Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 Question 10 You are requested to solve

Question 1

Question 2

Question 3

Question 4

Question 5

Question 6

Question 7

Question 8

Question 9

Question 10

You are requested to solve these 10 questions. I have tried a lot but can't yet correct answers yet. Please send me the answers before November 10, 2021.

Thank You

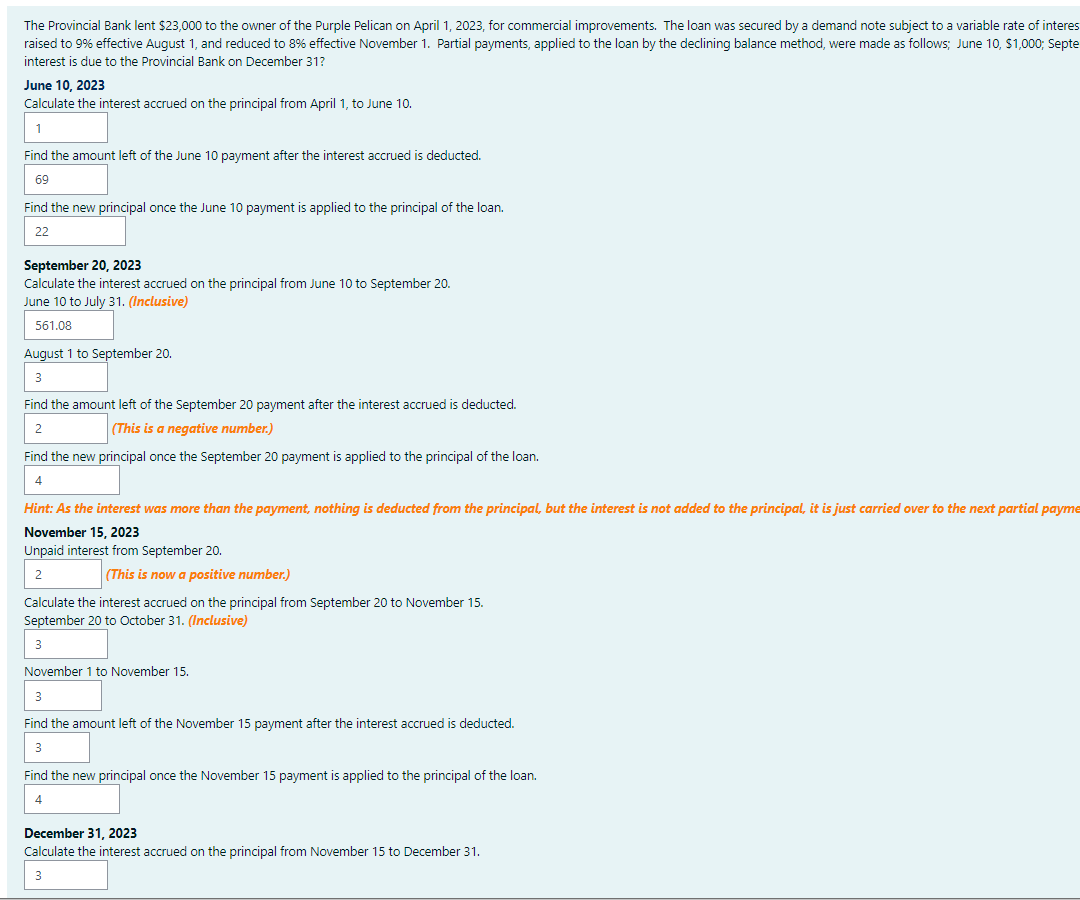

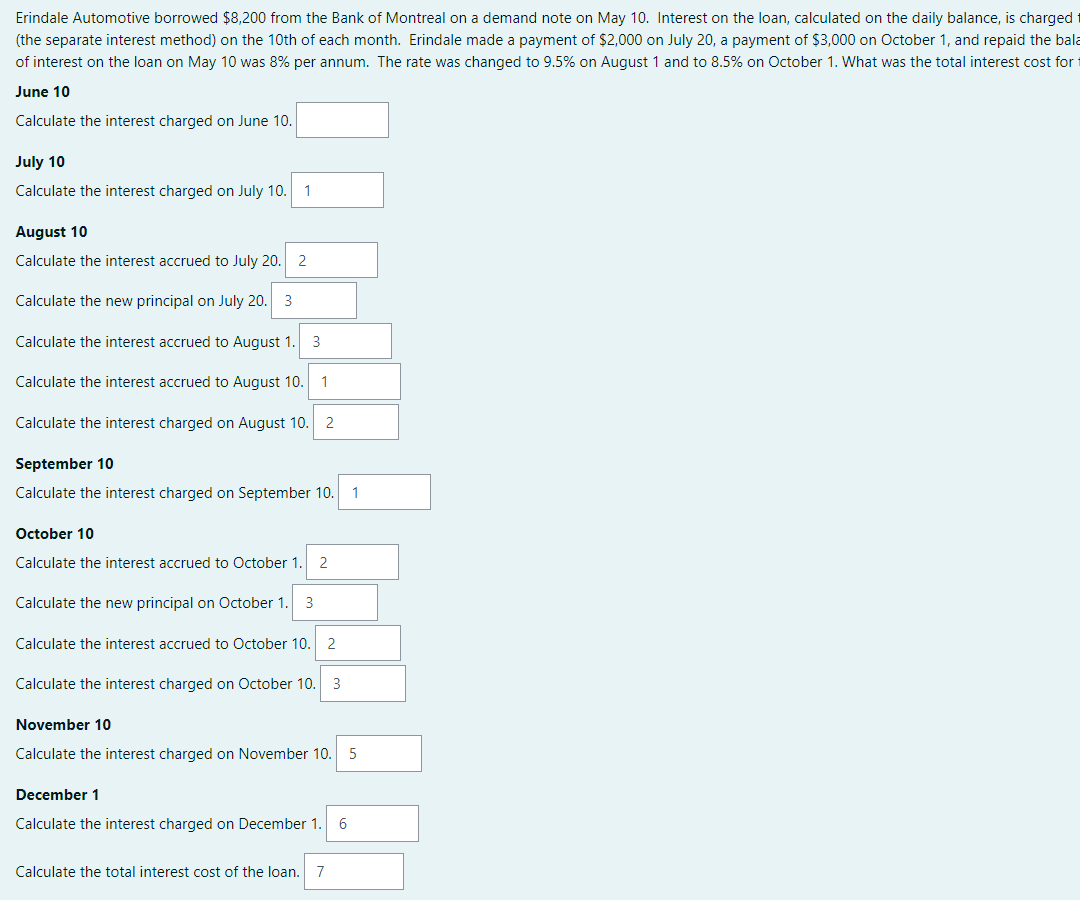

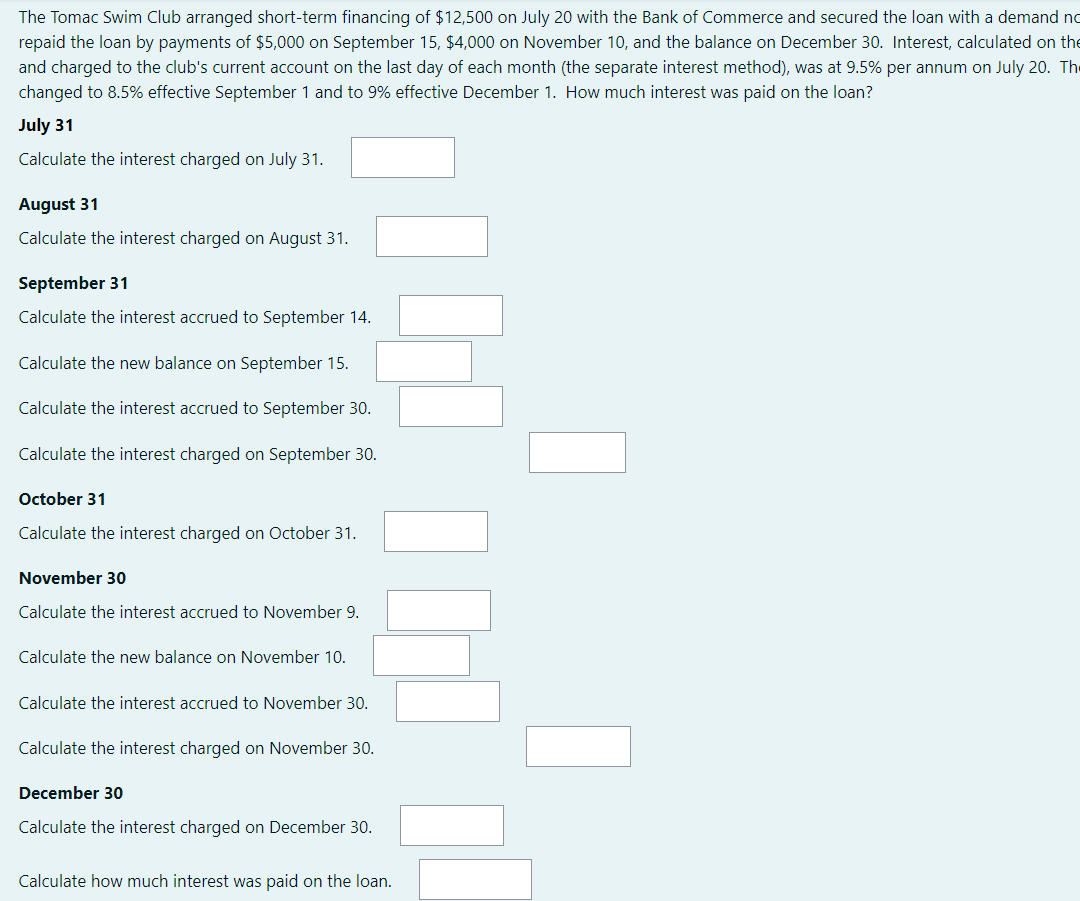

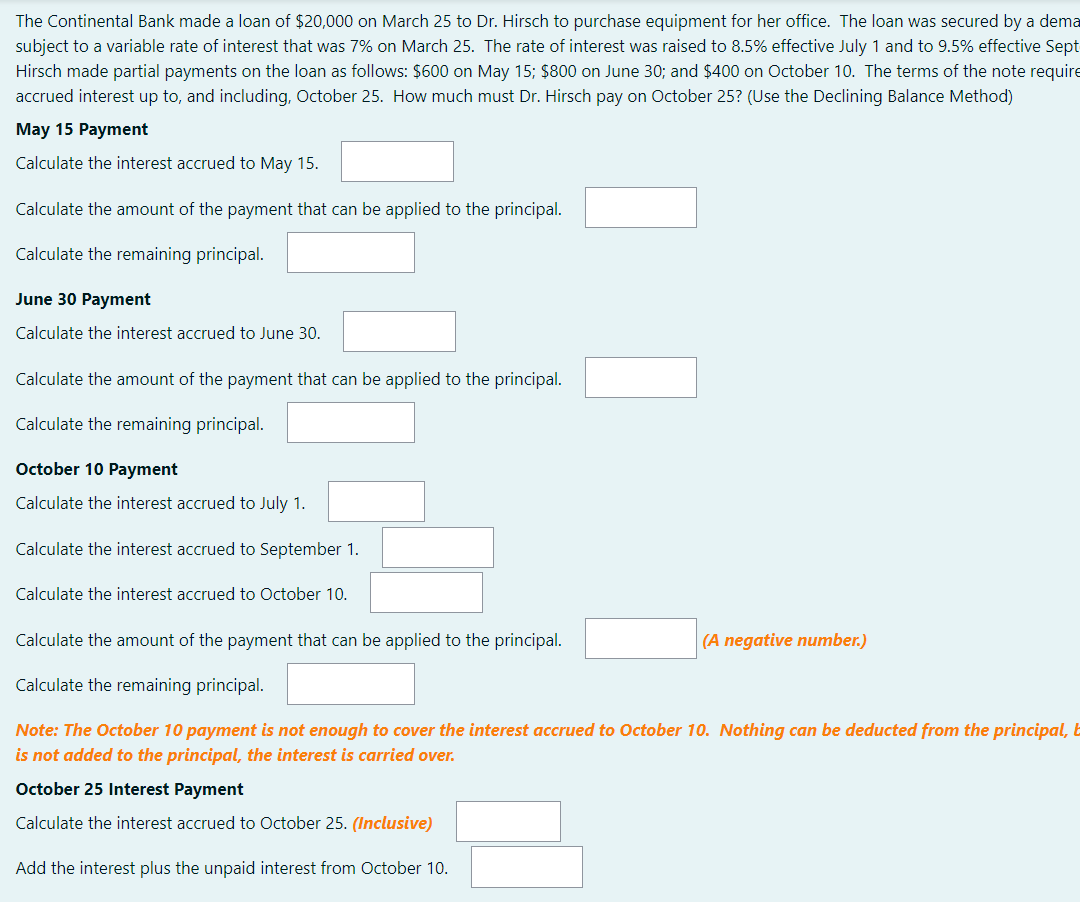

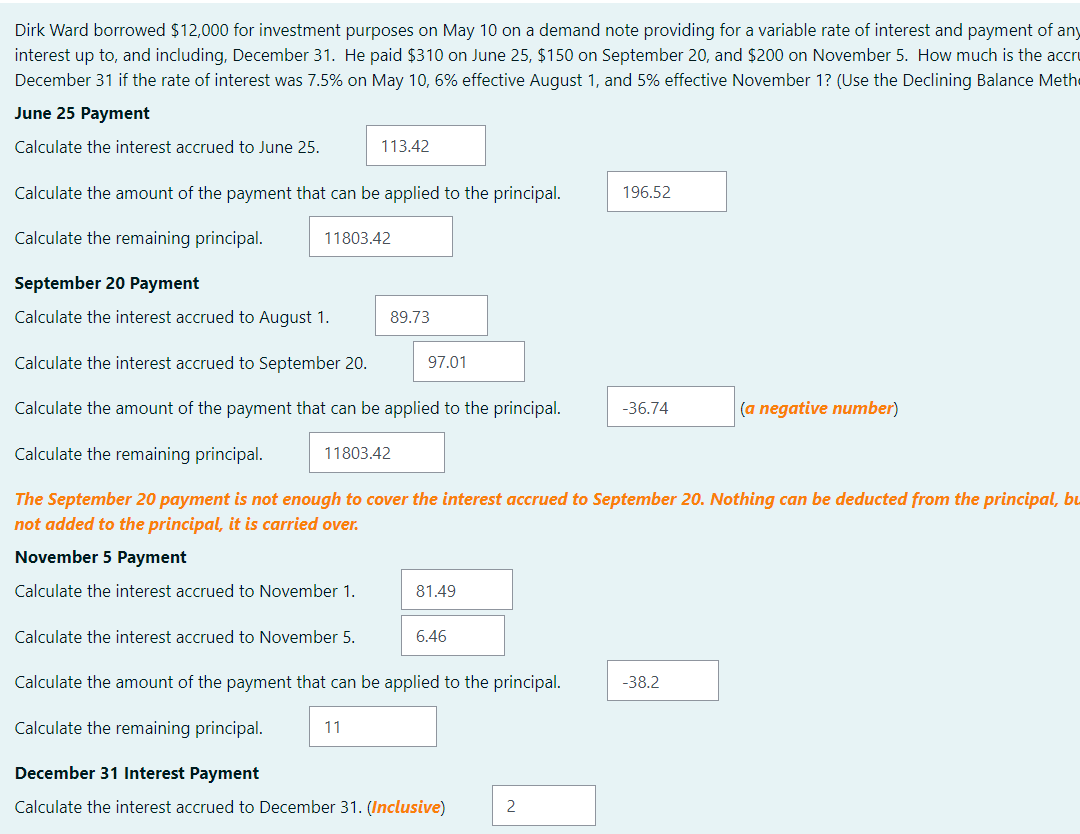

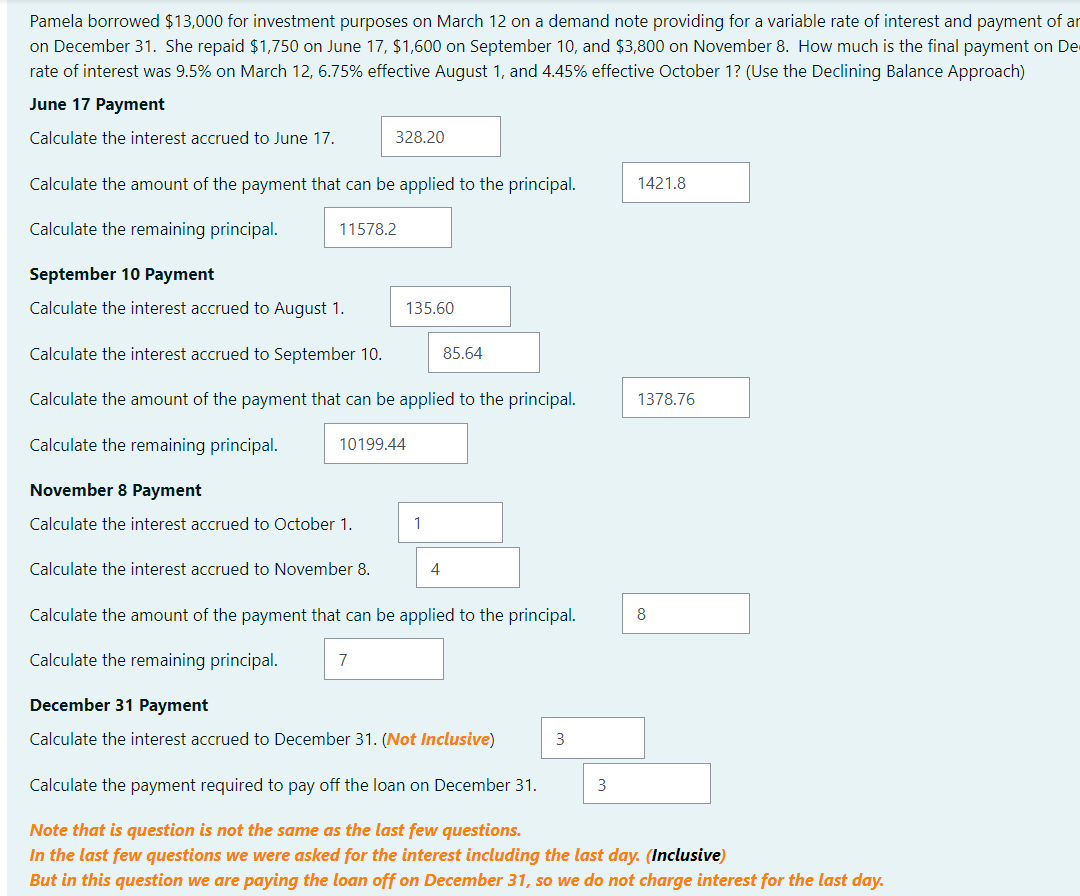

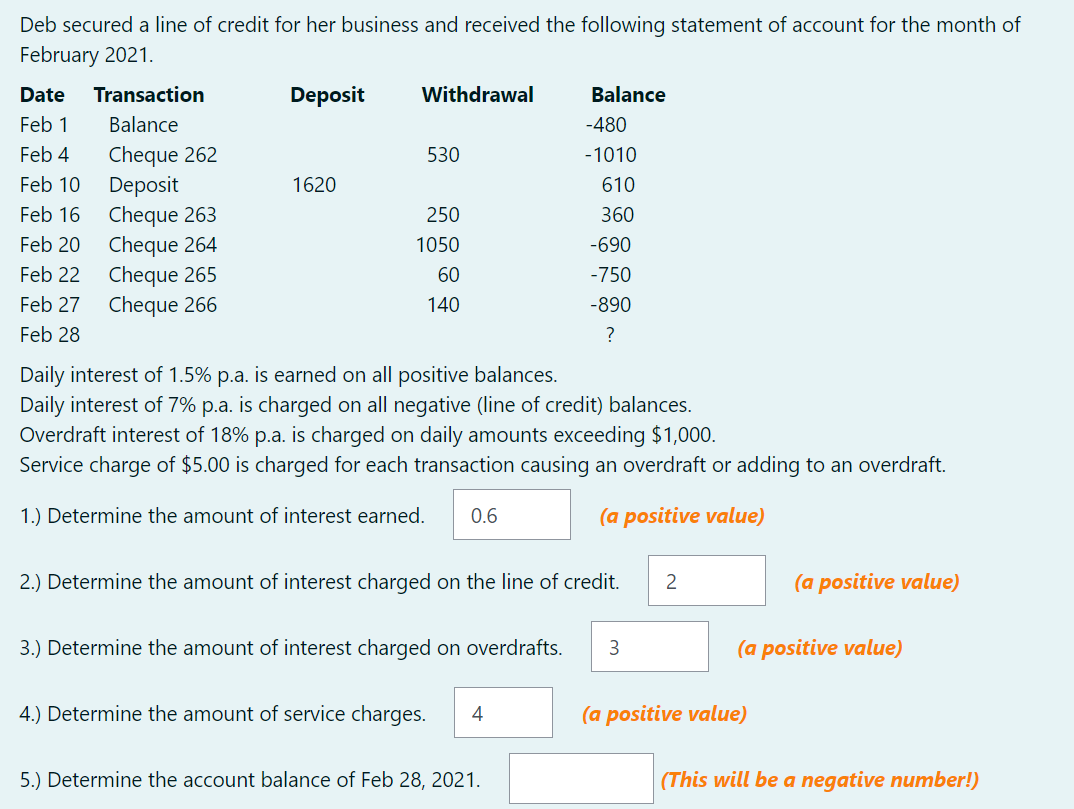

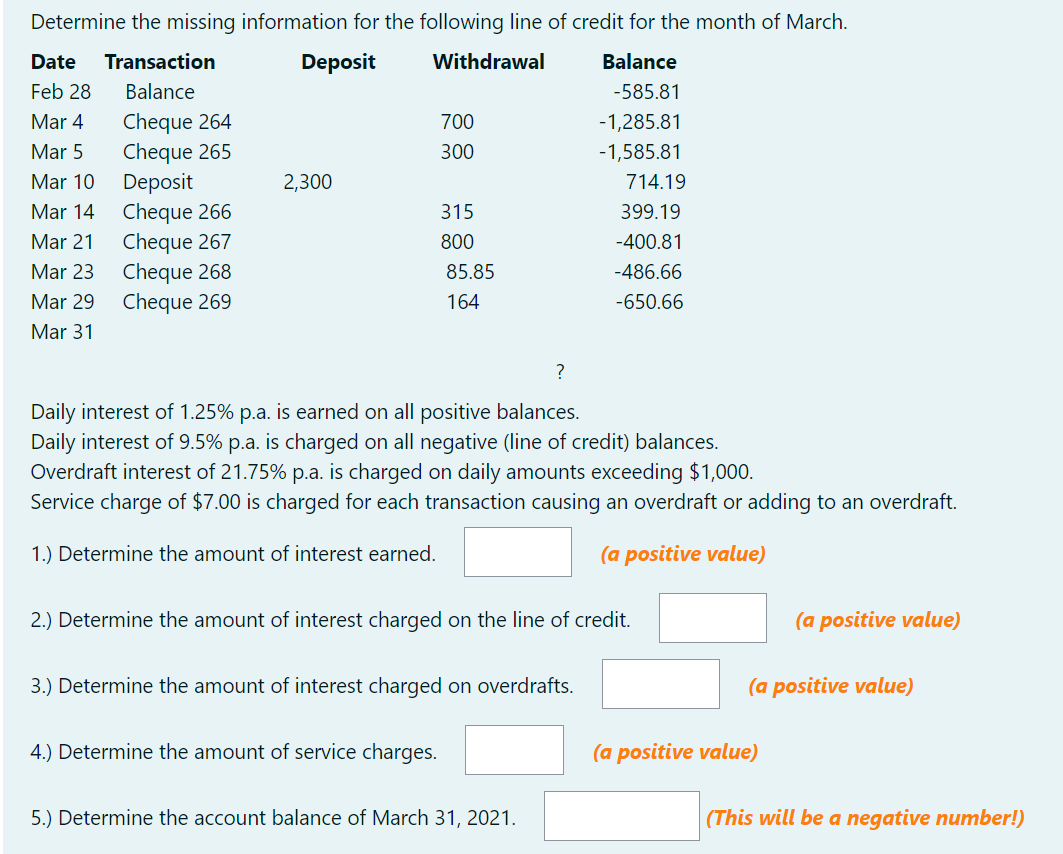

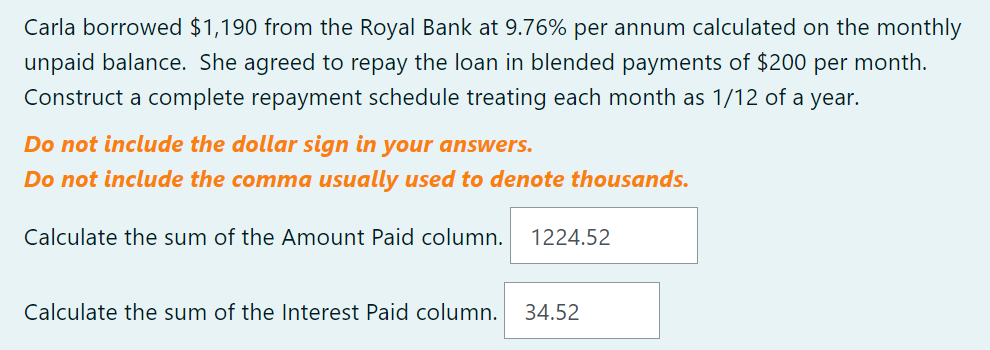

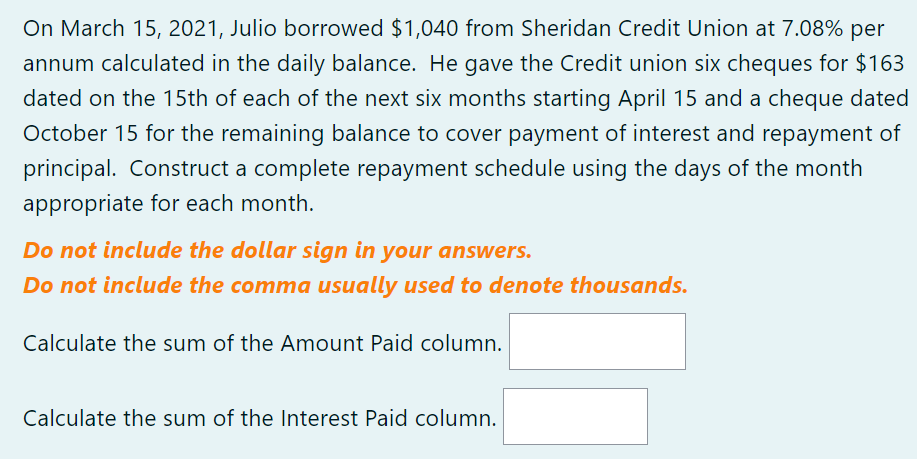

The Provincial Bank lent $23,000 to the owner of the Purple Pelican on April 1, 2023, for commercial improvements. The loan was secured by a demand note subject to a variable rate of interes raised to 9% effective August 1, and reduced to 8% effective November 1. Partial payments, applied to the loan by the declining balance method, were made as follows: June 10, $1,000; Septe interest due to the Provincial Bank on December 31? June 10, 2023 Calculate the interest accrued on the principal from April 1, to June 10. 1 Find the amount left of the June 10 payment after the interest accrued is deducted. 69 Find the new principal once the June 10 payment is applied to the principal of the loan. 22 September 20, 2023 Calculate the interest accrued on the principal from June 10 to September 20. June 10 to July 31. (Inclusive) 561.08 August 1 to September 20. 3 Find the amount left of the September 20 payment after the interest accrued is deducted. 2 (This is a negative number.) Find the new principal once the September 20 payment is applied to the principal of the loan. 4 Hint: As the interest was more than the payment, nothing is deducted from the principal, but the interest is not added to the principal, it is just carried over to the next partial payme November 15, 2023 Unpaid interest from September 20. (This is now a positive number.) Calculate the interest accrued on the principal from September 20 to November 15. September 20 to October 31. (Inclusive) 3 2 November 1 to November 15. 3 Find the amount left of the November 15 payment after the interest accrued is deducted. 3 Find the new principal once the November 15 payment is applied to the principal of the loan. 4 December 31, 2023 Calculate the interest accrued on the principal from November 15 to December 31. 3 Erindale Automotive borrowed $8,200 from the Bank of Montreal on a demand note on May 10. Interest on the loan, calculated on the daily balance, is charged (the separate interest method) on the 10th of each month. Erindale made a payment of $2,000 on July 20, a payment of $3,000 on October 1, and repaid the bala of interest on the loan on May 10 was 8% per annum. The rate was changed to 9.5% on August 1 and to 8.5% on October 1. What was the total interest cost for June 10 Calculate the interest charged on June 10. July 10 Calculate the interest charged on July 10. 