question 1

questions 2

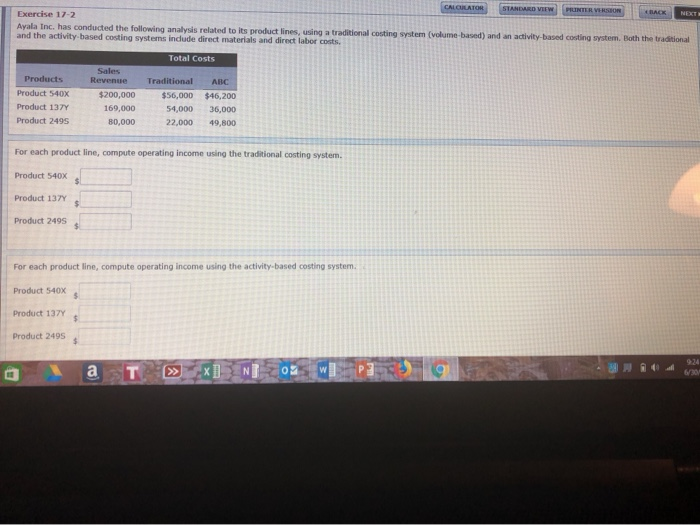

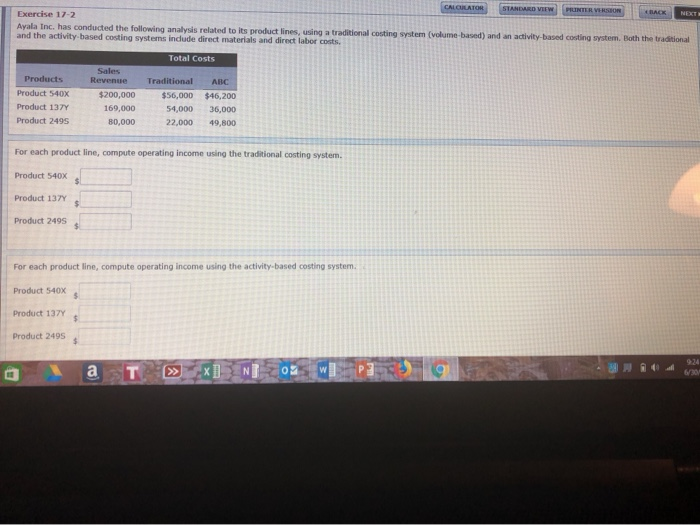

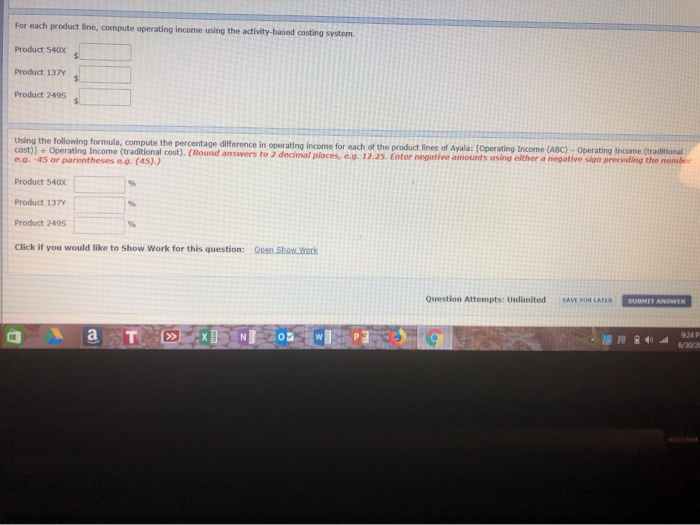

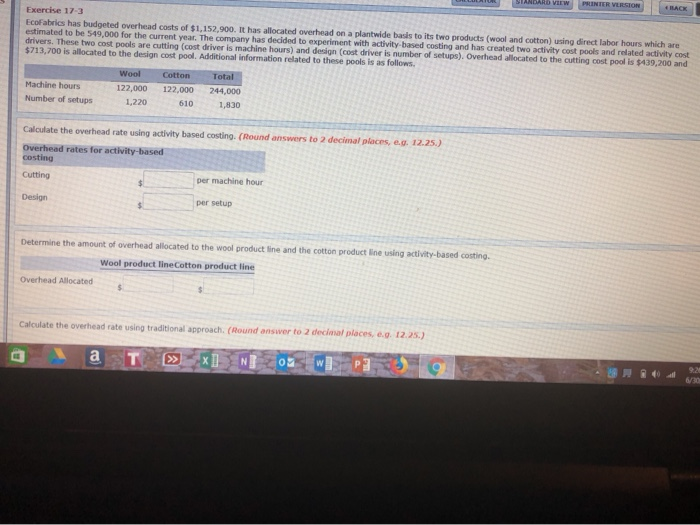

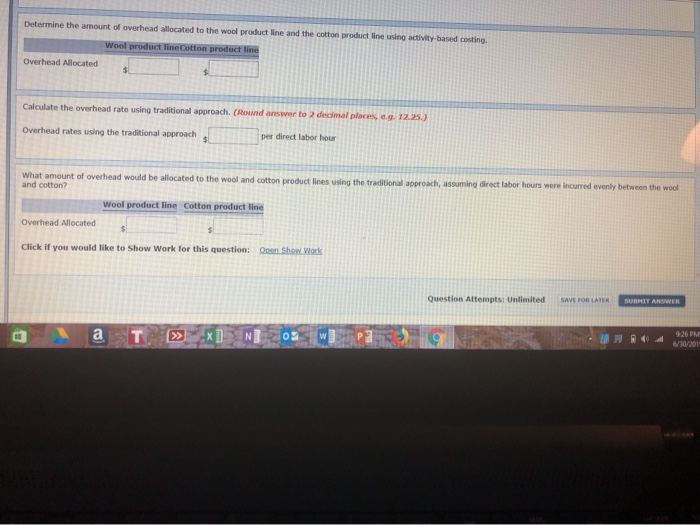

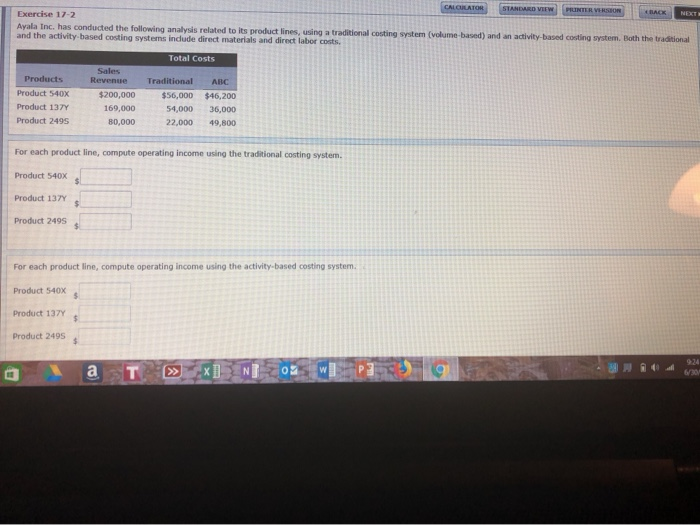

CALOULATOR STANDARD VIEW PRINTER VERSHON Exercise 17-2 Ayala Inc. has conducted the following analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and the activity-based costing systems indlude direct materials and direct labor costs, eBACK NEXT Total Costs Sales Revenue Products Traditional ABC Product 540X $200,000 $56,000 $46,200 Product 137Y 169,000 54,000 36,000 Product 249s 80,000 22,000 49,800 For each product line, compute operating income using the traditional costing system. Product 540X Product 137Y Product 249S For each product line, compute operating income using the activity-based costing system. Product 540X Product 137Y Product 2495 924 N 4 a T W 6/30 For each product line, compute operating income using the activity-based costing system. Product 540X Product 137Y Product 2495 Using the following formula, compute the percentage difference in operating income for each of the product lines of Ayala: [Operating Income (ABC))- Operating Income (traditional cost)]+ Operating Income (traditional cost). (Round answers to 2 decimal places, e.a, 12.25. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Product 540X Product 137Y Product 2495 Click if you would like to Show Work for this question: Open Show Work Question Attempts: Unlimited SAVE FOR LAIUR SUBMIT ANSWER T X a 924 P 6/30/20 PRINTER VERSION STANDARD VIEW tBACKO Exercise 17-3 EcoFabrics has budgeted overhead costs of $1.152,900. It