Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Jeppard Pty Ltd as at 15 June 2020. (6

Question 1

Required:

Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Jeppard Pty Ltd as at 15 June 2020. (6 marks)

(b) Prepare the general journal entries in the records of Gus Sdn Bhd at 15 June 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. (6 marks)

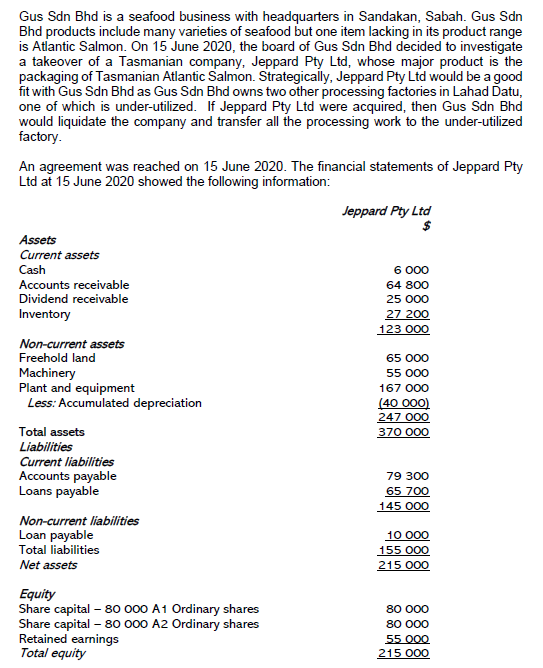

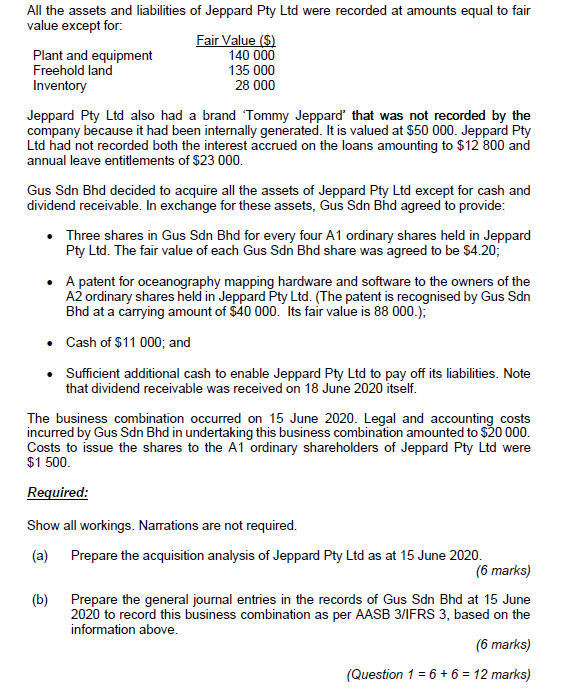

Gus Sdn Bhd is a seafood business with headquarters in Sandakan, Sabah. Gus Sdn Bhd products include many varieties of seafood but one item lacking in its product range is Atlantic Salmon. On 15 June 2020, the board of Gus Sdn Bhd decided to investigate a takeover of a Tasmanian company, Jeppard Pty Ltd, whose major product is the packaging of Tasmanian Atlantic Salmon. Strategically, Jeppard Pty Ltd would be a good fit with Gus Sdn Bhd as Gus Sdn Bhd owns two other processing factories in Lahad Datu, one of which is under-utilized. If Jeppard Pty Ltd were acquired, then Gus Sdn Bhd would liquidate the company and transfer all the processing work to the under-utilized factory. An agreement was reached on 15 June 2020. The financial statements of Jeppard Pty Ltd at 15 June 2020 showed the following information: Jeppard Pty Ltd $ 6 000 Assets Current assets Cash Accounts receivable Dividend receivable Inventory 64 800 25 000 27 200 123 000 65 000 Non-current assets Freehold land Machinery Plant and equipment Less: Accumulated depreciation 55 000 167 000 (40 000) 247 000 370 000 Total assets Liabilities Current liabilities Accounts payable Loans payable 79 300 65 700 145 000 Non-current liabilities Loan payable Total liabilities Net assets 10 000 155 000 215 000 80 000 Equity Share capital - 80 000 A1 Ordinary shares Share capital 80 000 A2 Ordinary shares Retained earnings Total equity 80 000 55 000 215 000 All the assets and liabilities of Jeppard Pty Ltd were recorded at amounts equal to fair value except for: Fair Value ($) Plant and equipment 140 000 Freehold land 135 000 Inventory 28 000 Jeppard Pty Ltd also had a brand Tommy Jeppard' that was not recorded by the company because it had been internally generated. It is valued at $50 000. Jeppard Pty Ltd had not recorded both the interest accrued on the loans amounting to $12 800 and annual leave entitlements of $23 000. Gus Sdn Bhd decided to acquire all the assets of Jeppard Pty Ltd except for cash and dividend receivable. In exchange for these assets, Gus Sdn Bhd agreed to provide: Three shares in Gus Sdn Bhd for every four A1 ordinary shares held in Jeppard Pty Ltd. The fair value of each Gus Sdn Bhd share was agreed to be $4.20; A patent for oceanography mapping hardware and software to the owners of the A2 ordinary shares held in Jeppard Pty Ltd. (The patent is recognised by Gus Sdn Bhd at a carrying amount of $40 000. Its fair value is 88 000.); Cash of $11 000; and Sufficient additional cash to enable Jeppard Pty Ltd to pay off its liabilities. Note that dividend receivable was received on 18 June 2020 itself. The business combination occurred on 15 June 2020. Legal and accounting costs incurred by Gus Sdn Bhd in undertaking this business combination amounted to $20 000. Costs to issue the shares to the A1 ordinary shareholders of Jeppard Pty Ltd were $1 500 Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Jeppard Pty Ltd as at 15 