1 August 10 Calculate the interest accrued to July 20. 2 Calculate the new principal on July 20. 3 Calculate the interest accrued to August 1. 3 Calculate the interest accrued to August 10. 1 Calculate the interest charged on August 10. 2 September 10 Calculate the interest charged on September 10. 1 October 10 Calculate the interest accrued to October 1. 2 Calculate the new principal on October 1. 3 Calculate the interest accrued to October 10. 2 Calculate the interest charged on October 10. 3 November 10 Calculate the interest charged on November 10. 5 December 1 Calculate the interest charged on December 1. 6 Calculate the total interest cost of the loan. 7 The Tomac Swim Club arranged short-term financing of $12,500 on July 20 with the Bank of Commerce and secured the loan with a demand no repaid the loan by payments of $5,000 on September 15, $4,000 on November 10, and the balance on December 30. Interest, calculated on the and charged to the club's current account on the last day of each month (the separate interest method), was at 9.5% per annum on July 20. Th changed to 8.5% effective September 1 and to 9% effective December 1. How much interest was paid on the loan? July 31 Calculate the interest charged on July 31. August 31 Calculate the interest charged on August 31. September 31 Calculate the interest accrued to September 14. Calculate the new balance on September 15. Calculate the interest accrued to September 30. Calculate the interest charged on September 30. October 31 Calculate the interest charged on October 31. November 30 Calculate the interest accrued to November 9. Calculate the new balance on November 10. Calculate the interest accrued to November 30. Calculate the interest charged on November 30. December 30 Calculate the interest charged on December 30. Calculate how much interest was paid on the loan. The Continental Bank made a loan of $20,000 on March 25 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a dema subject to a variable rate of interest that was 7% on March 25. The rate of interest was raised to 8.5% effective July 1 and to 9.5% effective Sept Hirsch made partial payments on the loan as follows: $600 on May 15; $800 on June 30; and $400 on October 10. The terms of the note require accrued interest up to, and including, October 25. How much must Dr. Hirsch pay on October 25? (Use the Declining Balance Method) May 15 Payment Calculate the interest accrued to May 15. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal. June 30 Payment Calculate the interest accrued to June 30. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal. October 10 Payment Calculate the interest accrued to July 1. Calculate the interest accrued to September 1. Calculate the interest accrued to October 10. Calculate the amount of the payment that can be applied to the principal. (A negative number.) Calculate the remaining principal. Note: The October 10 payment is not enough to cover the interest accrued to October 10. Nothing can be deducted from the principal, is not added to the principal, the interest is carried over. October 25 Interest Payment Calculate the interest accrued to October 25. (Inclusive) Add the interest plus the unpaid interest from October 10. Dirk Ward borrowed $12,000 for investment purposes on May 10 on a demand note providing for a variable rate of interest and payment of any interest up to, and including, December 31. He paid $310 on June 25, $150 on September 20, and $200 on November 5. How much is the accru December 31 if the rate of interest was 7.5% on May 10,6% effective August 1, and 5% effective November 1? (Use the Declining Balance Meth June 25 Payment Calculate the interest accrued to June 25. 113.42 Calculate the amount of the payment that can be applied to the principal. 196.52 Calculate the remaining principal. 11803.42 September 20 Payment Calculate the interest accrued to August 1. 89.73 Calculate the interest accrued to September 20. 97.01 Calculate the amount of the payment that can be applied to the principal. -36.74 (a negative number) Calculate the remaining principal. 11803.42 The September 20 payment is not enough to cover the interest accrued to September 20. Nothing can be deducted from the principal, bu not added to the principal, it is carried over. November 5 Payment Calculate the interest accrued to November 1. 81.49 Calculate the interest accrued to November 5. 6.46 Calculate the amount of the payment that can be applied to the principal. -38.2 Calculate the remaining principal. 11 December 31 Interest Payment Calculate the interest accrued to December 31. (Inclusive) 2 Pamela borrowed $13,000 for investment purposes on March 12 on a demand note providing for a variable rate of interest and payment of ar on December 31. She repaid $1,750 on June 17, $1,600 on September 10, and $3,800 on November 8. How much is the final payment on De rate of interest was 9.5% on March 12, 6.75% effective August 1, and 4.45% effective October 1? (Use the Declining Balance Approach) June 17 Payment Calculate the interest accrued to June 17. 328.20 Calculate the amount of the payment that can be applied to the principal. 1421.8 Calculate the remaining principal. 11578.2 September 10 Payment Calculate the interest accrued to August 1. 135.60 Calculate the interest accrued to September 10. 85.64 Calculate the amount of the payment that can be applied to the principal. 1378.76 Calculate the remaining principal. 10199.44 November 8 Payment Calculate the interest accrued to October 1. 1 Calculate the interest accrued to November 8. 4 Calculate the amount of the payment that can be applied to the principal. 8 Calculate the remaining principal. 7 December 31 Payment Calculate the interest accrued to December 31. (Not Inclusive) 3 Calculate the payment required to pay off the loan on December 31. 