Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Show all excel formulas Question 2: show all excel formulas (Use cells A6 to B27 from the given information to complete this question.

Question 1: Show all excel formulas

Question 2: show all excel formulas

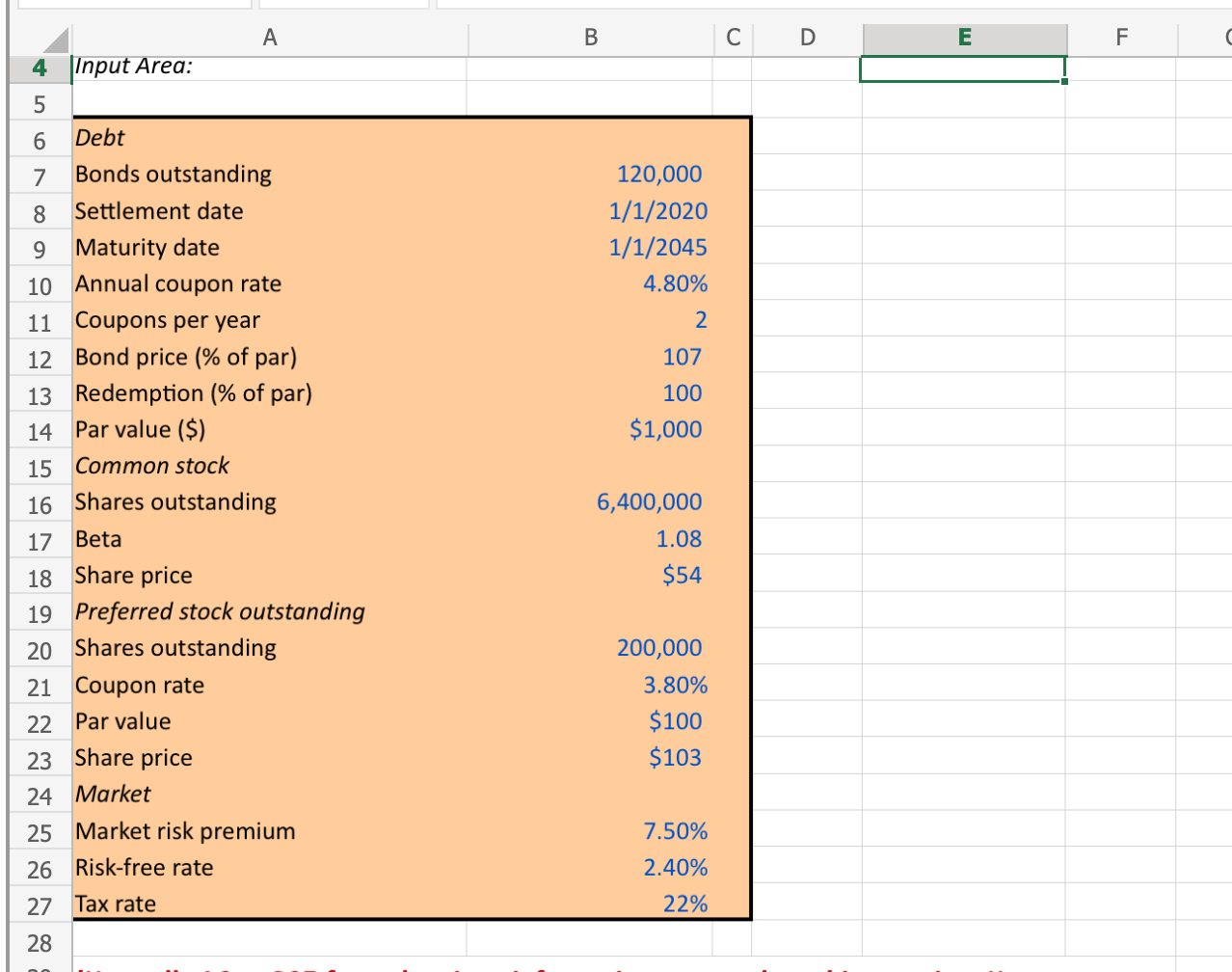

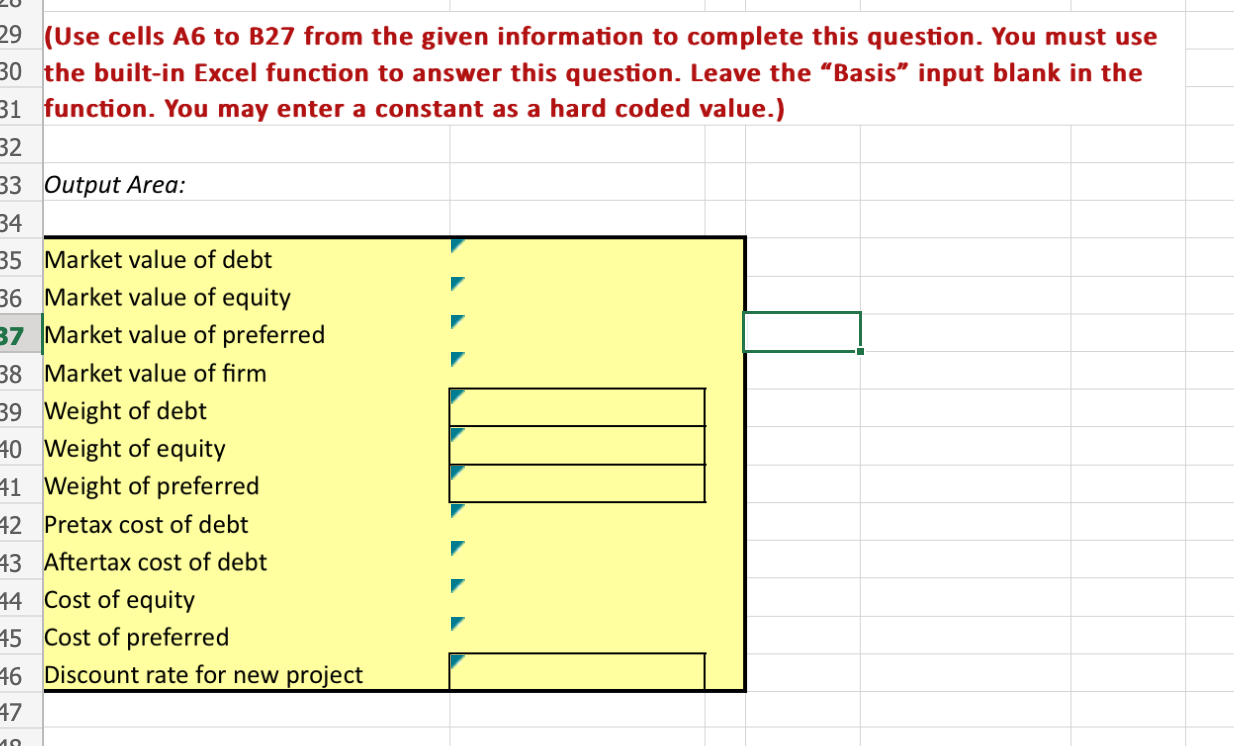

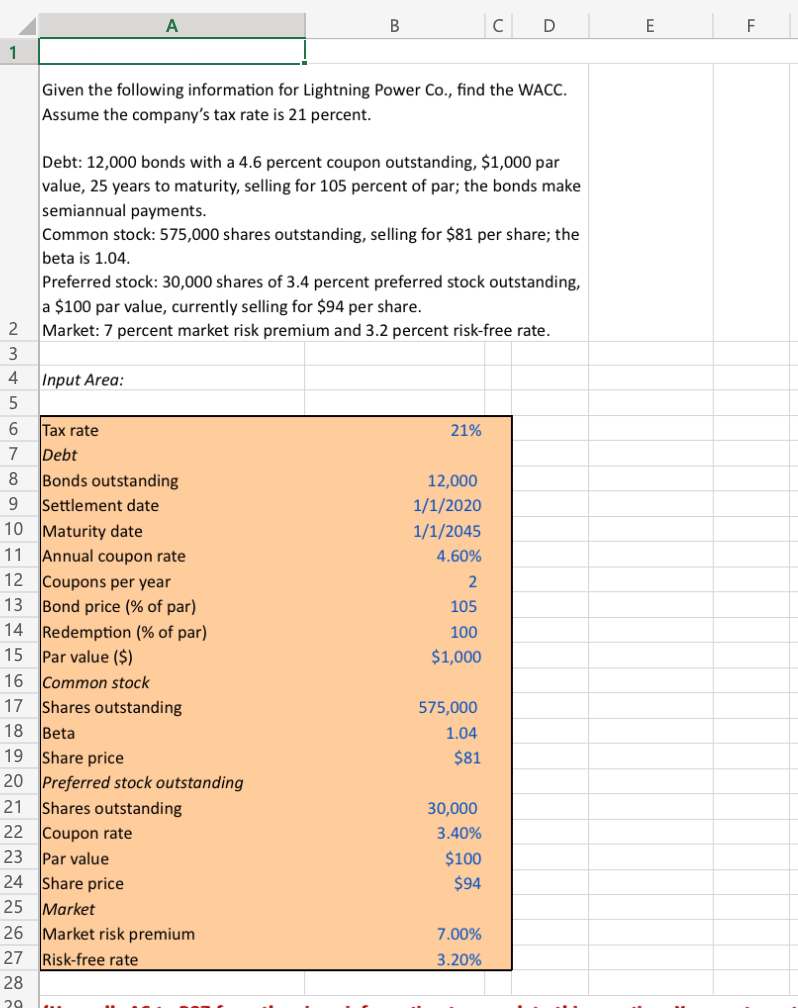

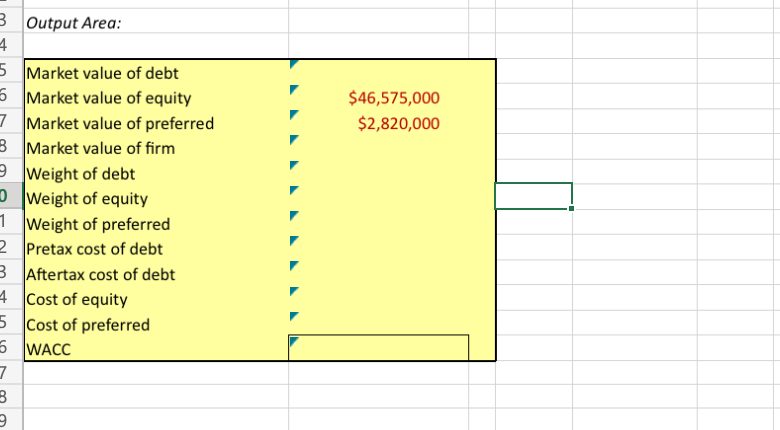

(Use cells A6 to B27 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.) Output Area: Market value of debt Market value of equity Market value of preferred Market value of firm Weight of debt Weight of equity Weight of preferred Pretax cost of debt Aftertax cost of debt Cost of equity Cost of preferred Discount rate for new project