Question 1.

Question 2.

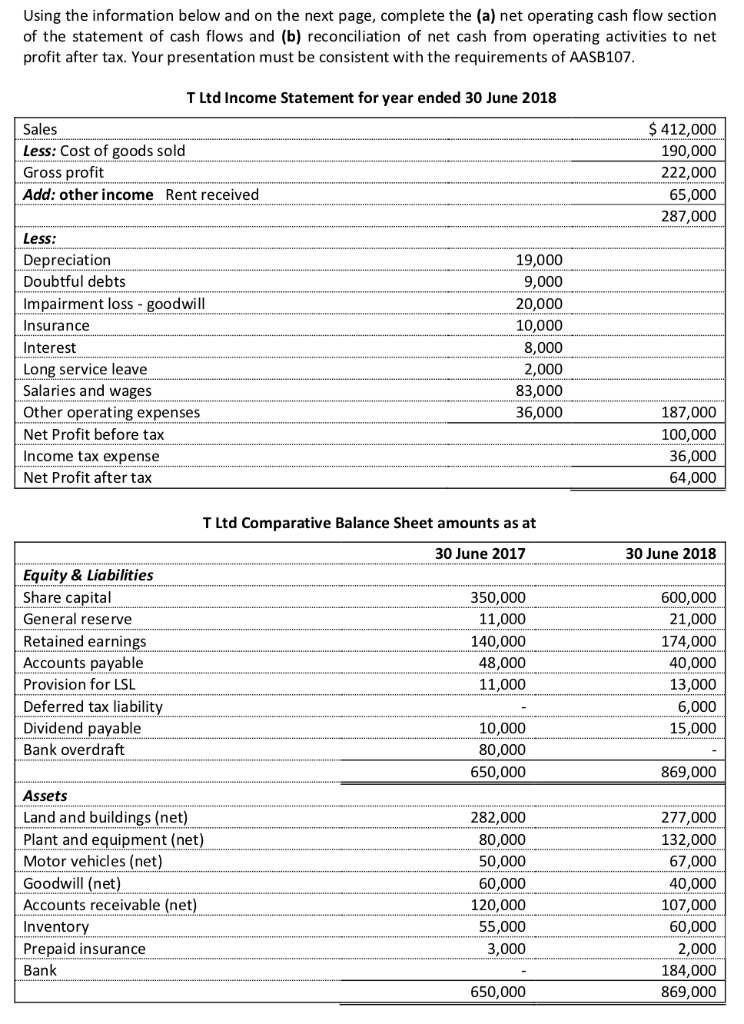

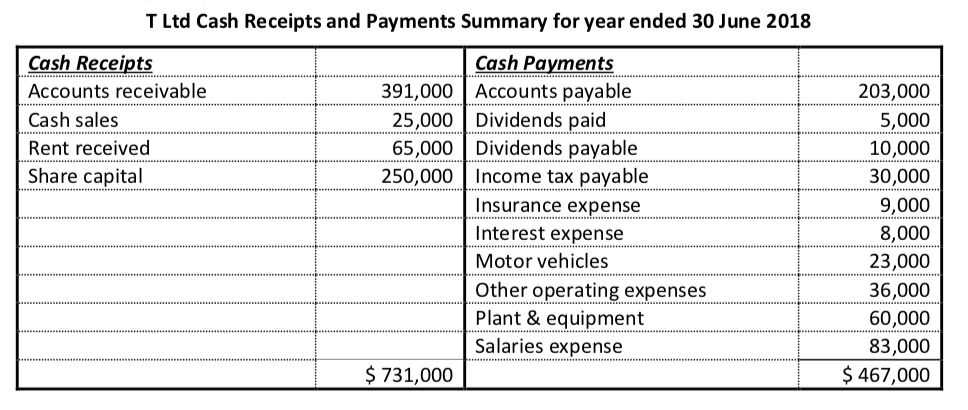

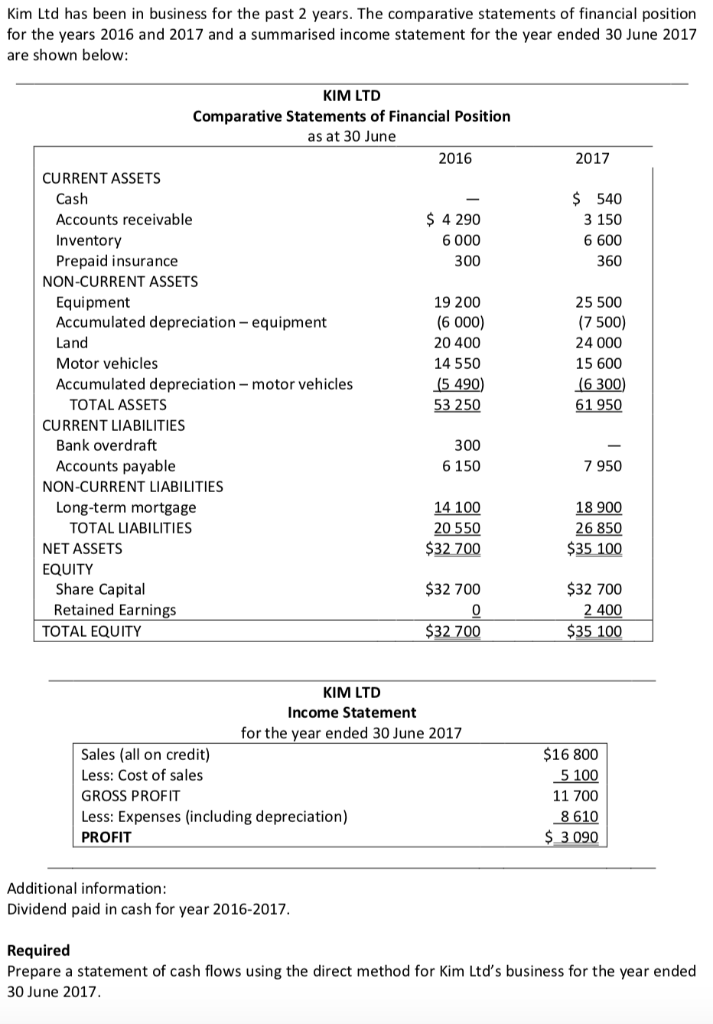

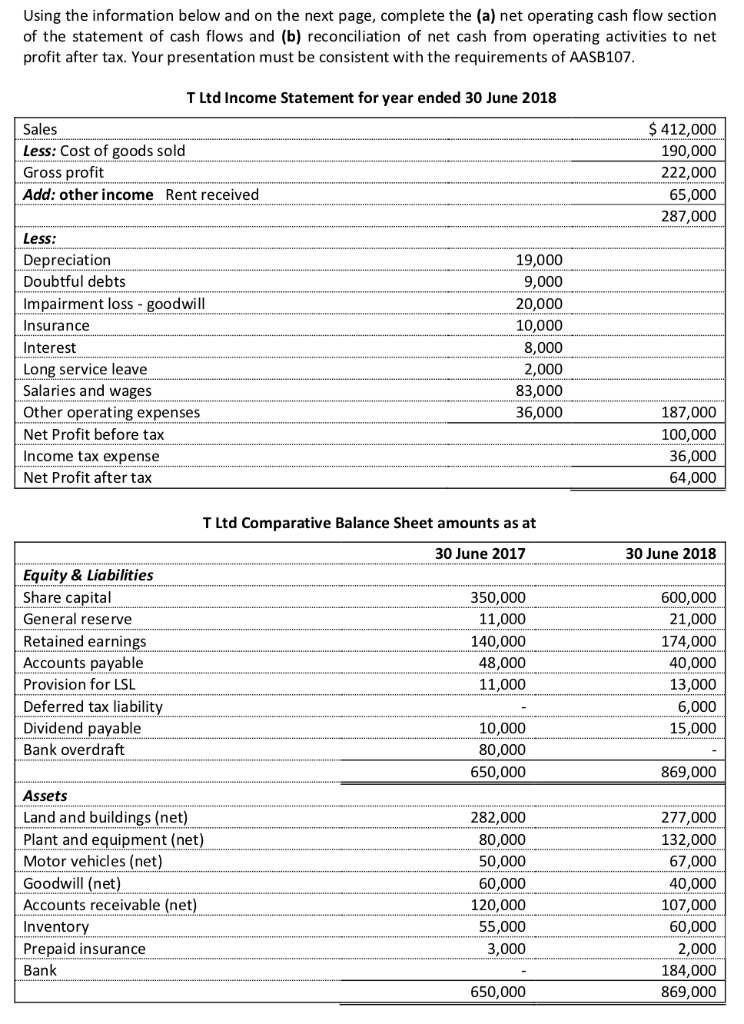

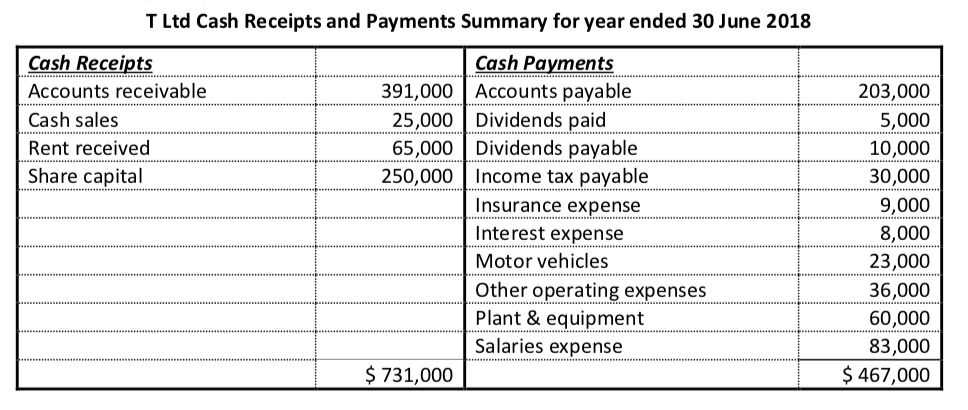

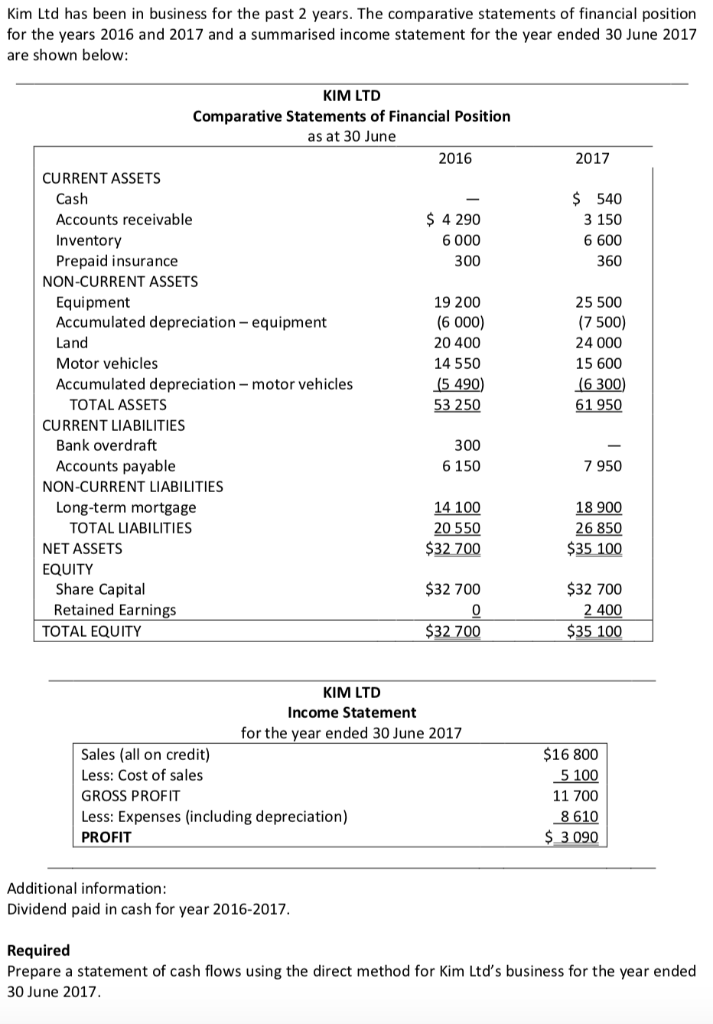

Using the information below and on the next page, complete the (a) net operating cash flow section of the statement of cash flows and (b) reconciliation of net cash from operating activities to net profit after tax. Your presentation must be consistent with the requirements of AASB107. T Ltd Income Statement for year ended 30 June 2018 Sales Less: Cost of goods sold Gross profit Add: other income Rent received $ 412,000 190,000 222,000 65,000 287,000 Less: Depreciation Doubtful debts Impairment loss - goodwill Insurance Interest Long service leave Salaries and wages