Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 QUESTION ONE [20] REQUIRED Study the information provided below and answer the following questions: 1.1 Calculate the Payback Period of Machine Ati (answer

Question 1

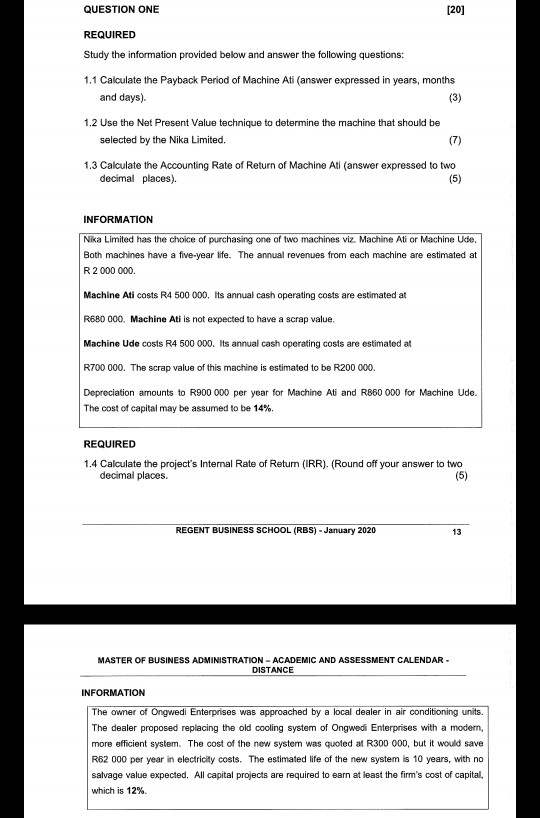

QUESTION ONE [20] REQUIRED Study the information provided below and answer the following questions: 1.1 Calculate the Payback Period of Machine Ati (answer expressed in years, months and days) (3) 1.2 Use the Net Present Value technique to determine the machine that should be selected by the Nika Limited. 1.3 Calculate the Accounting Rate of Return of Machine Atl (answer expressed to two decimal places). INFORMATION Nika Limited has the choice of purchasing one of two machines viz Machine Ati or Machine Ude. Both machines have a five-year life. The annual revenues from each machine are estimated at R 2 000 000 Machine Ati costs R4 500 000. Its annual cash operating costs are estimated at R680 000. Machine Ati is not expected to have a scrap value. Machine Ude costs R4 500 000. Its annual cash operating costs are estimated at R700 000. The scrap value of this machine is estimated to be R200 000 Depreciation amounts to R900 000 per year for Machine Ali and R860 000 for Machine Ude. The cost of capital may be assumed to be 14%. REQUIRED 1.4 Calculate the project's Internal Rate of Return (IRR). (Round off your answer to two decimal places. REGENT BUSINESS SCHOOL (RBS) - January 2020 MASTER OF BUSINESS ADMINISTRATION - ACADEMIC AND ASSESSMENT CALENDAR DISTANCE INFORMATION The owner of Ongwedi Enterprises was approached by a local dealer in air conditioning units The dealer proposed replacing the old cooling system of Ongwedi Enterprises with a modem, more efficient system. The cost of the new system was quoted at R300 000, but it would save R62 000 per year in electricity costs. The estimated life of the new system is 10 years, with no salvage value expected. All capital projects are required to earn at least the firm's cost of capital, which is 12%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started