Answered step by step

Verified Expert Solution

Question

1 Approved Answer

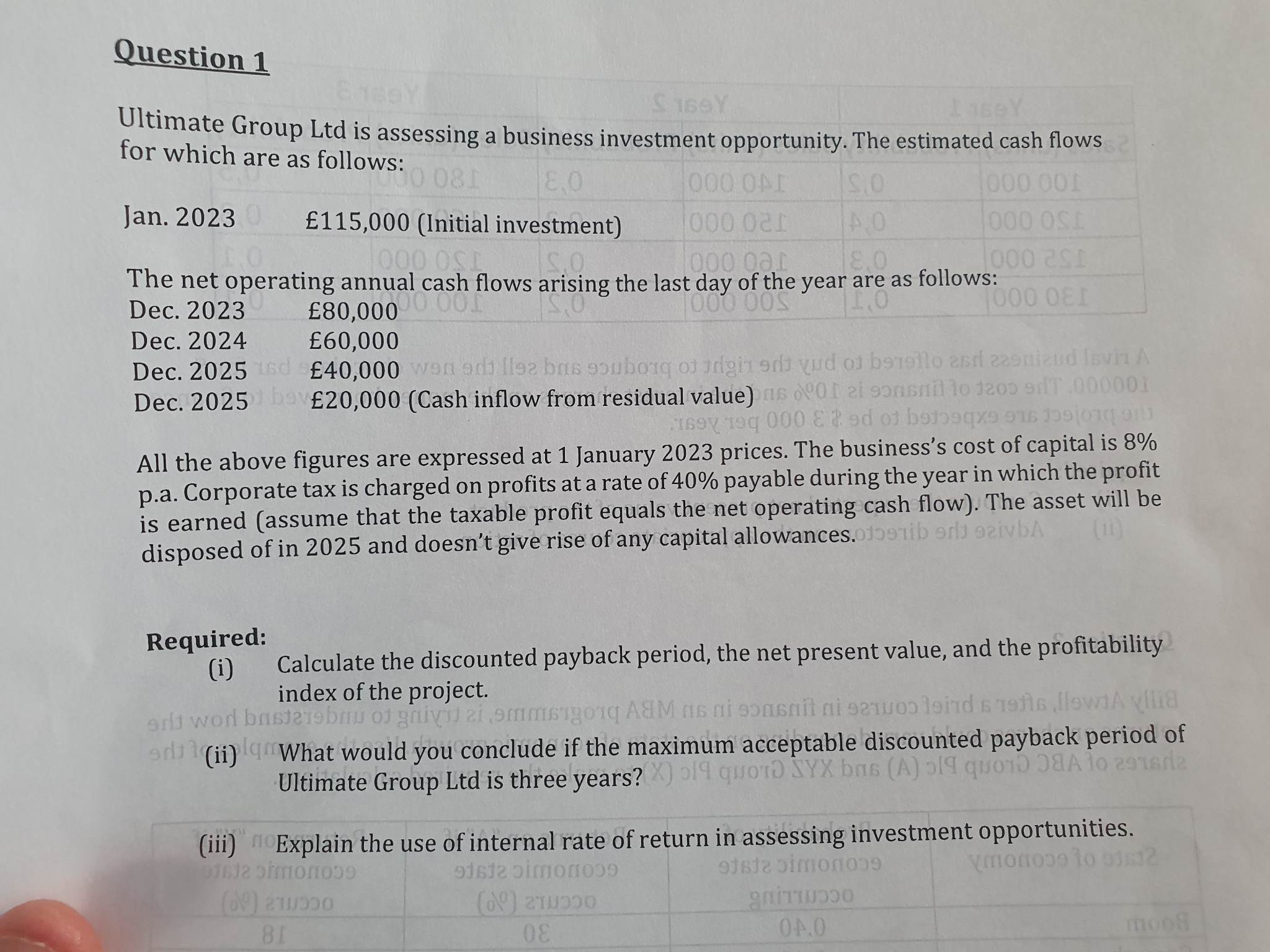

Question 1 S 169Y Ultimate Group Ltd is assessing a business investment opportunity. The estimated cash flows for which are as follows: 8,0 1000

Question 1 S 169Y Ultimate Group Ltd is assessing a business investment opportunity. The estimated cash flows for which are as follows: 8,0 1000 OPF S.O 000 001 Jan. 2023 0 115,000 (Initial investment) 000 021 4.0 000 OSL S.O 000 oar 8,0 000 201 000 OSL The net operating annual cash flows arising the last day of the year are as follows: ual cash fl 80,00000 00T 000 00S 1,0 1000 OEI Dec. 2023 Dec. 2024 60,000 Dec. 2025 sd 40,000 won adi Iloe bus subordin e d of b919110 2 229nieud Isvin A Dec. 2025 bov20,000 (Cash inflow from residual value)ons Of ei som to 1200 9.000001 189 190 000 8 2 ed of betooq nls All the above figures are expressed at 1 January 2023 prices. The business's cost of capital is 8% p.a. Corporate tax is charged on profits at a rate of 40% payable during the year in which the profit is earned (assume that the taxable profit equals the net operating cash flow). The asset will be disposed of in 2025 and doesn't give rise of any capital allowances.0159ib or 92ivba Required: (i) 1000 081 Calculate the discounted payback period, the net present value, and the profitability index of the project. srit wod briste71ebu of givizi 9mmsugonq A&M as ni sonsait ni servos loinds 19fls ,llowiA vllia (ii)qWhat would you conclude if the maximum acceptable discounted payback period of Ultimate Group Ltd is three years?X) 19 quot SYX bas (A) 5 quod A 0 29162 (iii) Explain the use of internal rate of return in assessing investment opportunities. moose to 612 01612 Dimon0539 91st2 simono otste simon (9) (0) 81 08 04.0 mood

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets break this down step by step i Calculate the discounted payback period the net present value NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started