Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 - Show your working. a. Selatan Corporation is planning to buy a bond that matures in 10 years. The annual coupon payment is

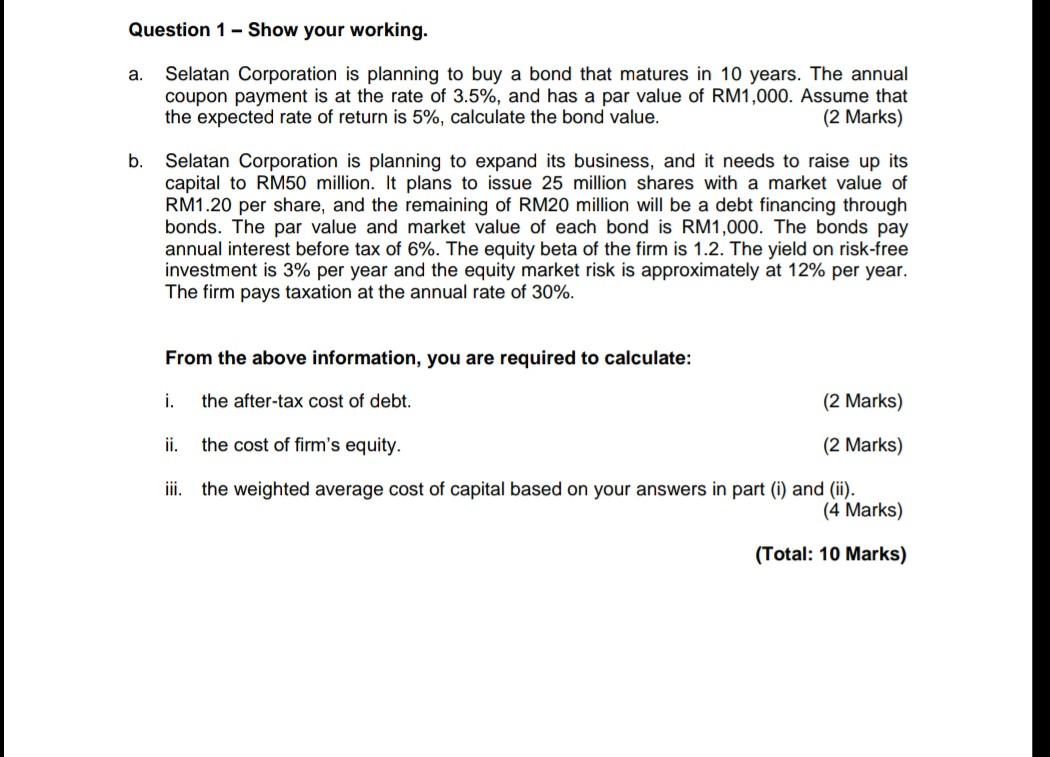

Question 1 - Show your working. a. Selatan Corporation is planning to buy a bond that matures in 10 years. The annual coupon payment is at the rate of 3.5%, and has a par value of RM1,000. Assume that the expected rate of return is 5%, calculate the bond value. (2 Marks) b. Selatan Corporation is planning to expand its business, and it needs to raise up its capital to RM50 million. It plans to issue 25 million shares with a market value of RM1.20 per share, and the remaining of RM20 million will be a debt financing through bonds. The par value and market value of each bond is RM1,000. The bonds pay annual interest before tax of 6%. The equity beta of the firm is 1.2. The yield on risk-free investment is 3% per year and the equity market risk is approximately at 12% per year. The firm pays taxation at the annual rate of 30%. From the above information, you are required to calculate: i. the after-tax cost of debt. (2 Marks) ii. the cost of firm's equity. (2 Marks) iii. the weighted average cost of capital based on your answers in part (i) and (ii). (4 Marks) (Total: 10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started