June 2020. (6 marks) (b) Prepare the general journal entries in the records of Gus Sdn Bhd at 15 June 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. (6 marks) (Question 1 = 6 + 6 = 12 marks) Gus Sdn Bhd is a seafood business with headquarters in Sandakan, Sabah. Gus Sdn Bhd products include many varieties of seafood but one item lacking in its product range is Atlantic Salmon. On 15 June 2020, the board of Gus Sdn Bhd decided to investigate a takeover of a Tasmanian company, Jeppard Pty Ltd, whose major product is the packaging of Tasmanian Atlantic Salmon. Strategically, Jeppard Pty Ltd would be a good fit with Gus Sdn Bhd as Gus Sdn Bhd owns two other processing factories in Lahad Datu, one of which is under-utilized. If Jeppard Pty Ltd were acquired, then Gus Sdn Bhd would liquidate the company and transfer all the processing work to the under-utilized factory. An agreement was reached on 15 June 2020. The financial statements of Jeppard Pty Ltd at 15 June 2020 showed the following information: Jeppard Pty Ltd $ 6 000 Assets Current assets Cash Accounts receivable Dividend receivable Inventory 64 800 25 000 27 200 123 000 65 000 Non-current assets Freehold land Machinery Plant and equipment Less: Accumulated depreciation 55 000 167 000 (40 000) 247 000 370 000 Total assets Liabilities Current liabilities Accounts payable Loans payable 79 300 65 700 145 000 Non-current liabilities Loan payable Total liabilities Net assets 10 000 155 000 215 000 80 000 Equity Share capital - 80 000 A1 Ordinary shares Share capital 80 000 A2 Ordinary shares Retained earnings Total equity 80 000 55 000 215 000 All the assets and liabilities of Jeppard Pty Ltd were recorded at amounts equal to fair value except for: Fair Value ($) Plant and equipment 140 000 Freehold land 135 000 Inventory 28 000 Jeppard Pty Ltd also had a brand Tommy Jeppard' that was not recorded by the company because it had been internally generated. It is valued at $50 000. Jeppard Pty Ltd had not recorded both the interest accrued on the loans amounting to $12 800 and annual leave entitlements of $23 000. Gus Sdn Bhd decided to acquire all the assets of Jeppard Pty Ltd except for cash and dividend receivable. In exchange for these assets, Gus Sdn Bhd agreed to provide: Three shares in Gus Sdn Bhd for every four A1 ordinary shares held in Jeppard Pty Ltd. The fair value of each Gus Sdn Bhd share was agreed to be $4.20; A patent for oceanography mapping hardware and software to the owners of the A2 ordinary shares held in Jeppard Pty Ltd. (The patent is recognised by Gus Sdn Bhd at a carrying amount of $40 000. Its fair value is 88 000.); Cash of $11 000; and Sufficient additional cash to enable Jeppard Pty Ltd to pay off its liabilities. Note that dividend receivable was received on 18 June 2020 itself. The business combination occurred on 15 June 2020. Legal and accounting costs incurred by Gus Sdn Bhd in undertaking this business combination amounted to $20 000. Costs to issue the shares to the A1 ordinary shareholders of Jeppard Pty Ltd were $1 500 Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Jeppard Pty Ltd as at 15 June 2020. (6 marks) (b) Prepare the general journal entries in the records of Gus Sdn Bhd at 15 June 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. (6 marks) (Question 1 = 6 + 6 = 12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started