Answered step by step

Verified Expert Solution

Question

1 Approved Answer

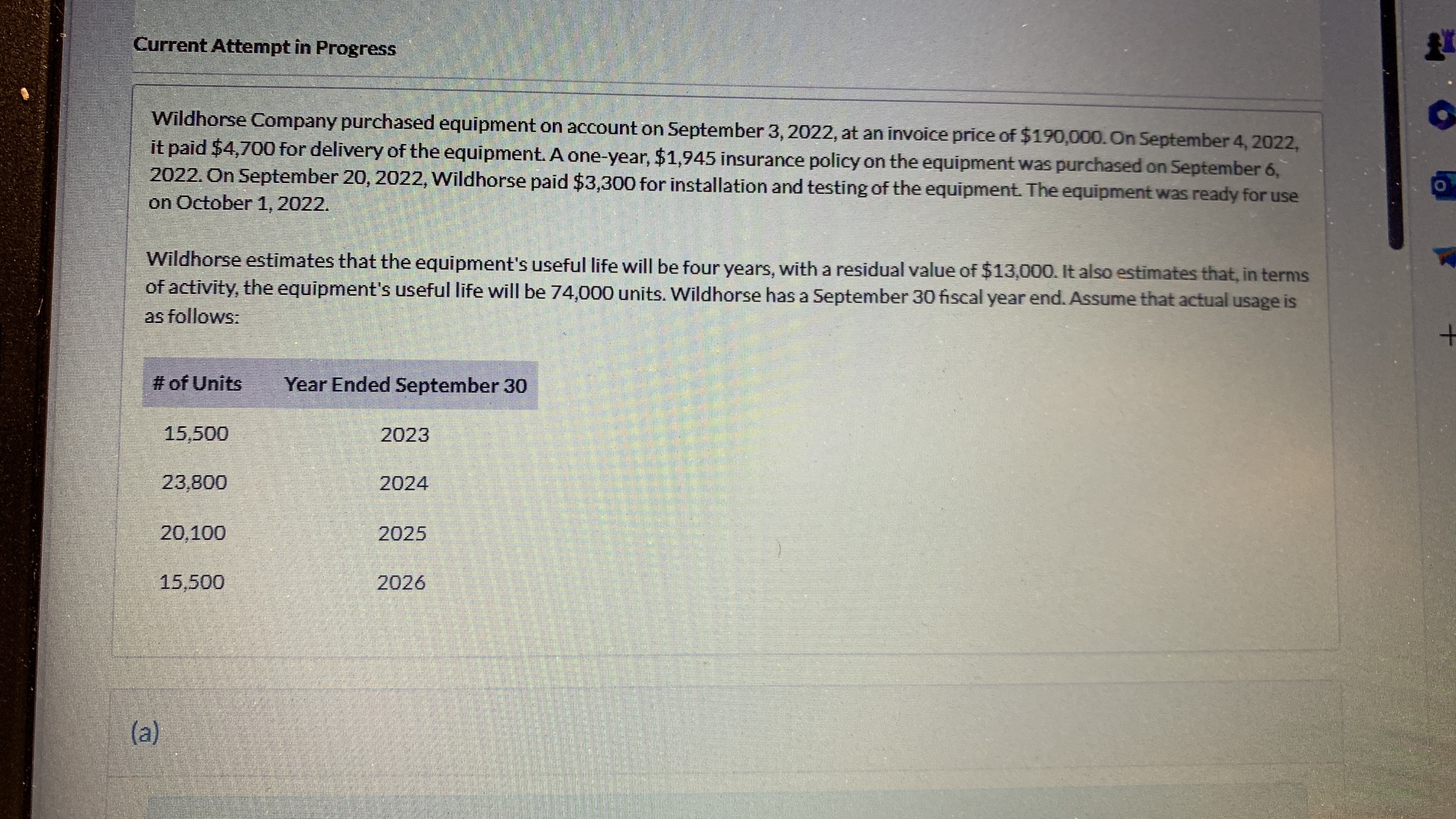

Question 1. Question 2. Question 3. Wildhorse Company purchased equipment on account on September 3,2022 , at an invoice price of $190,000. On September 4,

Question 1.

Question 2.

Question 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started