Given the following information for Lightning Power Co., find the WACC. Assume the company's tax rate is 21 percent. Debt: 12,000 bonds with a 4.6 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 105 percent of par; the bonds make semiannual payments. Common stock: 575,000 shares outstanding, selling for $81 per share; the beta is 1.04 . Preferred stock: 30,000 shares of 3.4 percent preferred stock outstanding, a $100 par value, currently selling for $94 per share. Market: 7 percent market risk premium and 3.2 percent risk-free rate. Input Area: \begin{tabular}{|lr|} \hline Tax rate & 21% \\ Debt & \\ Bonds outstanding & 12,000 \\ Settlement date & 1/1/2020 \\ Maturity date & 1/1/2045 \\ Annual coupon rate & 4.60% \\ Coupons per year & 2 \\ Bond price (\% of par) & 105 \\ Redemption (\% of par) & 100 \\ Par value (\$) & $1,000 \\ Common stock & \\ Shares outstanding & 575,000 \\ Beta & 1.04 \\ Share price & $81 \\ Preferred stock outstanding & \\ Shares outstanding & 30,000 \\ Coupon rate & 3.40% \\ Par value & $100 \\ Share price & $94 \\ Market & \\ Market risk premium & 7.00% \\ Risk-free rate & 3.20% \\ \hline \end{tabular} Output Area: \begin{tabular}{|l|r|} \hline Market value of debt \\ Market value of equity \\ Market value of preferred \\ Market value of firm & $46,575,000 \\ Weight of debt & $2,820,000 \\ Weight of equity \\ Weight of preferred \\ Pretax cost of debt \\ Aftertax cost of debt \\ Cost of equity \\ Cost of preferred \\ WACC & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started