3 Note that is question is not the same as the last few questions. In the last few questions we were asked for the interest including the last day. (Inclusive) But in this question we are paying the loan off on December 31, so we do not charge interest for the last day. Deb secured a line of credit for her business and received the following statement of account for the month of February 2021. Date Transaction Deposit Withdrawal Balance Feb 1 Balance -480 Feb 4 Cheque 262 530 -1010 Feb 10 Deposit 1620 610 Feb 16 Cheque 263 250 360 Feb 20 Cheque 264 1050 -690 Feb 22 Cheque 265 60 -750 Feb 27 Cheque 266 140 -890 Feb 28 ? Daily interest of 1.5% p.a. is earned on all positive balances. Daily interest of 7% p.a. is charged on all negative (line of credit) balances. Overdraft interest of 18% p.a. is charged on daily amounts exceeding $1,000. Service charge of $5.00 is charged for each transaction causing an overdraft or adding to an overdraft. 1.) Determine the amount of interest earned. 0.6 (a positive value) 2.) Determine the amount of interest charged on the line of credit. 2 (a positive value) 3.) Determine the amount of interest charged on overdrafts. 3 (a positive value) 4.) Determine the amount of service charges. 4 (a positive value) 5.) Determine the account balance of Feb 28, 2021. (This will be a negative number!) 700 Determine the missing information for the following line of credit for the month of March. Date Transaction Deposit Withdrawal Balance Feb 28 Balance -585.81 Mar 4 Cheque 264 -1,285.81 Mar 5 Cheque 265 300 -1,585.81 Mar 10 Deposit 2,300 714.19 Mar 14 Cheque 266 315 399.19 Mar 21 Cheque 267 -400.81 Mar 23 Cheque 268 85.85 -486.66 Mar 29 Cheque 269 164 -650.66 Mar 31 800 ? Daily interest of 1.25% p.a. is earned on all positive balances. Daily interest of 9.5% p.a. is charged on all negative (line of credit) balances. Overdraft interest of 21.75% p.a. is charged on daily amounts exceeding $1,000. Service charge of $7.00 is charged for each transaction causing an overdraft or adding to an overdraft. 1.) Determine the amount of interest earned. (a positive value) 2.) Determine the amount of interest charged on the line of credit. (a positive value) 3.) Determine the amount of interest charged on overdrafts. (a positive value) 4.) Determine the amount of service charges. (a positive value) 5.) Determine the account balance of March 31, 2021. (This will be a negative number!) Carla borrowed $1,190 from the Royal Bank at 9.76% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $200 per month. Construct a complete repayment schedule treating each month as 1/12 of a year. Do not include the dollar sign in your answers. Do not include the comma usually used to denote thousands. Calculate the sum of the Amount Paid column. 1224.52 Calculate the sum of the Interest Paid column. 