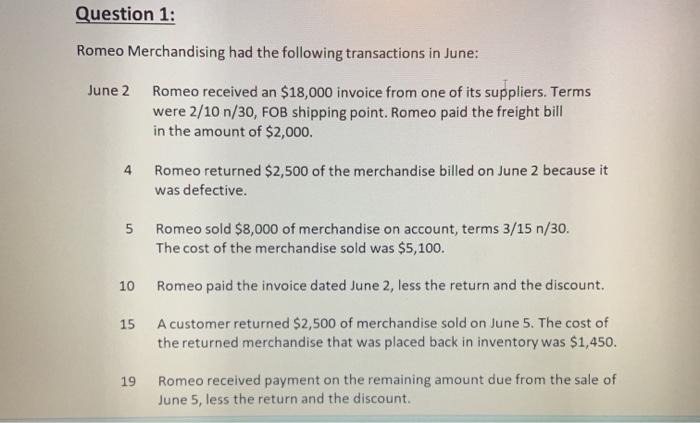

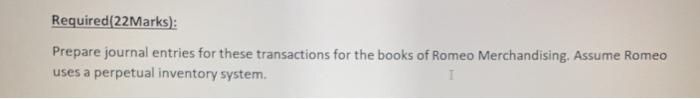

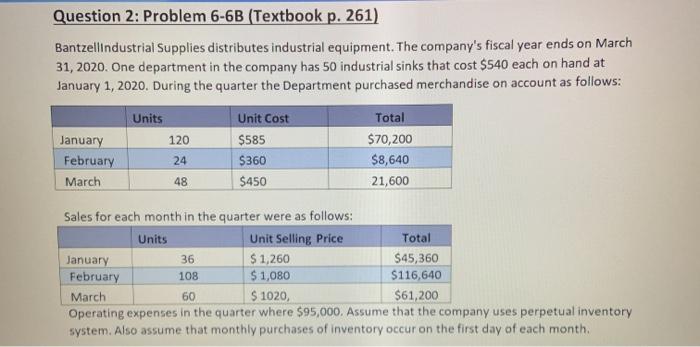

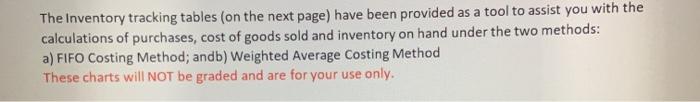

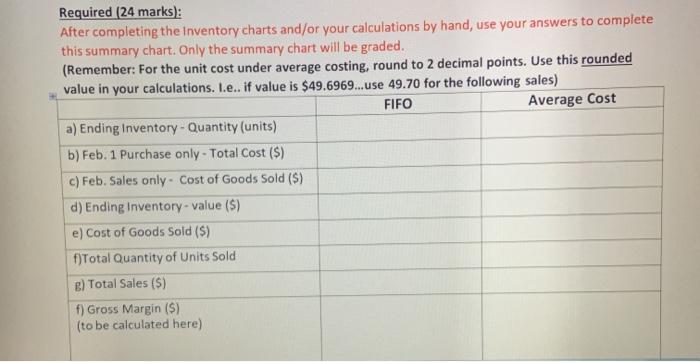

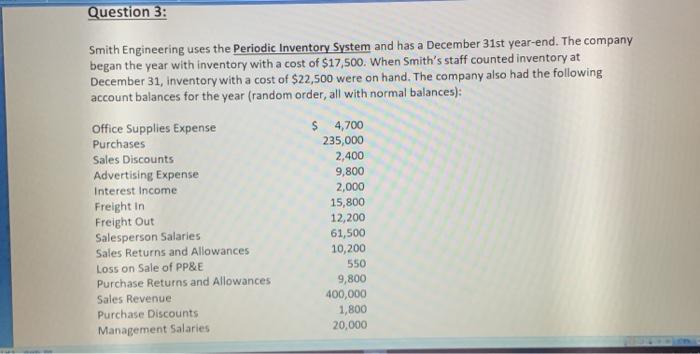

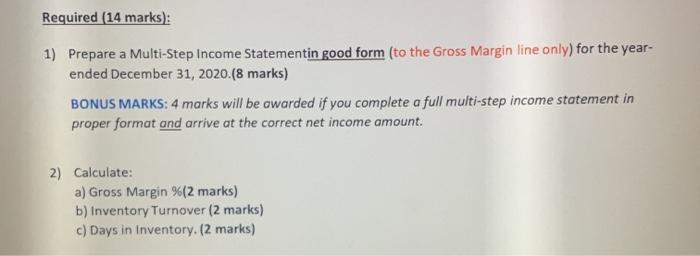

Question 1: Romeo Merchandising had the following transactions in June: June 2 Romeo received an $18,000 invoice from one of its suppliers. Terms were 2/10 n/30, FOB shipping point. Romeo paid the freight bill in the amount of $2,000. 4 Romeo returned $2,500 of the merchandise billed on June 2 because it was defective. 5 Romeo sold $8,000 of merchandise on account, terms 3/15 n/30. The cost of the merchandise sold was $5,100. Romeo paid the invoice dated June 2, less the return and the discount. 15 A customer returned $2,500 of merchandise sold on June 5. The cost of the returned merchandise that was placed back in inventory was $1,450. 10 19 Romeo received payment on the remaining amount due from the sale of June 5, less the return and the discount. Required(22Marks): Prepare journal entries for these transactions for the books of Romeo Merchandising, Assume Romeo uses a perpetual inventory system. Question 2: Problem 6-6B (Textbook p. 261) Bantzellindustrial Supplies distributes industrial equipment. The company's fiscal year ends on March 31, 2020. One department in the company has 50 industrial sinks that cost $540 each on hand at January 1, 2020. During the quarter the Department purchased merchandise on account as follows: Units January February March 120 24 Unit Cost $585 $360 $450 Total $70,200 $8,640 21,600 48 36 Sales for each month in the quarter were as follows: Units Unit Selling Price Total January $ 1,260 $45,360 February 108 $ 1,080 $116,640 March 60 $ 1020, $61,200 Operating expenses in the quarter where $95,000. Assume that the company uses perpetual inventory system. Also assume that monthly purchases of inventory occur on the first day of each month The Inventory tracking tables (on the next page) have been