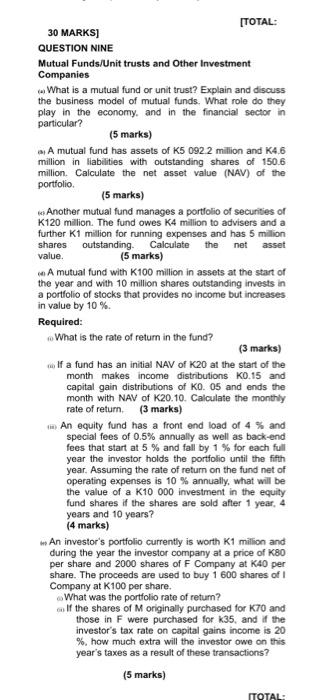

[TOTAL: 30 MARKS] QUESTION NINE Mutual Funds/Unit trusts and Other Investment Companies (w) What is a mutual fund or unit trust? Explain and discuss the business model of mutual funds. What role do they play in the economy. and in the financial sector in particular? (5 marks) a) A mutual fund has assets of K5092.2 million and K4.6 million in liabilities with outstanding shares of 150.6 million. Caiculate the net asset value (NAV) of the portfolio. (5 marks) (4) Another mutual fund manages a portfolio of securities of K120 milion. The fund owes K4 million to advisers and a further K1 million for running expenses and has 5 million shares outstanding. Calculate the net asset value. (5 marks) 4. A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10%. Required: w. What is the rate of return in the fund? (3 marks) wii If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0.05 and ends the month with NAV of K20.10. Calculate the monthly rate of retum. (3 marks) (iii) An equity fund has a front end load of 4% and special fees of 0.5% annually as well as back-end fees that start at 5% and fall by 1% for each full year the investor holds the portiolio until the fith year. Assuming the rate of return on the fund net of operating expenses is 10% annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years? (4 marks) in An investor's portfolio currently is worth K1 milion and during the year the imvestor company at a price of K80 per share and 2000 shares of F Company at K40 per share. The proceeds are used to buy 1600 shares of I Company at K100 per share. What was the portfolio rate of return? a If the shares of M originally purchased for K70 and those in F were purchased for k35, and if the investor's tax rate on capital gains income is 20 \%. how much extra will the investor owe on this year's taxes as a result of these transactions