34.52 On March 15, 2021, Julio borrowed $1,040 from Sheridan Credit Union at 7.08% per annum calculated in the daily balance. He gave the Credit union six cheques for $163 dated on the 15th of each of the next six months starting April 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal. Construct a complete repayment schedule using the days of the month appropriate for each month. Do not include the dollar sign in your answers. Do not include the comma usually used to denote thousands. Calculate the sum of the Amount Paid column. Calculate the sum of the Interest Paid column. . The Provincial Bank lent $23,000 to the owner of the Purple Pelican on April 1, 2023, for commercial improvements. The loan was secured by a demand note subject to a variable rate of interes raised to 9% effective August 1, and reduced to 8% effective November 1. Partial payments, applied to the loan by the declining balance method, were made as follows: June 10, $1,000; Septe interest due to the Provincial Bank on December 31? June 10, 2023 Calculate the interest accrued on the principal from April 1, to June 10. 1 Find the amount left of the June 10 payment after the interest accrued is deducted. 69 Find the new principal once the June 10 payment is applied to the principal of the loan. 22 September 20, 2023 Calculate the interest accrued on the principal from June 10 to September 20. June 10 to July 31. (Inclusive) 561.08 August 1 to September 20. 3 Find the amount left of the September 20 payment after the interest accrued is deducted. 2 (This is a negative number.) Find the new principal once the September 20 payment is applied to the principal of the loan. 4 Hint: As the interest was more than the payment, nothing is deducted from the principal, but the interest is not added to the principal, it is just carried over to the next partial payme November 15, 2023 Unpaid interest from September 20. (This is now a positive number.) Calculate the interest accrued on the principal from September 20 to November 15. September 20 to October 31. (Inclusive) 3 2 November 1 to November 15. 3 Find the amount left of the November 15 payment after the interest accrued is deducted. 3 Find the new principal once the November 15 payment is applied to the principal of the loan. 4 December 31, 2023 Calculate the interest accrued on the principal from November 15 to December 31. 3 Erindale Automotive borrowed $8,200 from the Bank of Montreal on a demand note on May 10. Interest on the loan, calculated on the daily balance, is charged (the separate interest method) on the 10th of each month. Erindale made a payment of $2,000 on July 20, a payment of $3,000 on October 1, and repaid the bala of interest on the loan on May 10 was 8% per annum. The rate was changed to 9.5% on August 1 and to 8.5% on October 1. What was the total interest cost for June 10 Calculate the interest charged on June 10. July 10 Calculate the interest charged on July 10. 1 August 10 Calculate the interest accrued to July 20. 2 Calculate the new principal on July 20. 3 Calculate the interest accrued to August 1. 3 Calculate the interest accrued to August 10. 1 Calculate the interest charged on August 10. 2 September 10 Calculate the interest charged on September 10. 