Question

Question 1. Search kn the internet (SARS website) for tge latest tables for the 2023 (from 1 March 2022 to 28 February 2023) and 2024

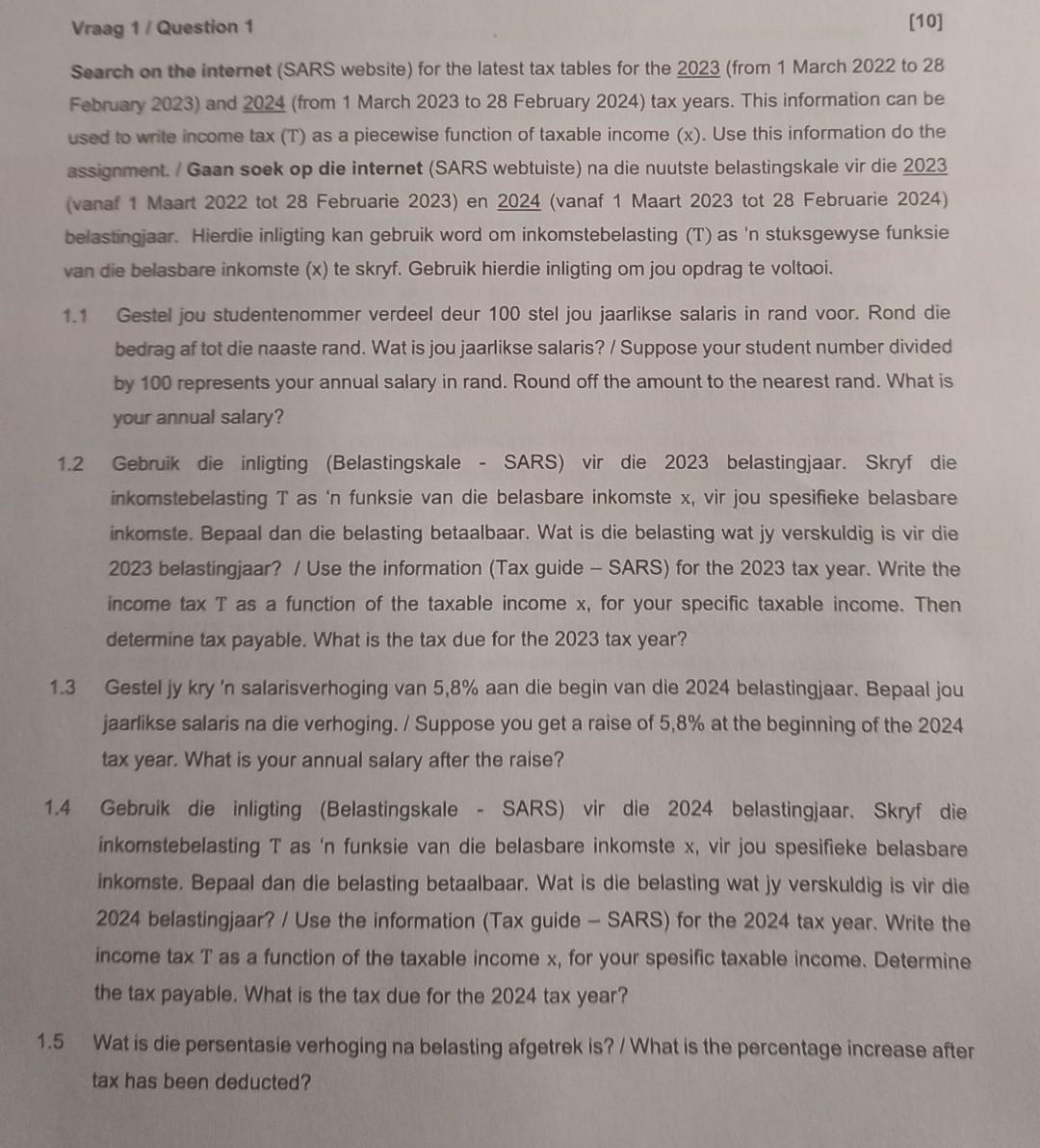

Question 1. Search kn the internet (SARS website) for tge latest tables for the 2023 (from 1 March 2022 to 28 February 2023) and 2024 (from 1 March 2023 to 28 February 2024) tax years. This information can be used to write tax (T) as a piecewise function of taxable income (x). Use this information to do the assignment.

1.1) Suppose 46016619 divided by 100 represents your anual salary in rand.Round off the amount to the nearest rand.What is your annual salary?

1.2) Use the information (Tax guide-SARS) for the 2023 tax year.Write the income tax (T) as a function of the taxable income (x), for your spesific table income.Then determine tax payable. What is the tax due for the 2023 tax year?

1.3) Suppose you get a raise of 5,8% at the beginning of the 2024 tax year.What is your annual salary after the raise?

1.4) Use the information (Tax guide- SARS) for the 2024 tax year. Write the income tax (T) as a function of the taxable income (x), for.your spesific taxable income.Determine the tax payable. What is the tax due for tge 2024 tax year?

1.5) What is the percentage increase after tax has been deducted?

1.1 Gestel jou studentenommer verdeel deur 100 stel jou jaarlikse salaris in rand voor. Rond die bedrag af tot die naaste rand. Wat is jou jaarlikse salaris? / Suppose your student number divided by 100 represents your annual salary in rand. Round off the amount to the nearest rand. What is your annual salary? 1.2 Gebruik die inligting (Belastingskale - SARS) vir die 2023 belastingjaar. Skryf die inkomstebelasting T as ' n funksie van die belasbare inkomste x, vir jou spesifieke belasbare inkomste. Bepaal dan die belasting betaalbaar. Wat is die belasting wat jy verskuldig is vir die 2023 belastingjaar? / Use the information (Tax guide - SARS) for the 2023 tax year. Write the income tax T as a function of the taxable income x, for your specific taxable income. Then determine tax payable. What is the tax due for the 2023 tax year? 1.3 Gestel jy kry 'n salarisverhoging van 5,8% aan die begin van die 2024 belastingjaar. Bepaal jou jaarlikse salaris na die verhoging. / Suppose you get a raise of 5,8% at the beginning of the 2024 tax year. What is your annual salary after the raise? 1.4 Gebruik die inligting (Belastingskale - SARS) vir die 2024 belastingjaar. Skryf die inkomstebelasting T as ' n funksie van die belasbare inkomste x, vir jou spesifieke belasbare inkomste. Bepaal dan die belasting betaalbaar. Wat is die belasting wat jy verskuldig is vir die 2024 belastingjaar? / Use the information (Tax guide - SARS) for the 2024 tax year. Write the income tax T as a function of the taxable income x, for your spesific taxable income. Determine the tax payable. What is the tax due for the 2024 tax year? 1.5 Wat is die persentasie verhoging na belasting afgetrek is? / What is the percentage increase after tax has been deductedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started