Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000). If your answer is not a whole

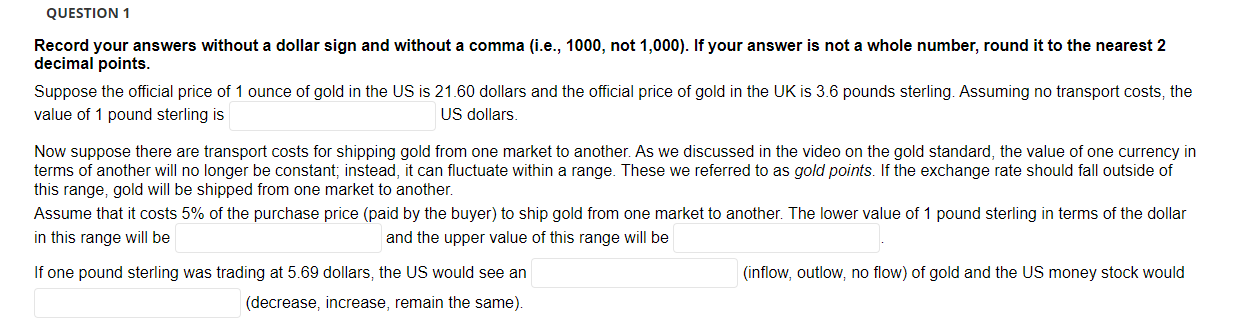

QUESTION 1 Record your answers without a dollar sign and without a comma (i.e., 1000, not 1,000). If your answer is not a whole number, round it to the nearest 2 decimal points. Suppose the official price of 1 ounce of gold in the US is 21.60 dollars and the official price of gold in the UK is 3.6 pounds sterling. Assuming no transport costs, the value of 1 pound sterling is US dollars. Now suppose there are transport costs for shipping gold from one market to another. As we discussed in the video on the gold standard, the value of one currency in terms of another will no longer be constant; instead, it can fluctuate within a range. These we referred to as gold points. If the exchange rate should fall outside of this range, gold will be shipped from one market to another. Assume that it costs 5% of the purchase price (paid by the buyer) to ship gold from one market to another. The lower value of 1 pound sterling in terms of the dollar in this range will be and the upper value of this range will be If one pound sterling was trading at 5.69 dollars, the US would see an (decrease, increase, remain the same). (inflow, outlow, no flow) of gold and the US money stock would

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 1 1 Assuming no transport costs the value of 1 pound sterling in US d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started