Answered step by step

Verified Expert Solution

Question

1 Approved Answer

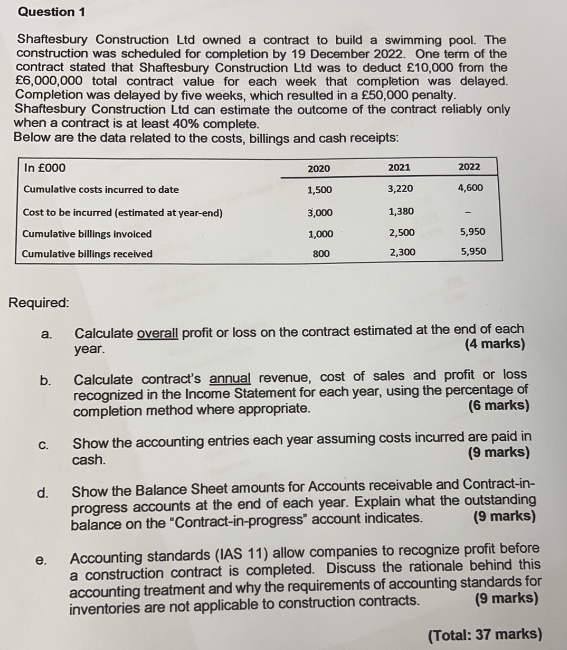

Question 1 Shaftesbury Construction Ltd owned a contract to build a swimming pool. The construction was scheduled for completion by 1 9 December 2 0

Question

Shaftesbury Construction Ltd owned a contract to build a swimming pool. The

construction was scheduled for completion by December One term of the

contract stated that Shaftesbury Construction Ltd was to deduct from the

total contract value for each week that completion was delayed.

Completion was delayed by five weeks, which resulted in a penalty.

Shaftesbury Construction Ltd can estimate the outcome of the contract reliably only

when a contract is at least complete.

Below are the data related to the costs, billings and cash receipts:

Required:

a Calculate overall profit or loss on the contract estimated at the end of each

year.

b Calculate contract's annual revenue, cost of sales and profit or loss

recognized in the Income Statement for each year, using the percentage of

completion method where appropriate.

c Show the accounting entries each year assuming costs incurred are paid in

cash.

d Show the Balance Sheet amounts for Accounts receivable and Contractin

progress accounts at the end of each year. Explain what the outstanding

balance on the "Contractinprogress" account indicates.

marks

e Accounting standards IAS allow companies to recognize profit before

a construction contract is completed. Discuss the rationale behind this

accounting treatment and why the requirements of accounting standards for

inventories are not applicable to construction contracts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started