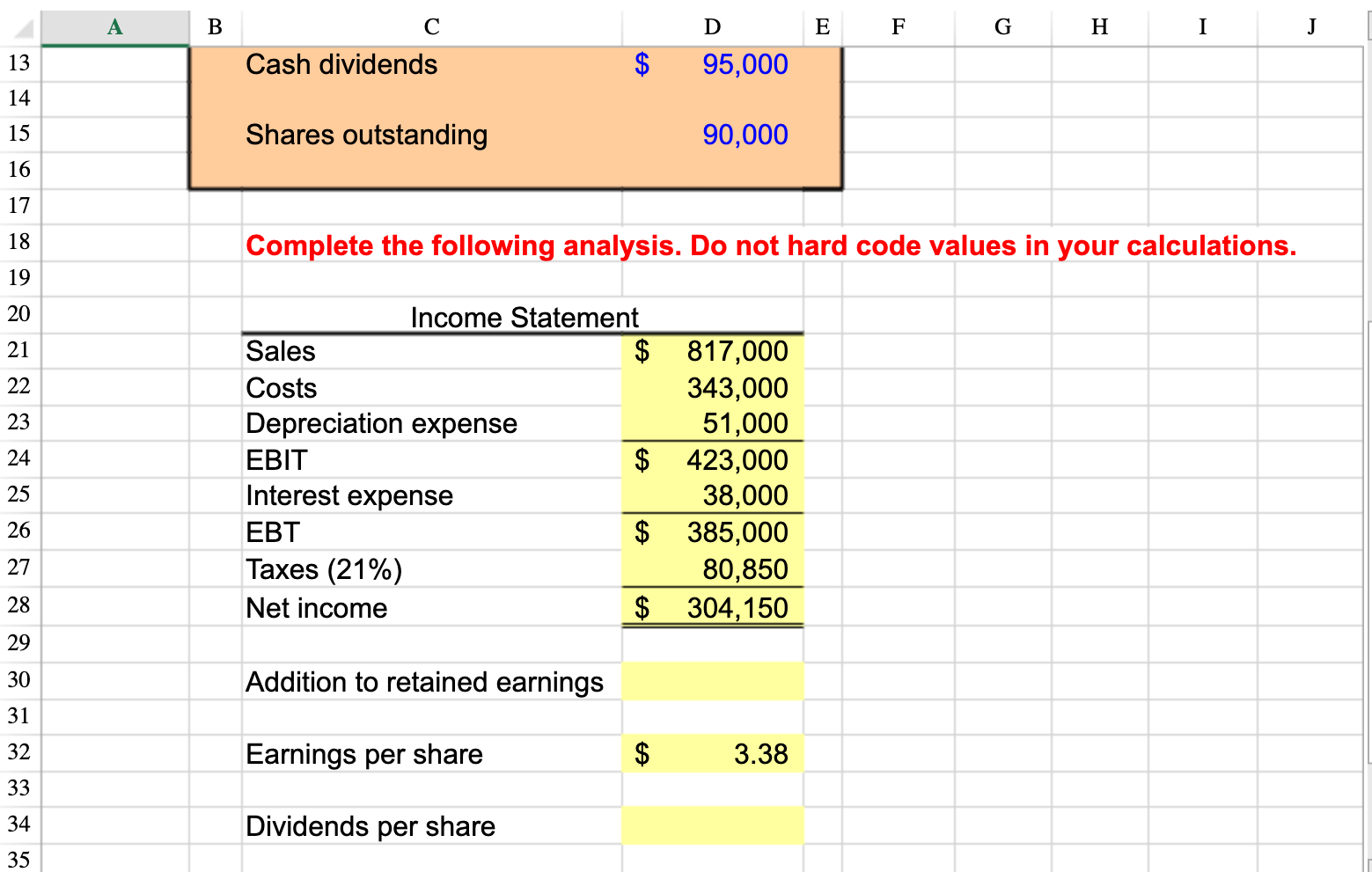

question 2 ^

question 2 ^

question 3 ^

question 3 ^

please fill in blanks by using correct formulas :)

B D E F G H I J K - 2 3 Given the following information for Gandolfino Pizza Co., calculate the depreciation expense: sales = $61,000; costs = $29,600; addition to retained earnings = $5,600; dividends paid = $1,950; interest expense = $4,300; tax rate = 21 percent. = = = 4 5 6 7 8 Sales $ Costs $ Addition to retained earnings $ Dividends paid $ Interest expense $ Tax rate 61,000 29,600 5,600 1,950 4,300 21% 9 10 11 12 13 14 Complete the following analysis. Do not hard code values in your calculations. NOTE: You must enter your calculations in the order numbered in Column B. 15 16 17 61,000 29,600 18 Income Statement 1) Sales $ 2) Costs 10) Depreciation expense 9) EBIT 8) Interest expense 19 20 21 4,300 B F G H I J K 10 $ Interest expense Tax rate D E 4,300 21% 11 12 13 14 Complete the following analysis. Do not hard code values in your calculations. NOTE: You must enter your calculations in the order numbered in Column B. 15 16 17 61,000 29,600 18 19 20 Income Statement 1) Sales $ 2) Costs 10) Depreciation expense 9) EBIT 8) Interest expense 6) EBT 7) Taxes 5) Net income 21 4,300 22 23 24 25 26 3) 4) Dividends $ Addition to retained earnings $ 1,950 5,600 27 28 29 30 21 A B D E F G H I J 3 Billy's Exterminators, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000, interest expense of $38,000, and a tax rate of 21 percent. The firm just paid out $95,000 in cash dividends. The company has 90,000 shares of common stock outstanding. What is the earnings per share, or EPS, figure? What is the dividends per share? 4 5 6 7 Sales Costs Depreciation expense Interest expense $ 817,000 343,000 51,000 38,000 8 9 10 11 Tax rate 21% 12 13 Cash dividends 95,000 14 15 Shares outstanding 90,000 16 17 18 Complete the following analysis. Do not hard code values in your calculations. 19 20 21 Sales Costs Income Statement $ 817,000 343 000. 22 A B D E F G H I J 13 Cash dividends $ 95,000 14 15 Shares outstanding 90,000 16 17 18 Complete the following analysis. Do not hard code values in your calculations. 19 20 21 22 23 24 Income Statement Sales $ 817,000 Costs 343,000 Depreciation expense 51,000 EBIT $ 423,000 Interest expense 38,000 $ 385,000 Taxes (21%) 80,850 Net income $ 304,150 25 26 27 28 29 30 Addition to retained earnings 31 32 Earnings per share $ 3.38 33 34 Dividends per share 35 A B F G H I D E KCCO, Inc., has current assets of $5,300, net fixed assets of $24,900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of the shareholders' equity account for this firm? How much is net working capital? 3 4 5 6 $ Current assets Net fixed assets 5,300 24,900 7 8 9 $ Current liabilities Long-term debt 4,600 10,300 10 11 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 $ $ Current assets Net fixed assets Balance sheet 5,300 Current liabilities 24,900 Long-term debt Owners' equity 17 4,600 10,300 ? 18 19 20 21 Total assets $ 30,200 Total liabilities & equity 22 23 Owners' equity A B D E F G H I 7 Net fixed assets 24,900 8 9 $ Current liabilities Long-term debt 4,600 10,300 10 11 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 $ $ Current assets Net fixed assets Balance sheet 5,300 Current liabilities 24,900 Long-term debt Owners' equity 17 4,600 10,300 ? 18 19 20 21 Total assets $ 30,200 Total liabilities & equity 22 23 Owners' equity 24 25 Net working capital 26 27 28 29Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started