Other operating expenses Net Profit before tax Income tax expense Net Profit after tax 19,000 9,000 20,000 10,000 8,000 2,000 83,000 36,000 187,000 100,000 36,000 64,000 T Ltd Comparative Balance Sheet amounts as at 30 June 2017 30 June 2018 Equity & Liabilities Share capital General reserve Retained earnings Accounts payable Provision for LSL Deferred tax liability Dividend payable Bank overdraft 350,000 11,000 140,000 48,000 11,000 ....... ...... 600,000 21,000 174,000 40,000 13,000 6,000 15,000 10,000 80,000 650,000 869,000 Assets Land and buildings (net) Plant and equipment (net) Motor vehicles (net) Goodwill (net) Accounts receivable (net) Inventory Prepaid insurance Bank 282,000 80,000 50,000 60,000 120,000 55,000 3,000 277,000 132,000 67,000 40,000 107,000 60,000 2,000 184,000 869,000 650,000 T Ltd Cash Receipts and Payments Summary for year ended 30 June 2018 Cash Receipts Accounts receivable Cash sales Rent received Share capital Cash Payments 391,000 Accounts payable 25,000 Dividends paid 65,000 Dividends payable 250,000 Income tax payable Insurance expense Interest expense Motor vehicles Other operating expenses Plant & equipment Salaries expense $ 731,000 ............ 203,000 5,000 10,000 30,000 9,000 8,000 23,000 36,000 60,000 83,000 $ 467,000 Kim Ltd has been in business for the past 2 years. The comparative statements of financial position for the years 2016 and 2017 and a summarised income statement for the year ended 30 June 2017 are shown below: 2017 $ 540 3 150 6 600 360 KIM LTD Comparative Statements of Financial Position as at 30 June 2016 CURRENT ASSETS Cash Accounts receivable $ 4290 Inventory 6 000 Prepaid insurance 300 NON-CURRENT ASSETS Equipment 19 200 Accumulated depreciation - equipment (6 000) Land 20 400 Motor vehicles 14 550 Accumulated depreciation - motor vehicles (5 490) TOTAL ASSETS 53 250 CURRENT LIABILITIES Bank overdraft 300 Accounts payable 6 150 NON-CURRENT LIABILITIES Long-term mortgage 14 100 TOTAL LIABILITIES 20 550 NET ASSETS $32 700 EQUITY Share Capital $32 700 Retained Earnings TOTAL EQUITY $32 700 25 500 (7 500) 24 000 15 600 (6 300 61 950 7 950 18 900 26 850 $35 100 0 $32 700 2 400 $35 100 KIM LTD Income Statement for the year ended 30 June 2017 Sales (all on credit) Less: Cost of sales GROSS PROFIT Less: Expenses (including depreciation) PROFIT $16 800 5 100 11 700 8 610 $ 3 090 Additional information: Dividend paid in cash for year 2016-2017. Required Prepare a statement of cash flows using the direct method for Kim Ltd's business for the year ended 30 June 2017