Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 question 2 question 3 Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and

question 1

question 2

question 3

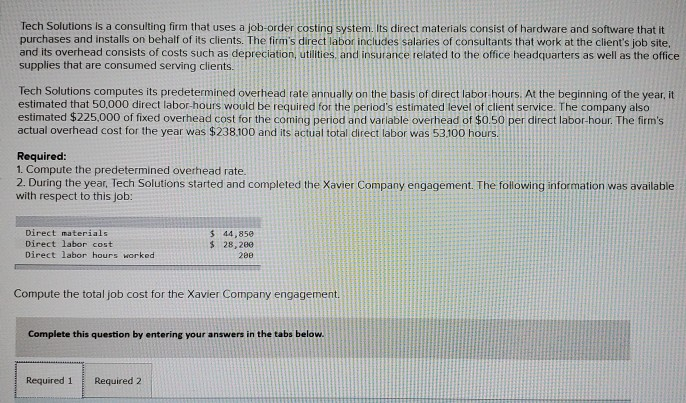

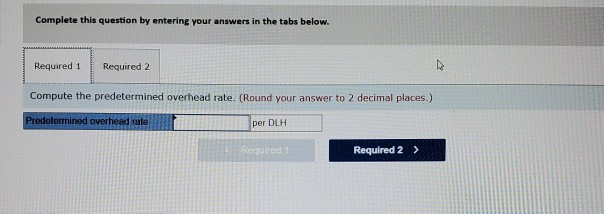

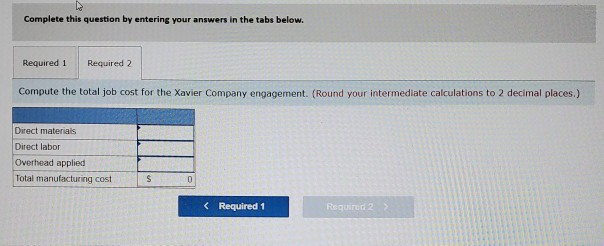

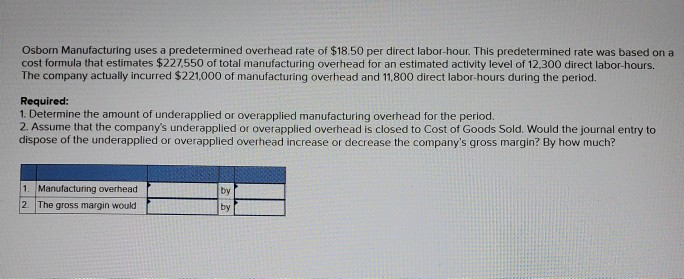

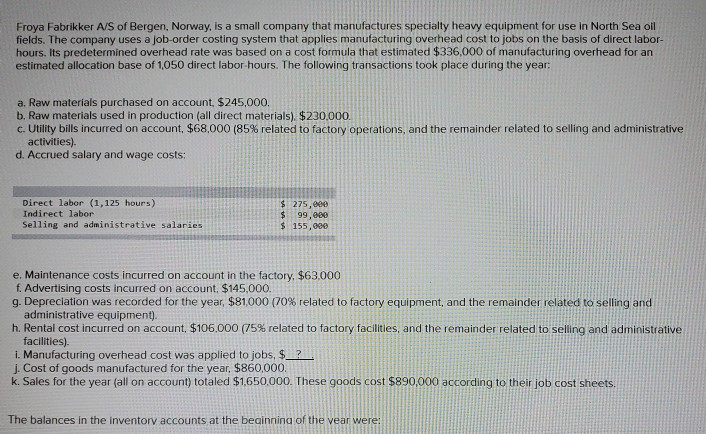

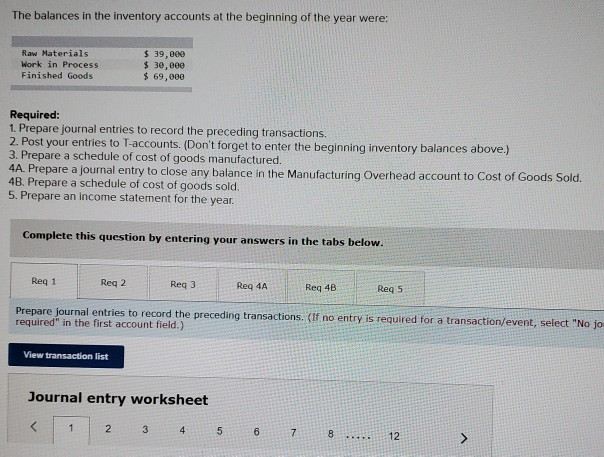

Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site. and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor hours. At the beginning of the year, it estimated that 50.000 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $225,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $238.100 and its actual total direct labor was 53,100 hours. Required: 1. Compute the predetermined overhead rate. 2. During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available with respect to this job: Direct materials Direct labor cost Direct labor hours worked $ 44,850 $ 28, 200 280 Compute the total job cost for the Xavier Company engagement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLH Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the total job cost for the Xavier Company engagement. (Round your intermediate calculations to 2 decimal places.) Direct materials Direct labor Overhead applied Total manufacturing cost Required 1 RETUR Osborn Manufacturing uses a predetermined overhead rate of $18.50 per direct labor hour. This predetermined rate was based on a cost formula that estimates $227,550 of total manufacturing overhead for an estimated activity level of 12,300 direct labor-hours. The company actually incurred $221,000 of manufacturing overhead and 11,800 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead 2. The gross margin would Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specially heavy equipment for use in North Sea oll fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor hours. Its predetermined overhead rate was based on a cost formula that estimated $336,000 of manufacturing overhead for an estimated allocation base of 1,050 direct labor hours. The following transactions took place during the year: a. Raw materials purchased on account, $245,000. b. Raw materials used in production (all direct materials). $230,000. c. Utility bills incurred on account, $68,000 (85% related to factory operations, and the remainder related to selling and administrative activities) d. Accrued salary and wage costs: Direct labor (1,125 hours) Indirect labor Selling and administrative salaries $ 275, eee $ 99,000 $ 155,000 e. Maintenance costs incurred on account in the factory, $63.000 f. Advertising costs incurred on account, $145,000 g. Depreciation was recorded for the year, $81,000 (70% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $106.000 (75% related to factory facilities, and the remainder related to selling and administrative facilities) i. Manufacturing overhead cost was applied to jobs, $_?. j. Cost of goods manufactured for the year, $860,000. k. Sales for the year (all on account) totaled $1,650,000. These goods cost $890,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the vear Were! The balances in the inventory accounts at the beginning of the year were: Raw Materials Work in Process Finished Goods $ 39,000 $ 30,000 $ 69,000 Required: 1. Prepare journal entries to record the preceding transactions 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) 3. Prepare a schedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 48. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Reg 3 Req 4A Reg 4B Reg 5 Prepare journal entries to record the preceding transactions. (If no entry is required for a transaction/event, select "No ja required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started