provided as a tool to assist you with the calculations of purchases, cost of goods sold and inventory on hand under the two methods: a) FIFO Costing Method; andb) Weighted Average Costing Method These charts will NOT be graded and are for your use only. Required (24 marks): After completing the Inventory charts and/or your calculations by hand, use your answers to complete this summary chart. Only the summary chart will be graded. (Remember: For the unit cost under average costing, round to 2 decimal points. Use this rounded value in your calculations. I.e.. if value is $49.6969...use 49.70 for the following sales) FIFO Average Cost a) Ending Inventory - Quantity (units) b) Feb. 1 Purchase only - Total Cost ($) c) Feb. Sales only. Cost of Goods Sold ($) d) Ending Inventory-value () e) Cost of Goods Sold ($) f)Total Quantity of Units Sold e) Total Sales ($) f) Gross Margin ($) (to be calculated here) Question 3: Smith Engineering uses the Periodic Inventory System and has a December 31st year-end. The company began the year with inventory with a cost of $17,500. When Smith's staff counted inventory at December 31, inventory with a cost of $22,500 were on hand. The company also had the following account balances for the year (random order, all with normal balances): Office Supplies Expense $ 4,700 Purchases 235,000 Sales Discounts 2,400 Advertising Expense 9,800 Interest Income 2,000 Freight in 15,800 Freight Out 12,200 Salesperson Salaries 61,500 Sales Returns and Allowances 10,200 Loss on Sale of PP&E 550 Purchase Returns and Allowances 9,800 Sales Revenue 400,000 Purchase Discounts 1,800 Management Salaries 20,000 Required (14 marks): 1) Prepare a Multi-Step Income Statementin good form (to the Gross Margin line only) for the year- ended December 31, 2020.(8 marks) BONUS MARKS: 4 marks will be awarded if you complete a full multi-step income statement in proper format and arrive at the correct net income amount 2) Calculate: a) Gross Margin %(2 marks) b) Inventory Turnover (2 marks) c) Days in Inventory. (2 marks)