Question

question 1: question 2: You're a contestant on a TV game show. In the final round of the game, if contestants answer a question correctly,

question 1:

question 2:

question 2:

You're a contestant on a TV game show. In the final round of the game, if contestants answer a question correctly, they will increase their current winnings of $1 million to $3 million. If they are wrong, their prize is decreased to $750,000. You believe you have a 25% chance of answering the question correctly.

Ignoring your current winnings, your expected payoff from playing the final round of the game show is ($ ). Given that this is _______(negative or positive), you______(should or should not) play the final round of the game. (Hint: Enter a negative sign if the expected payoff is negative.)

The lowest probability of a correct guess that would make the guessing in the final round profitable (in expected value) is_________(11.6667%, 6.6667%, 11.0000%, 11.1111%). (Hint: At what probability does playing the final round yield an expected value of zero?)

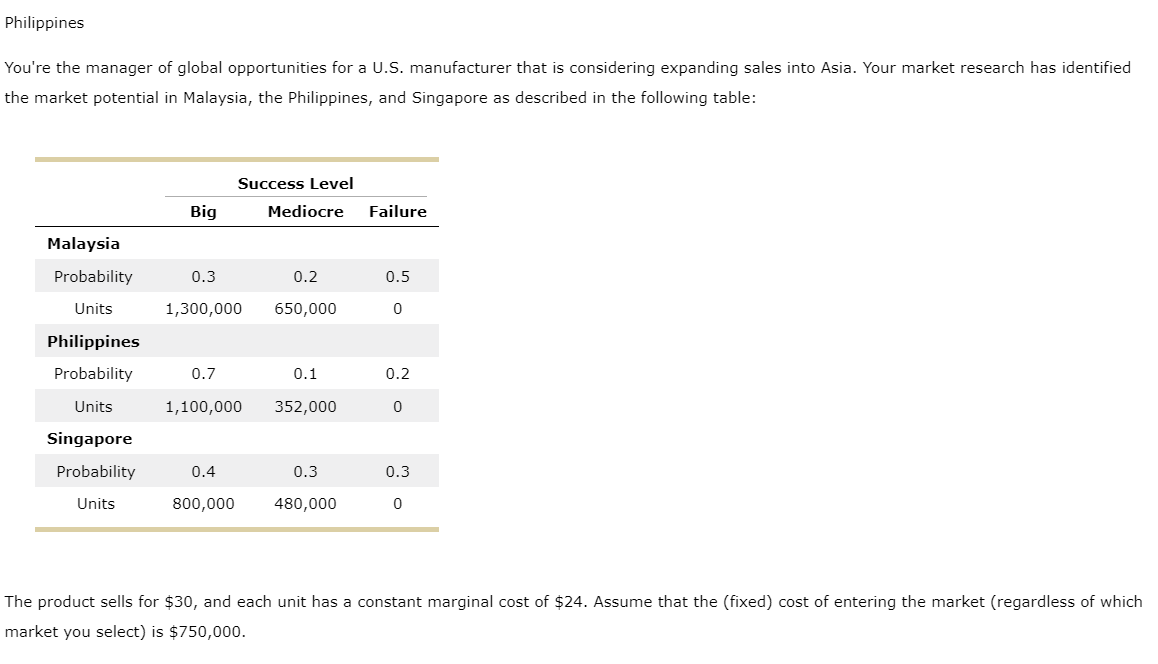

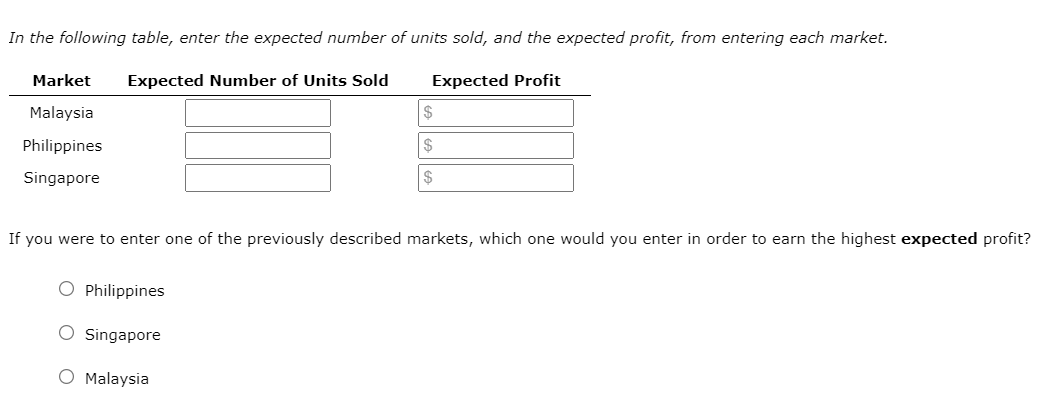

You're the manager of global opportunities for a U.S. manufacturer that is considering expanding sales into Asia. Your marked the market potential in Malaysia, the Philippines, and Singapore as described in the following table: The product sells for $30, and each unit has a constant marginal cost of $24. Assume that the (fixed) cost of entering the market (regardless of which market you select) is $750,000. In the following table, enter the expected number of units sold, and the expected profit, from entering each market. If you were to enter one of the previously described markets, which one would you enter in order to earn the highest expected profit? Philippines Singapore MalaysiaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started