1 October 10 Calculate the interest accrued to October 1. 2 Calculate the new principal on October 1. 3 Calculate the interest accrued to October 10. 2 Calculate the interest charged on October 10. 3 November 10 Calculate the interest charged on November 10. 5 December 1 Calculate the interest charged on December 1. 6 Calculate the total interest cost of the loan. 7 The Tomac Swim Club arranged short-term financing of $12,500 on July 20 with the Bank of Commerce and secured the loan with a demand no repaid the loan by payments of $5,000 on September 15, $4,000 on November 10, and the balance on December 30. Interest, calculated on the and charged to the club's current account on the last day of each month (the separate interest method), was at 9.5% per annum on July 20. Th changed to 8.5% effective September 1 and to 9% effective December 1. How much interest was paid on the loan? July 31 Calculate the interest charged on July 31. August 31 Calculate the interest charged on August 31. September 31 Calculate the interest accrued to September 14. Calculate the new balance on September 15. Calculate the interest accrued to September 30. Calculate the interest charged on September 30. October 31 Calculate the interest charged on October 31. November 30 Calculate the interest accrued to November 9. Calculate the new balance on November 10. Calculate the interest accrued to November 30. Calculate the interest charged on November 30. December 30 Calculate the interest charged on December 30. Calculate how much interest was paid on the loan. The Continental Bank made a loan of $20,000 on March 25 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a dema subject to a variable rate of interest that was 7% on March 25. The rate of interest was raised to 8.5% effective July 1 and to 9.5% effective Sept Hirsch made partial payments on the loan as follows: $600 on May 15; $800 on June 30; and $400 on October 10. The terms of the note require accrued interest up to, and including, October 25. How much must Dr. Hirsch pay on October 25? (Use the Declining Balance Method) May 15 Payment Calculate the interest accrued to May 15. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal. June 30 Payment Calculate the interest accrued to June 30. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal. October 10 Payment Calculate the interest accrued to July 1. Calculate the interest accrued to September 1. Calculate the interest accrued to October 10. Calculate the amount of the payment that can be applied to the principal. (A negative number.) Calculate the remaining principal. Note: The October 10 payment is not enough to cover the interest accrued to October 10. Nothing can be deducted from the principal, is not added to the principal, the interest is carried over. October 25 Interest Payment Calculate the interest accrued to October 25. (Inclusive) Add the interest plus the unpaid interest from October 10. Dirk Ward borrowed $12,000 for investment purposes on May 10 on a demand note providing for a variable rate of interest and payment of any interest up to, and including, December 31. He paid $310 on June 25, $150 on September 20, and $200 on November 5. How much is the accru December 31 if the rate of interest was 7.5% on May 10,6% effective August 1, and 5% effective November 1? (Use the Declining Balance Meth June 25 Payment Calculate the interest accrued to June 25. 