Answered step by step

Verified Expert Solution

Question

1 Approved Answer

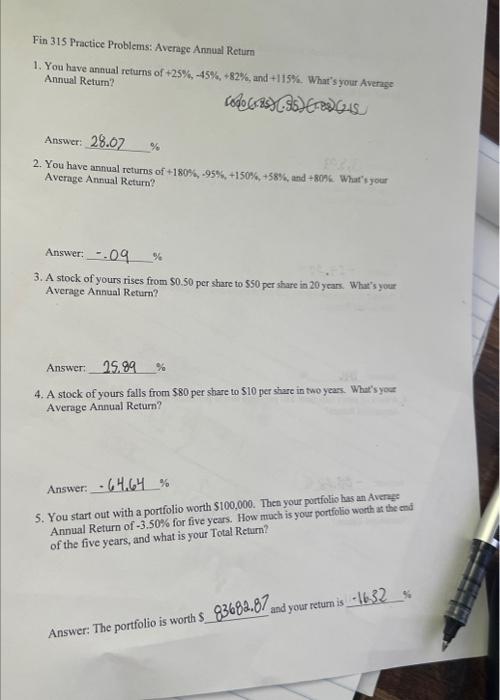

how do u solve. 1. You have annual returns of +25%,45%, 482%, and +115%. What's your Average Annual Retum? co40(1.25)(.35)(1.82)(245) Answer: 28.07% 2. You have

how do u solve.

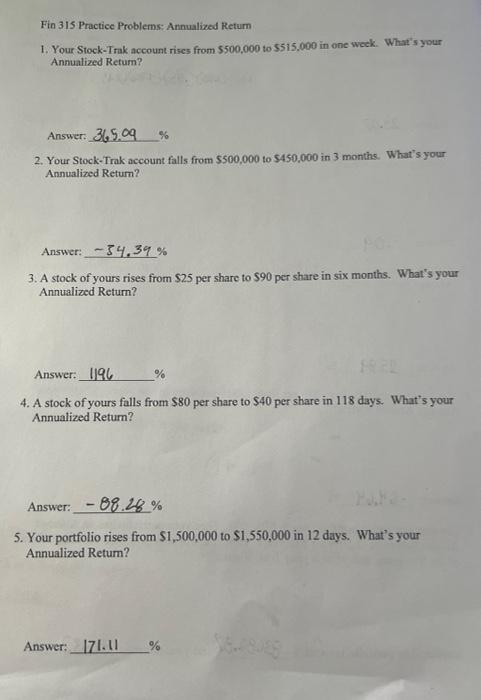

1. You have annual returns of +25%,45%, 482%, and +115%. What's your Average Annual Retum? co40(1.25)(.35)(1.82)(245) Answer: 28.07% 2. You have annual returns of Average Annual Return? Average Annual Return? Answer: .09 3. A stock of yours rises from $0.50 per share to $50 per share in 20 years. What's your Average Annual Return? Answer: 25.89% 4. A stock of yours falls from $80 per share to $10 per share in two yeas. Whar's your Average Annual Return? Answer: =64,64% 5. You start out with a portfolio worth S100,000. Then your portfolio has an Average Annual Return of 3.50% for five years. How much is your portfolio worth at the on of the five years, and what is your Total Return? Answer: The portfolio is worth $83688.87 and your retum is 1632 1. Your Stock-Trak account rises from $500,000 to $515,000 in one weck. What's your Annualized Return? Answer: 36509 2. Your Stock-Trak account falls from $500,000 to $450,000 in 3 months. What's your Annualized Return? Answer: 34,34% 3. A stock of yours rises from $25 per share to $90 per share in six months. What's your Annualized Return? Answer: 1196 4. A stock of yours falls from $80 per share to $40 per share in 118 days. What's your Annualized Return? Answer: 88.28% 5. Your portfolio rises from $1,500,000 to $1,550,000 in 12 days. What's your Annualized Return? Answer: 171.11%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started