has allocated overhead on a plantwide basis to its two products (wool and cotton) using direct labor hours which are estimated to be 549,000 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (cost driver is machine hours) and design (cost driver is number of setups), Overhead allocated to the cutting cost pool is $439,200 and $713,700 is allocated to the design cost pool. Additional information related to these pools is as follows Wool Cotton Total Machine hours 122,000 122,000 244,000 Number of setups 1,220 610 1,830 Calculate the overhead rate using activity based costing. (Round answers to 2 decimal places, e.g. 12.25.) Overhead rates for activity-based costing Cutting per machine hour Design per setup Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing. Wool product line Cotton product line Overhead Allocated Calculate the overhead rate using traditional approach. (Round answer to 2 decimal places, e.g. 12.25.) N 6/30 Ed Determine the amount of overhead allocated to the wool product ine and the cotton product line using activity-based costing. Wool product line Cotton product line Overhead Allocated Calculate the overhead rate using traditional approach. (Round answer to 2 decimal places, e.g. 12.25) Overhead rates using the traditional approach per direct labor hour What amount of overhead would be allocated to the wool and cotton product lines using the traditional approach, assuming direct labor hours were incurred evenly between the wool and cotton? Wool product line Cotton product line Overhead Allocated Click if you would like to Show Work for this question: Qpen Show Work Question Attempts: Unlimited SAVE FOR LATER SUBHIT ANSWER a 926 PM N 6/30/201