113.42 Calculate the amount of the payment that can be applied to the principal. 196.52 Calculate the remaining principal. 11803.42 September 20 Payment Calculate the interest accrued to August 1. 89.73 Calculate the interest accrued to September 20. 97.01 Calculate the amount of the payment that can be applied to the principal. -36.74 (a negative number) Calculate the remaining principal. 11803.42 The September 20 payment is not enough to cover the interest accrued to September 20. Nothing can be deducted from the principal, bu not added to the principal, it is carried over. November 5 Payment Calculate the interest accrued to November 1. 81.49 Calculate the interest accrued to November 5. 6.46 Calculate the amount of the payment that can be applied to the principal. -38.2 Calculate the remaining principal. 11 December 31 Interest Payment Calculate the interest accrued to December 31. (Inclusive) 2 Pamela borrowed $13,000 for investment purposes on March 12 on a demand note providing for a variable rate of interest and payment of ar on December 31. She repaid $1,750 on June 17, $1,600 on September 10, and $3,800 on November 8. How much is the final payment on De rate of interest was 9.5% on March 12, 6.75% effective August 1, and 4.45% effective October 1? (Use the Declining Balance Approach) June 17 Payment Calculate the interest accrued to June 17. 328.20 Calculate the amount of the payment that can be applied to the principal. 1421.8 Calculate the remaining principal. 11578.2 September 10 Payment Calculate the interest accrued to August 1. 135.60 Calculate the interest accrued to September 10. 85.64 Calculate the amount of the payment that can be applied to the principal. 1378.76 Calculate the remaining principal. 10199.44 November 8 Payment Calculate the interest accrued to October 1. 1 Calculate the interest accrued to November 8. 4 Calculate the amount of the payment that can be applied to the principal. 8 Calculate the remaining principal. 7 December 31 Payment Calculate the interest accrued to December 31. (Not Inclusive) 3 Calculate the payment required to pay off the loan on December 31. 3 Note that is question is not the same as the last few questions. In the last few questions we were asked for the interest including the last day. (Inclusive) But in this question we are paying the loan off on December 31, so we do not charge interest for the last day. Deb secured a line of credit for her business and received the following statement of account for the month of February 2021. Date Transaction Deposit Withdrawal Balance Feb 1 Balance -480 Feb 