Answered step by step

Verified Expert Solution

Question

1 Approved Answer

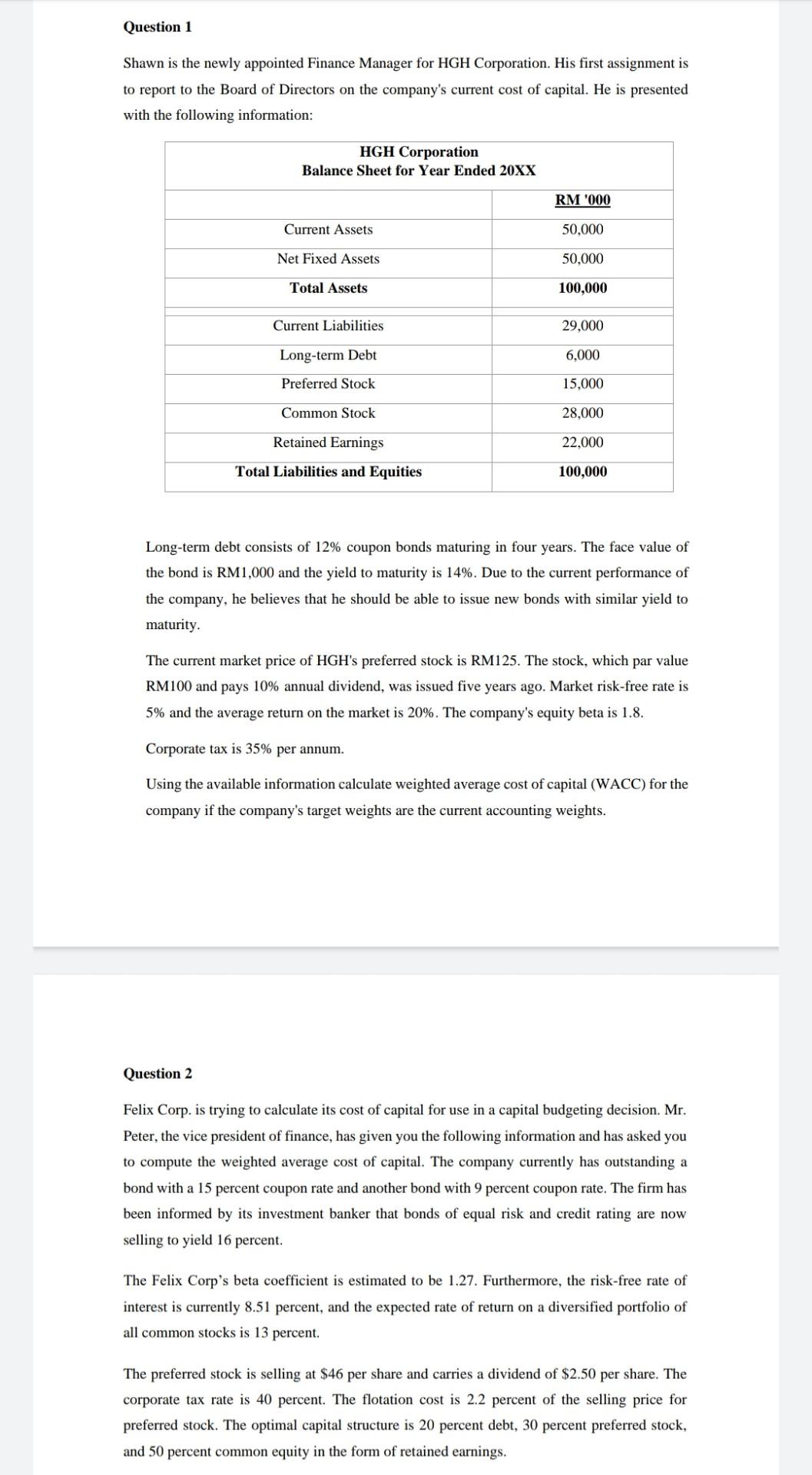

Question 1 Shawn is the newly appointed Finance Manager for HGH Corporation. His first assignment is to report to the Board of Directors on the

Question 1 Shawn is the newly appointed Finance Manager for HGH Corporation. His first assignment is to report to the Board of Directors on the company's current cost of capital. He is presented with the following information: HGH Corporation Balance Sheet for Year Ended 20XX RM 1000 Current Assets 50,000 Net Fixed Assets 50,000 Total Assets 100,000 Current Liabilities 29,000 Long-term Debt 00 Preferred Stock 15,000 Common Stock 28,000 Retained Earnings 22,000 Total Liabilities and Equities 100,000 Long-term debt consists of 12% coupon bonds maturing in four years. The face value of the bond is RM1,000 and the yield to maturity is 14%. Due to the current performance of the company, he believes that he should be able to issue new bonds with similar yield to maturity. The current market price of HGH's preferred stock is RM125. The stock, which par value RM100 and pays 10% annual dividend, was issued five years ago. Market risk-free rate is 5% and the average return on the market is 20%. The company's equity beta is 1.8. Corporate tax is 35% per annum. Using the available information calculate weighted average cost of capital (WACC) for the company if the company's target weights are the current accounting weights. Question 2 Felix Corp. is trying to calculate its cost of capital for use in a capital budgeting decision. Mr. Peter, the vice president of finance, has given you the following information and has asked you to compute the weighted average cost of capital. The company currently has outstanding a bond with a 15 percent coupon rate and another bond with 9 percent coupon rate. The firm has been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 16 percent. The Felix Corp's beta coefficient is estimated to be 1.27. Furthermore, the risk-free rate of interest is currently 8.51 percent, and the expected rate of return on a diversified portfolio of all common stocks is 13 percent. The preferred stock is selling at $46 per share and carries a dividend of $2.50 per share. The corporate tax rate is 40 percent. The flotation cost is 2.2 percent of the selling price for preferred stock. The optimal capital structure is 20 percent debt, 30 percent preferred stock, and 50 percent common equity in the form of retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started