Answered step by step

Verified Expert Solution

Question

1 Approved Answer

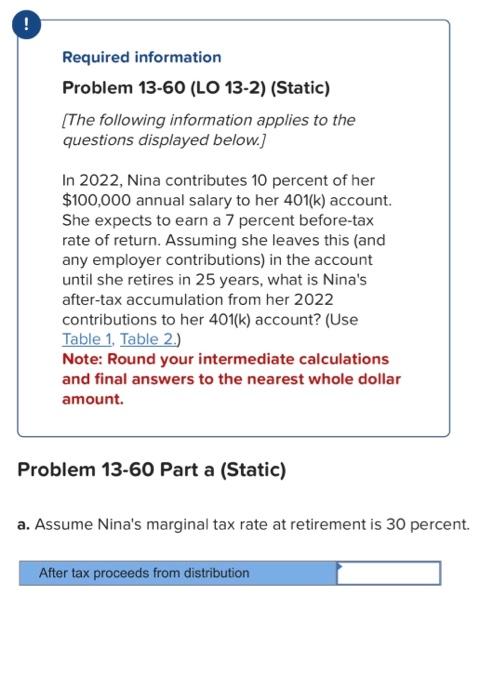

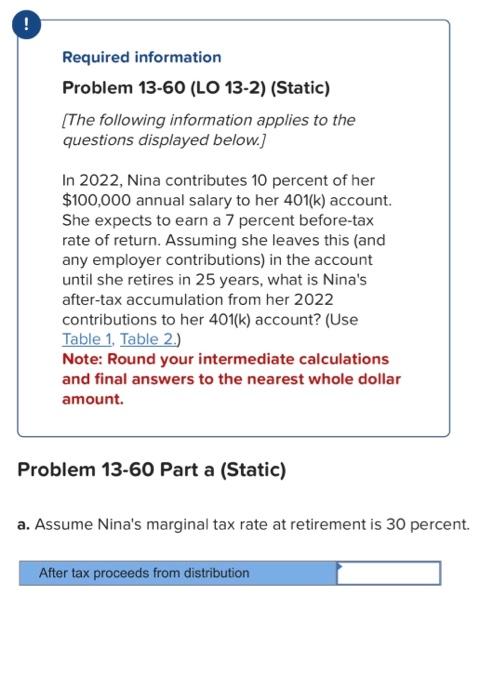

Question 1: Required information Problem 13-60 (LO 13-2) (Static) [The following information applies to the questions displayed below.] In 2022, Nina contributes 10 percent of

Question 1:

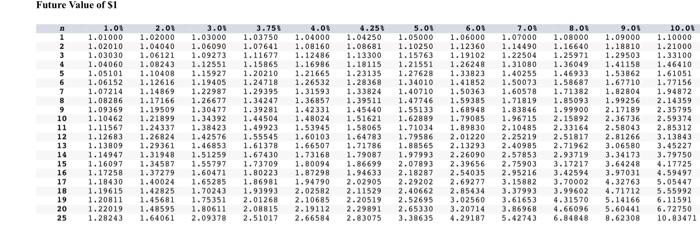

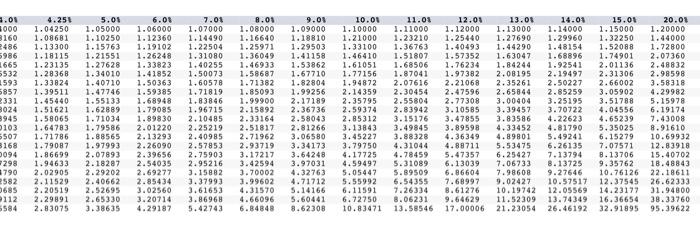

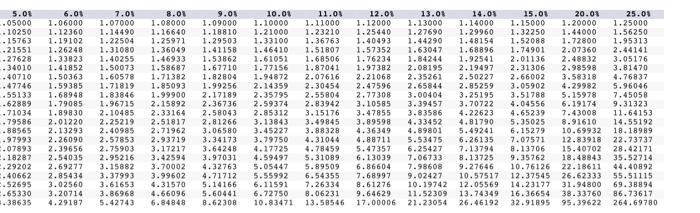

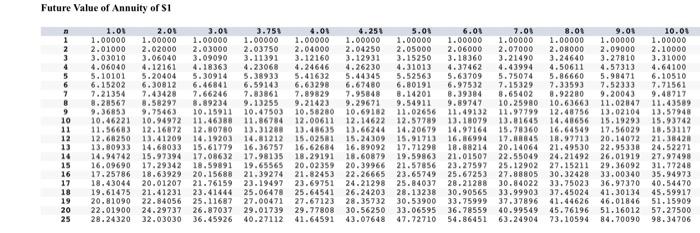

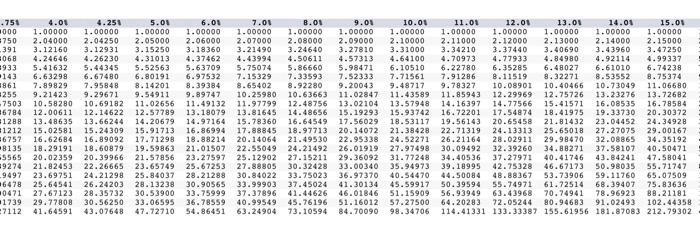

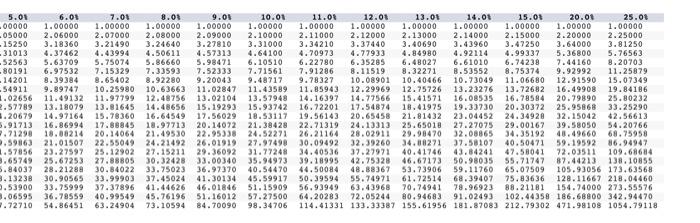

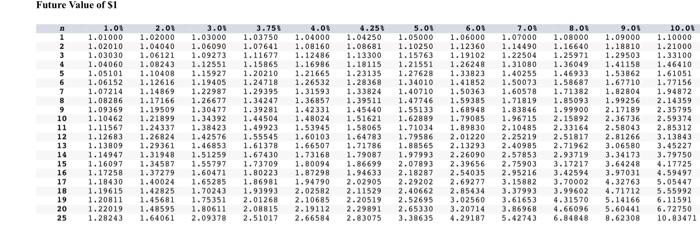

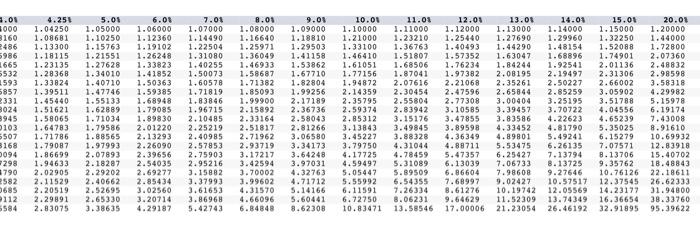

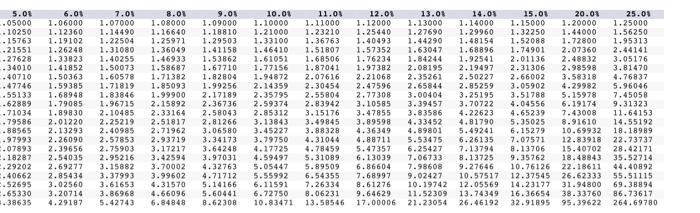

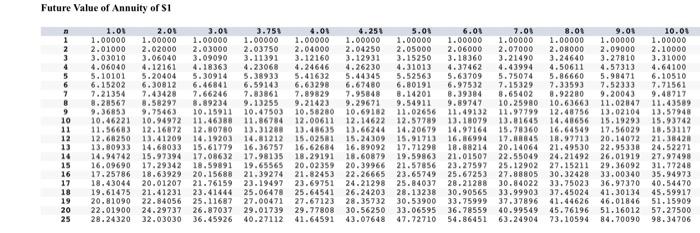

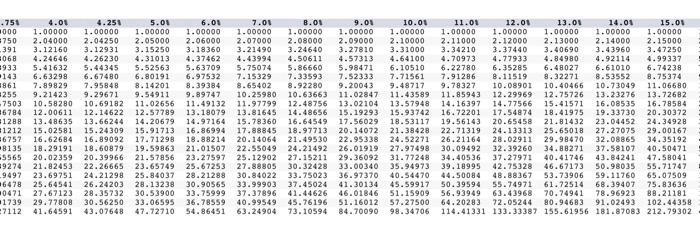

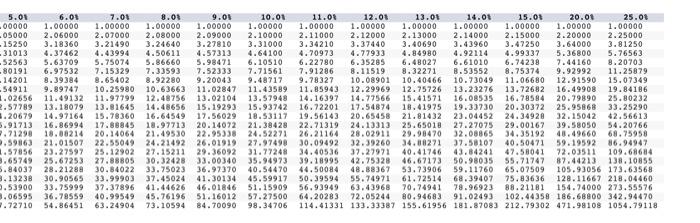

Required information Problem 13-60 (LO 13-2) (Static) [The following information applies to the questions displayed below.] In 2022, Nina contributes 10 percent of her $100,000 annual salary to her 401(k) account. She expects to earn a 7 percent before-tax rate of return. Assuming she leaves this (and any employer contributions) in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2022 contributions to her 401(k) account? (Use Table 1, Table 2.) Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-60 Part a (Static) a. Assume Nina's marginal tax rate at retirement is 30 percent. Future Value of $1 Future Value of Annuity of $1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started