4 Cheque 262 530 -1010 Feb 10 Deposit 1620 610 Feb 16 Cheque 263 250 360 Feb 20 Cheque 264 1050 -690 Feb 22 Cheque 265 60 -750 Feb 27 Cheque 266 140 -890 Feb 28 ? Daily interest of 1.5% p.a. is earned on all positive balances. Daily interest of 7% p.a. is charged on all negative (line of credit) balances. Overdraft interest of 18% p.a. is charged on daily amounts exceeding $1,000. Service charge of $5.00 is charged for each transaction causing an overdraft or adding to an overdraft. 1.) Determine the amount of interest earned. 0.6 (a positive value) 2.) Determine the amount of interest charged on the line of credit. 2 (a positive value) 3.) Determine the amount of interest charged on overdrafts. 3 (a positive value) 4.) Determine the amount of service charges. 4 (a positive value) 5.) Determine the account balance of Feb 28, 2021. (This will be a negative number!) 700 Determine the missing information for the following line of credit for the month of March. Date Transaction Deposit Withdrawal Balance Feb 28 Balance -585.81 Mar 4 Cheque 264 -1,285.81 Mar 5 Cheque 265 300 -1,585.81 Mar 10 Deposit 2,300 714.19 Mar 14 Cheque 266 315 399.19 Mar 21 Cheque 267 -400.81 Mar 23 Cheque 268 85.85 -486.66 Mar 29 Cheque 269 164 -650.66 Mar 31 800 ? Daily interest of 1.25% p.a. is earned on all positive balances. Daily interest of 9.5% p.a. is charged on all negative (line of credit) balances. Overdraft interest of 21.75% p.a. is charged on daily amounts exceeding $1,000. Service charge of $7.00 is charged for each transaction causing an overdraft or adding to an overdraft. 1.) Determine the amount of interest earned. (a positive value) 2.) Determine the amount of interest charged on the line of credit. (a positive value) 3.) Determine the amount of interest charged on overdrafts. (a positive value) 4.) Determine the amount of service charges. (a positive value) 5.) Determine the account balance of March 31, 2021. (This will be a negative number!) Carla borrowed $1,190 from the Royal Bank at 9.76% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $200 per month. Construct a complete repayment schedule treating each month as 1/12 of a year. Do not include the dollar sign in your answers. Do not include the comma usually used to denote thousands. Calculate the sum of the Amount Paid column. 1224.52 Calculate the sum of the Interest Paid column. 34.52 On March 15, 2021, Julio borrowed $1,040 from Sheridan Credit Union at 7.08% per annum calculated in the daily balance. He gave the Credit union six cheques for $163 dated on the 15th of each of the next six months starting April 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal. Construct a complete repayment schedule using the days of the month appropriate for each month. Do not include the dollar sign in your answers. Do not include the comma usually used to denote thousands. Calculate the sum of the Amount Paid column. Calculate the sum of the Interest Paid columnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started