Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Sol Diagnostics Inc is considering an investment of $1,350,000 in a diagnostic eqtipment to detect lung health. The equipment is expected to have

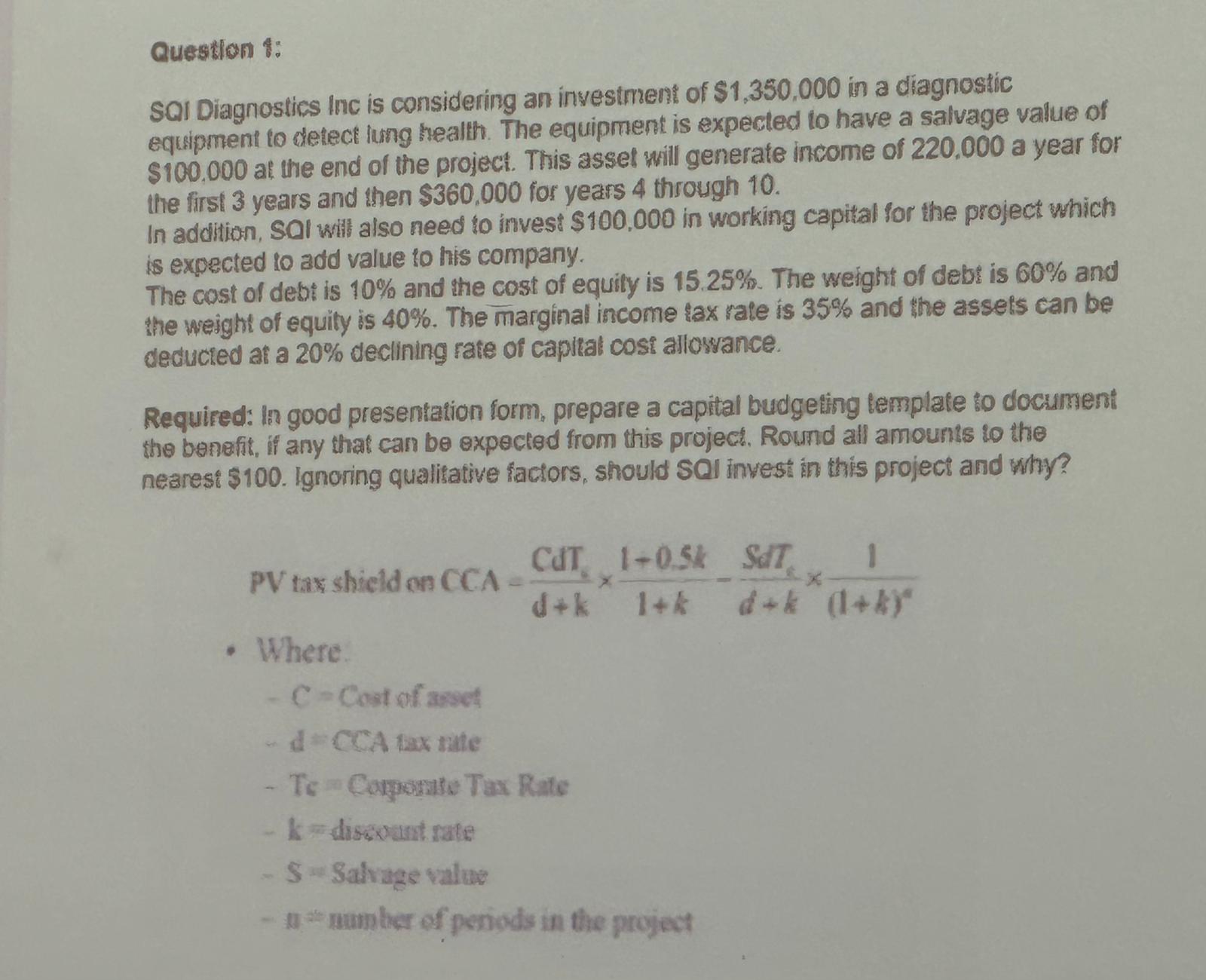

Question 1: Sol Diagnostics Inc is considering an investment of $1,350,000 in a diagnostic eqtipment to detect lung health. The equipment is expected to have a salvage value of $100,000 at the end of the project. This asset will generate income of 220,000 a year for the first 3 years and then $360,000 for years 4 through 10 . In addition, Sal will also need to invest $100,000 in working capital for the project which is expected to add value to his company. The cost of debt is 10% and the cost of equily is 15.25%. The weight of debt is 60% and the weight of equily is 40%. The marginal income tax rate is 35% and the assets can be deducted at a 20% declining rate of capltal cosi allowance. Required: In good presentation form, prepare a capital budgeting template to document the benefit, if any that can be expected from this project. Round all amounts to the nearest $100. Ignoring qualitative factors, should SOl invest in this project and why? PV tax shield en CCA =d+kCdTk1+k1+0.5kd+kSdTTc(1+k)21 - Where C= Coat of aroet in d CA A tax thite - Te a Cumbarate Tor Rate

Question 1: Sol Diagnostics Inc is considering an investment of $1,350,000 in a diagnostic eqtipment to detect lung health. The equipment is expected to have a salvage value of $100,000 at the end of the project. This asset will generate income of 220,000 a year for the first 3 years and then $360,000 for years 4 through 10 . In addition, Sal will also need to invest $100,000 in working capital for the project which is expected to add value to his company. The cost of debt is 10% and the cost of equily is 15.25%. The weight of debt is 60% and the weight of equily is 40%. The marginal income tax rate is 35% and the assets can be deducted at a 20% declining rate of capltal cosi allowance. Required: In good presentation form, prepare a capital budgeting template to document the benefit, if any that can be expected from this project. Round all amounts to the nearest $100. Ignoring qualitative factors, should SOl invest in this project and why? PV tax shield en CCA =d+kCdTk1+k1+0.5kd+kSdTTc(1+k)21 - Where C= Coat of aroet in d CA A tax thite - Te a Cumbarate Tor Rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started