Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 question 2 question 3 question 4 Admitting New Partner With Bonus a. Determine the recipient and amount of the partner bonus. Feedback T

question 1

question 2

question 3

question 4

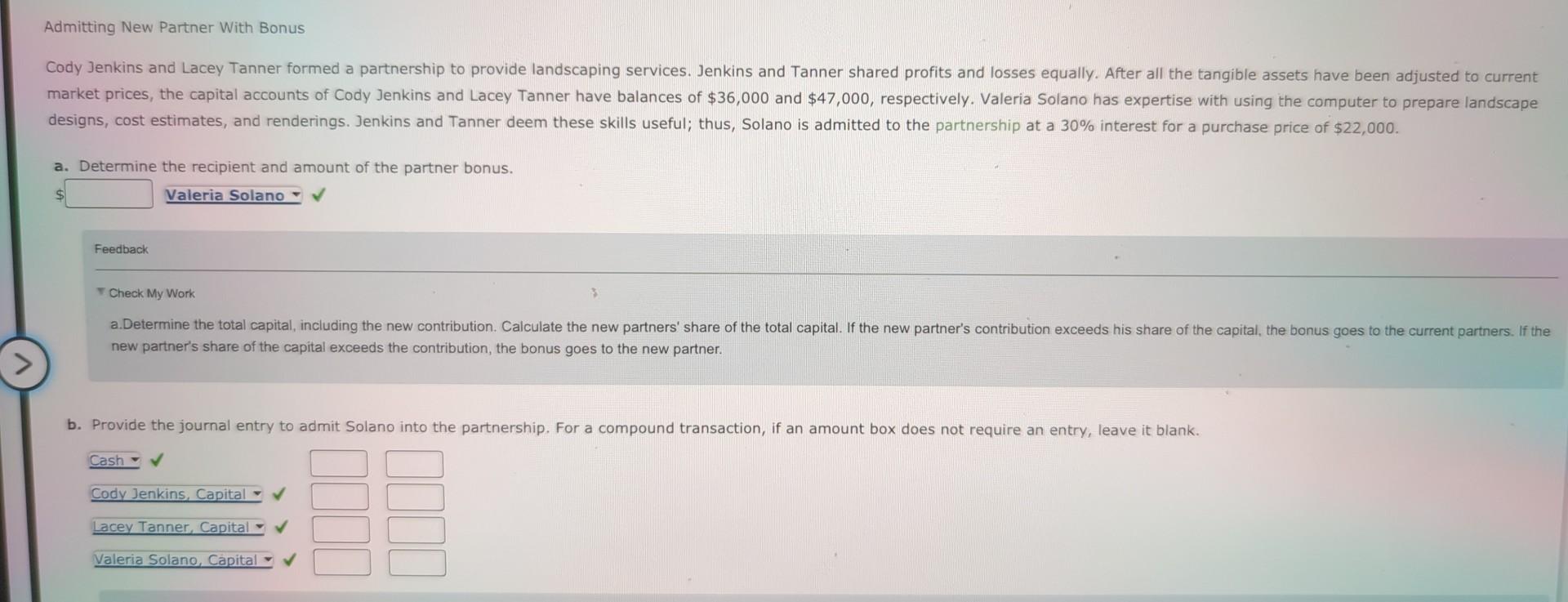

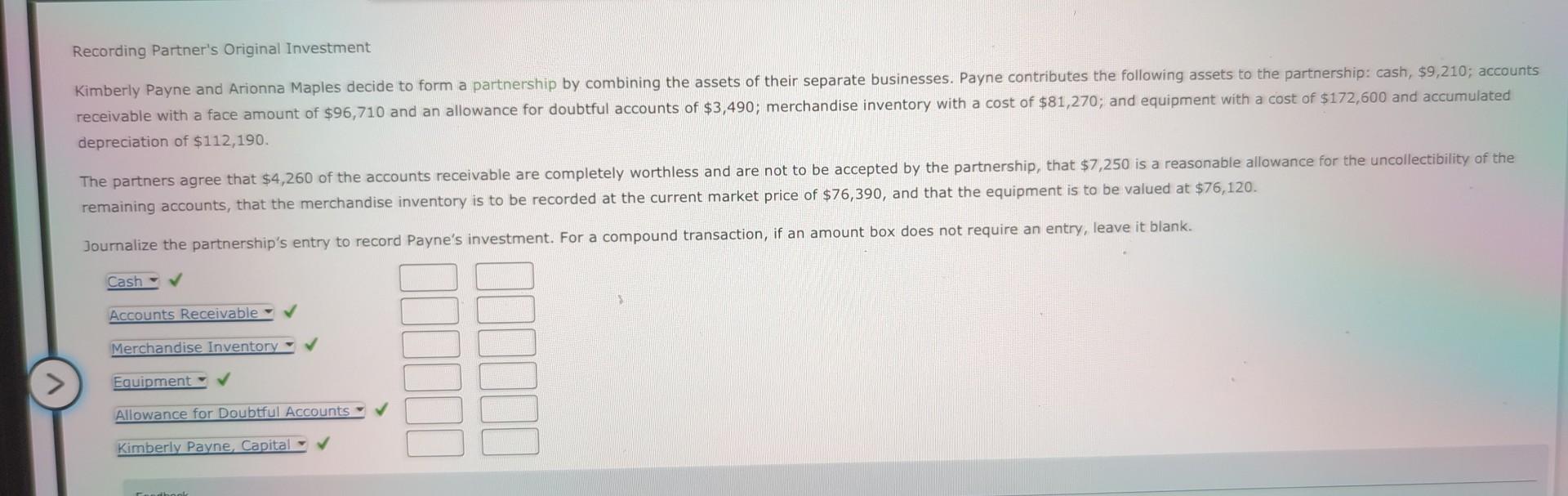

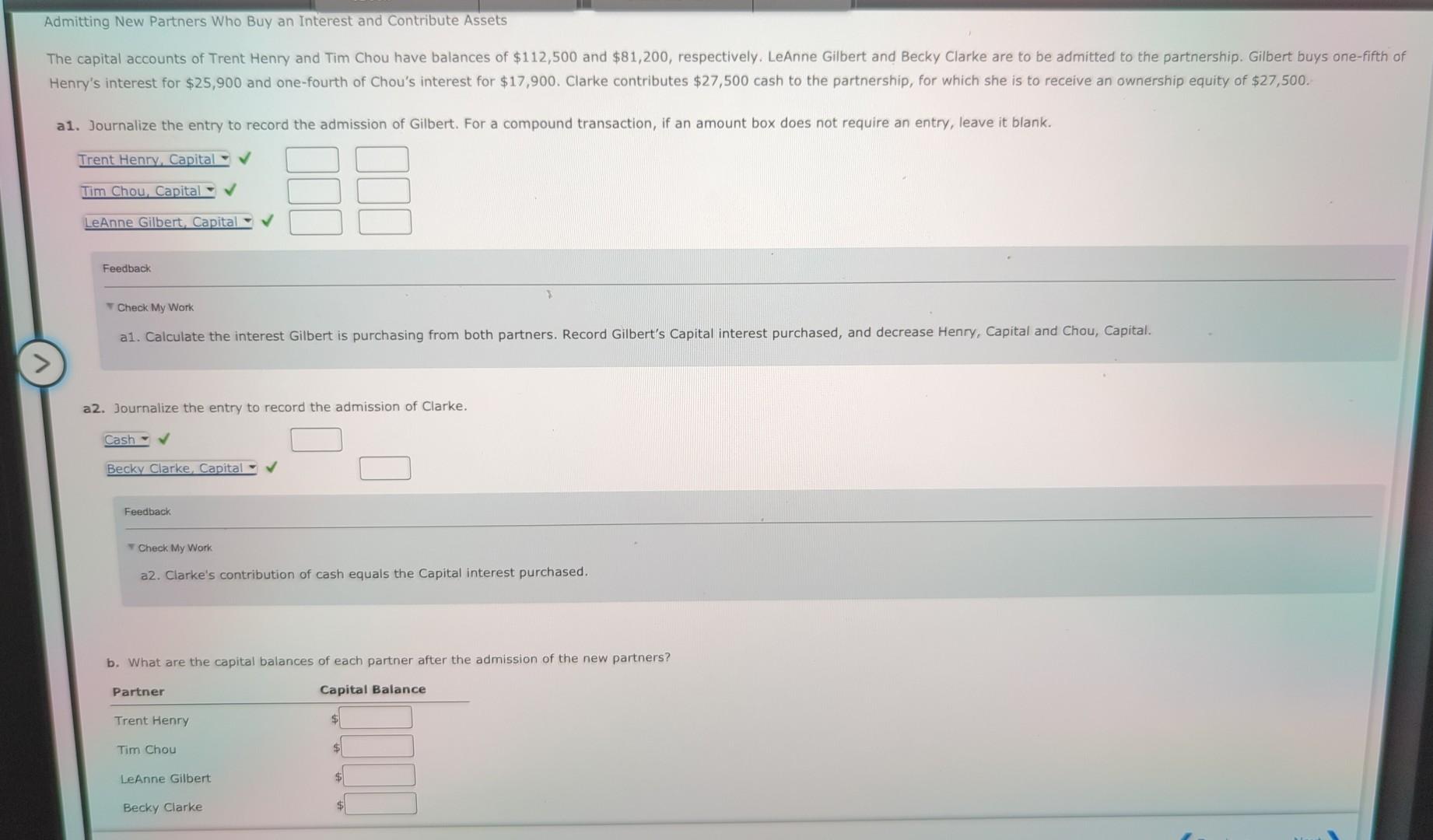

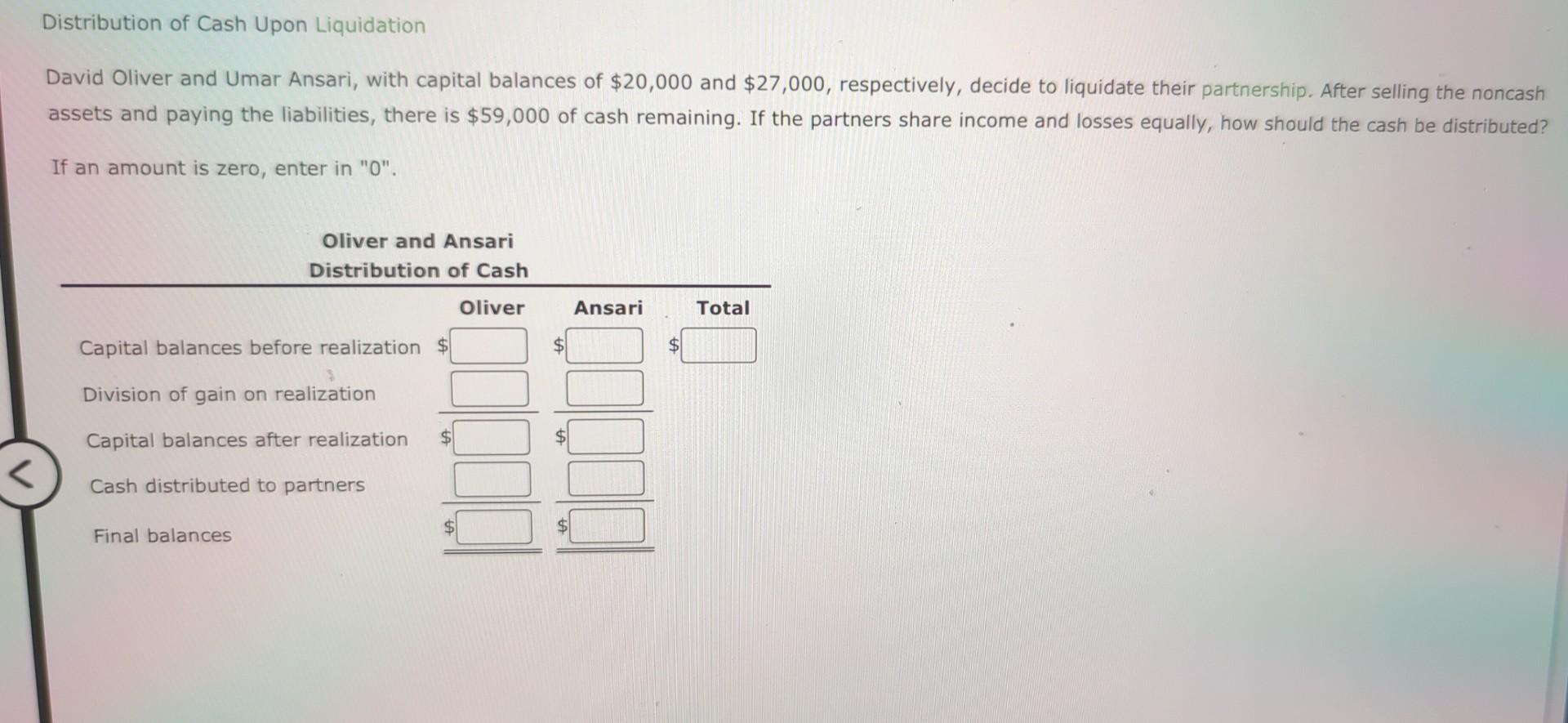

Admitting New Partner With Bonus a. Determine the recipient and amount of the partner bonus. Feedback T Check My Work new partner's share of the capital exceeds the contribution, the bonus goes to the new partner. Recording Partner's Original Investment depreciation of $112,190. remaining accounts, that the merchandise inventory is to be recorded at the current market price of $76,390, and that the equipment is $76,120. Journalize the partnership's entry to record Payne's investment. For a compound transaction, if an amount box does not require an entry, leave it blank. a1. Journalize the entry to record the admission of Gilbert. For a compound transaction, if an amount box does not require an entry, leave it blank. Feedback T Check My Work a2. Journalize the entry to record the admission of Clarke. Feedback w Check My Work a2. Clarke's contribution of cash equals the Capital interest purchased. b. What are the capital balances of each partner after the admission of the new partners? Distribution of Cash Upon Liquidation David Oliver and Umar Ansari, with capital balances of $20,000 and $27,000, respectively, decide to liquidate their partnership. After selling the noncash assets and paying the liabilities, there is $59,000 of cash remaining. If the partners share income and losses equally, how should the cash be distributed? If an amount is zero, enter in "0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started