Answered step by step

Verified Expert Solution

Question

1 Approved Answer

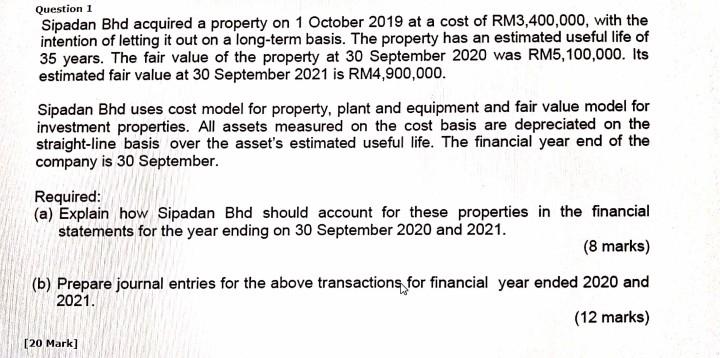

Question 1 Sipadan Bhd acquired a property on 1 October 2019 at a cost of RM3,400,000, with the intention of letting it out on a

Question 1 Sipadan Bhd acquired a property on 1 October 2019 at a cost of RM3,400,000, with the intention of letting it out on a long-term basis. The property has an estimated useful life of 35 years. The fair value of the property at 30 September 2020 was RM5,100,000. Its estimated fair value at 30 September 2021 is RM4,900,000. Sipadan Bhd uses cost model for property, plant and equipment and fair value model for investment properties. All assets measured on the cost basis are depreciated on the straight-line basis over the asset's estimated useful life. The financial year end of the company is 30 September. Required: (a) Explain how Sipadan Bhd should account for these properties in the financial statements for the year ending on 30 September 2020 and 2021. (8 marks) (b) Prepare journal entries for the above transactions for financial year ended 2020 and 2021. (12 marks) [20 Mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started