Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 QUESTION 4 QUESTION 9 A Company has a bond outstanding with a face value of $ 1 0 0 0 0 that reaches

QUESTION QUESTION QUESTION

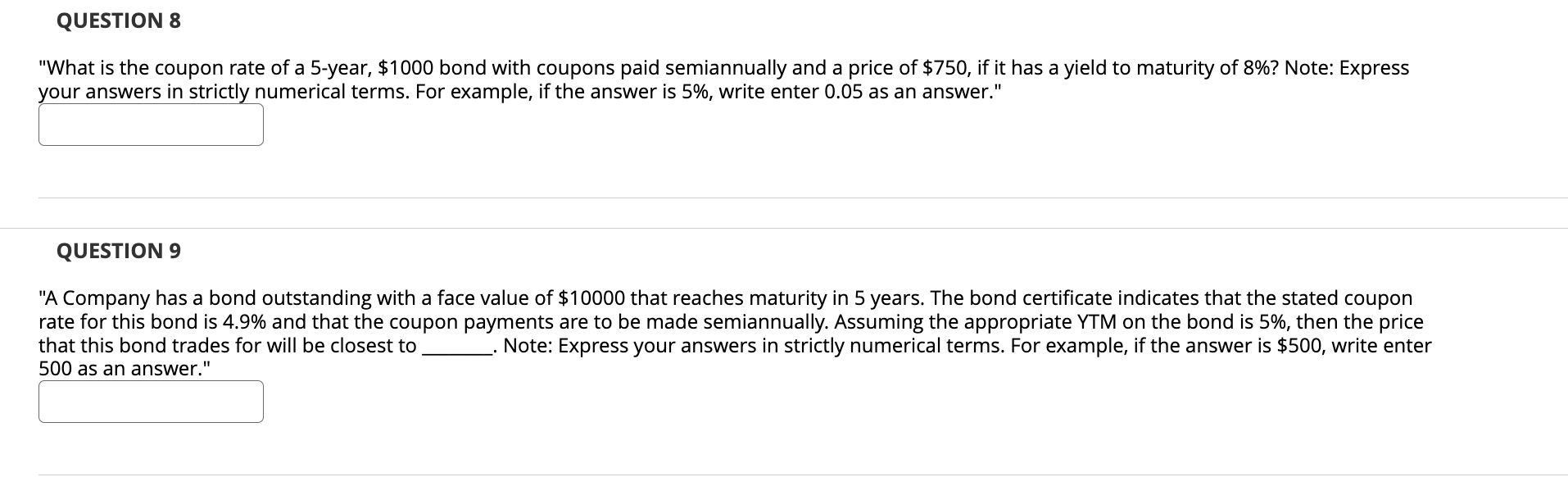

"A Company has a bond outstanding with a face value of $ that reaches maturity in years. The bond certificate indicates that the stated coupon

rate for this bond is and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the bond is then the price

that this bond trades for will be closest to

Note: Express your answers in strictly numerical terms. For example, if the answer is $ write enter

as an answer."

"A coupon bond that pays interest annually has a par value of $ matures in years, and has a yield to maturity of If the coupon rate is the

value of the bond today will be

answer."

Note: Express your answers in strictly numerical terms. For example, if the answer is $ write enter as an

QUESTION

"A coupon bond that pays interest quarterly has a par value of $ matures in years, and has a yield to maturity of If the coupon rate is the

value of the bond today will be

Note: Express your answers in strictly numerical terms. For example, if the answer is $ write enter as an

answer."

QUESTION

"What is the coupon payment of a year $ bond, YTM and with a coupon rate and quarterly payments? Note: Express your answers in strictly

numerical terms. For example, if the answer is $ write enter as an answer."

QUESTION

"Consider a zerocoupon bond with $ face value and years to maturity. If the YTM is this bond will trade at a price of

answers in strictlv numerical terms. For example, if the answer is $ write enter as an answer."

Which of the following bonds is trading at par?

"A bond with a $ face value trading at $

"A bond with a $ face value trading at $

"A bond with a $ face value trading at $

"A bond with a $ face value trading at $

QUESTION

"A company releases a fiveyear bond with a face value of $ and coupons paid semiannually. If market interest rates imply a YTM of which of the

following coupon rates will cause the bond to be issued at a discount?

QUESTION

Which of the following bonds is trading at a premium?

"A fiveyear bond with a $ face value whose yield to maturity is and coupon rate is APR paid semiannually.

"A tenyear bond with a $ face value whose yield to maturity is and coupon rate is APR paid semiannually.

A year bond with a $ face value whose yield to maturity is and coupon rate is APR paid semiannually.

"A twoyear bond with a $ face value whose yield to maturity is and coupon rate is APR paid monthly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started