Question 1 SM Ltd has two divisions, Division Alpha and Division Gama. Division Alpha manufactures component A, of which variable cost is 20 per

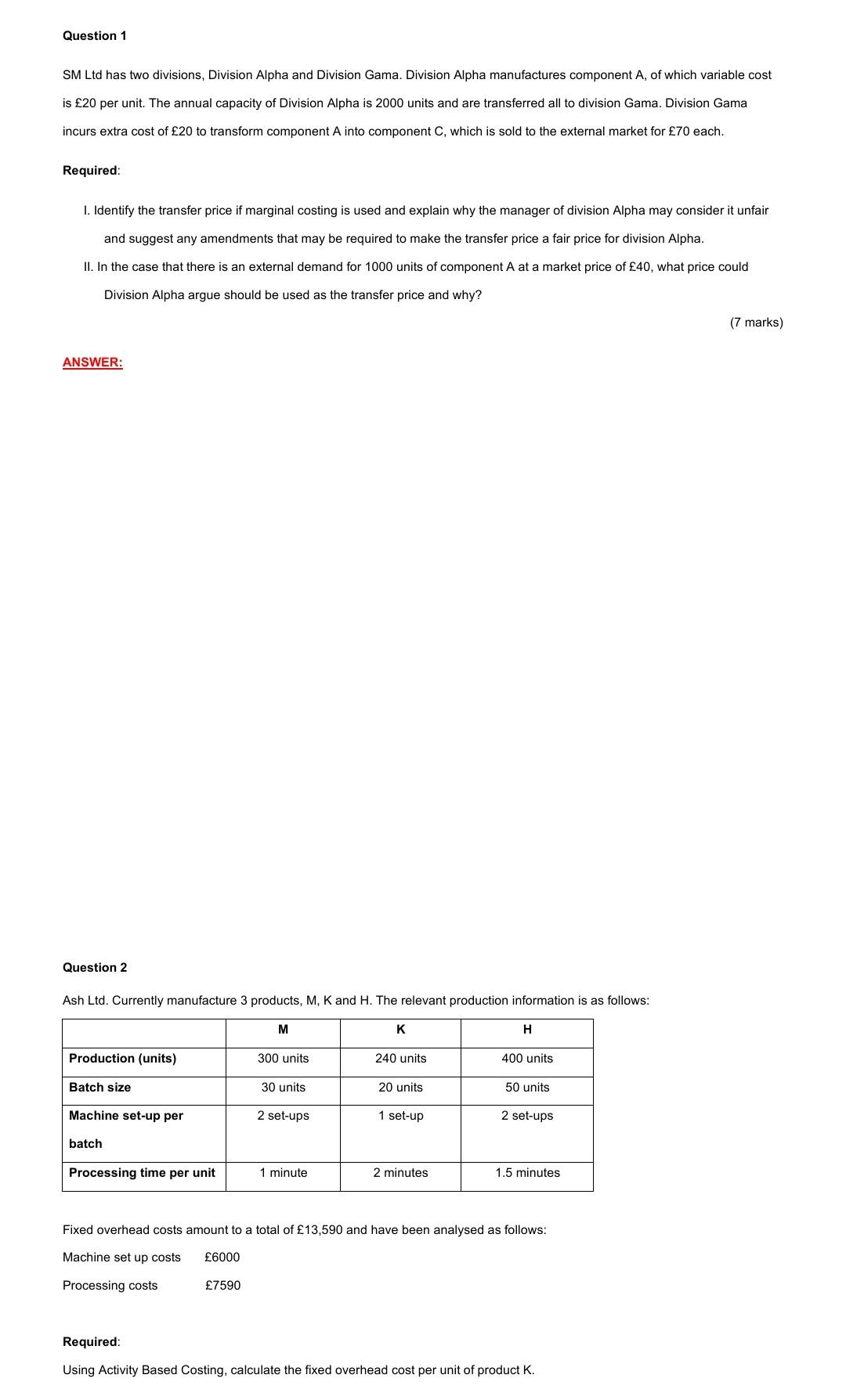

Question 1 SM Ltd has two divisions, Division Alpha and Division Gama. Division Alpha manufactures component A, of which variable cost is 20 per unit. The annual capacity of Division Alpha is 2000 units and are transferred all to division Gama. Division Gama incurs extra cost of 20 to transform component A into component C, which is sold to the external market for 70 each. Required: I. Identify the transfer price if marginal costing is used and explain why the manager of division Alpha may consider it unfair and suggest any amendments that may be required to make the transfer price a fair price for division Alpha. II. In the case that there is an external demand for 1000 units of component A at a market price of 40, what price could Division Alpha argue should be used as the transfer price and why? ANSWER: Question 2 Ash Ltd. Currently manufacture 3 products, M, K and H. The relevant production information is as follows: K M H Production (units) 300 units 240 units 400 units Batch size 30 units 20 units 50 units Machine set-up per 2 set-ups 1 set-up 2 set-ups batch Processing time per unit 1 minute 2 minutes 1.5 minutes Fixed overhead costs amount to a total of 13,590 and have been analysed as follows: Machine set up costs Processing costs 6000 7590 Required: Using Activity Based Costing, calculate the fixed overhead cost per unit of product K. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started