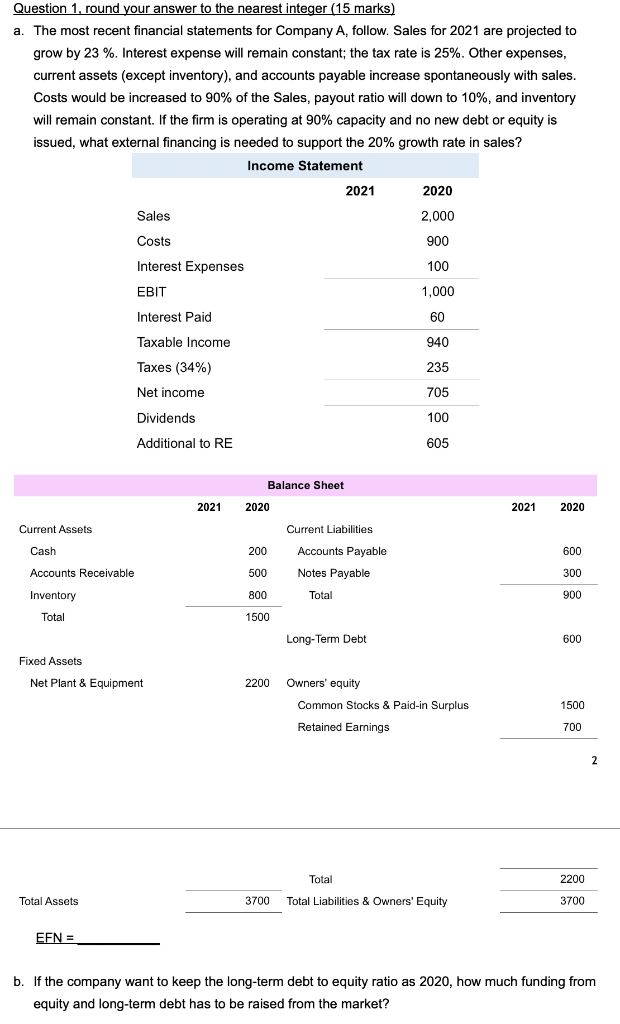

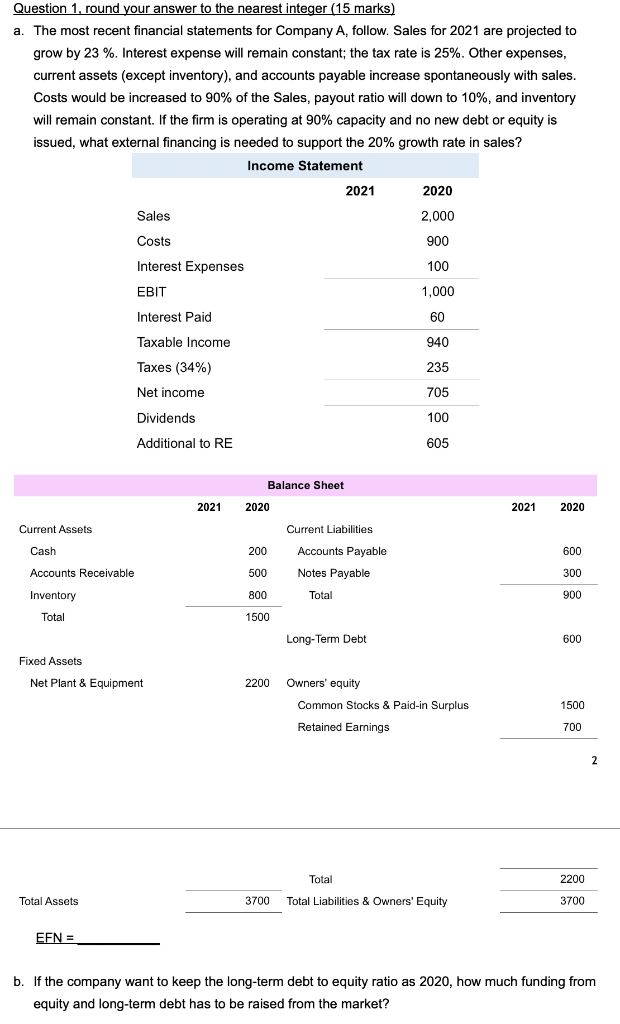

Question 1, round your answer to the nearest integer (15 marks) a. The most recent financial statements for Company A, follow. Sales for 2021 are projected to grow by 23 %. Interest expense will remain constant; the tax rate is 25%. Other expenses, current assets (except inventory), and accounts payable increase spontaneously with sales. Costs would be increased to 90% of the Sales, payout ratio will down to 10%, and inventory will remain constant. If the firm is operating at 90% capacity and no new debt or equity is issued, what external financing is needed to support the 20% growth rate in sales? Income Statement 2021 2020 Sales 2,000 Costs 900 100 Interest Expenses EBIT 1,000 Interest Paid 60 Taxable Income 940 235 Taxes (34%) Net income 705 Dividends 100 Additional to RE 605 Balance Sheet 2021 2020 2021 2020 Current Assets Cash 200 600 Current Liabilities Accounts Payable Notes Payable Total Accounts Receivable 500 300 Inventory 800 900 Total 1500 Long-Term Debt 600 Fixed Assets Net Plant & Equipment 2200 Owners' equity Common Stocks & Paid-in Surplus 1500 Retained Earnings 700 2 Total 2200 Total Assets 3700 Total Liabilities & Owners' Equity 3700 EFN = b. If the company want to keep the long-term debt to equity ratio as 2020, how much funding from equity and long-term debt has to be raised from the market? Question 1, round your answer to the nearest integer (15 marks) a. The most recent financial statements for Company A, follow. Sales for 2021 are projected to grow by 23 %. Interest expense will remain constant; the tax rate is 25%. Other expenses, current assets (except inventory), and accounts payable increase spontaneously with sales. Costs would be increased to 90% of the Sales, payout ratio will down to 10%, and inventory will remain constant. If the firm is operating at 90% capacity and no new debt or equity is issued, what external financing is needed to support the 20% growth rate in sales? Income Statement 2021 2020 Sales 2,000 Costs 900 100 Interest Expenses EBIT 1,000 Interest Paid 60 Taxable Income 940 235 Taxes (34%) Net income 705 Dividends 100 Additional to RE 605 Balance Sheet 2021 2020 2021 2020 Current Assets Cash 200 600 Current Liabilities Accounts Payable Notes Payable Total Accounts Receivable 500 300 Inventory 800 900 Total 1500 Long-Term Debt 600 Fixed Assets Net Plant & Equipment 2200 Owners' equity Common Stocks & Paid-in Surplus 1500 Retained Earnings 700 2 Total 2200 Total Assets 3700 Total Liabilities & Owners' Equity 3700 EFN = b. If the company want to keep the long-term debt to equity ratio as 2020, how much funding from equity and long-term debt has to be raised from the market