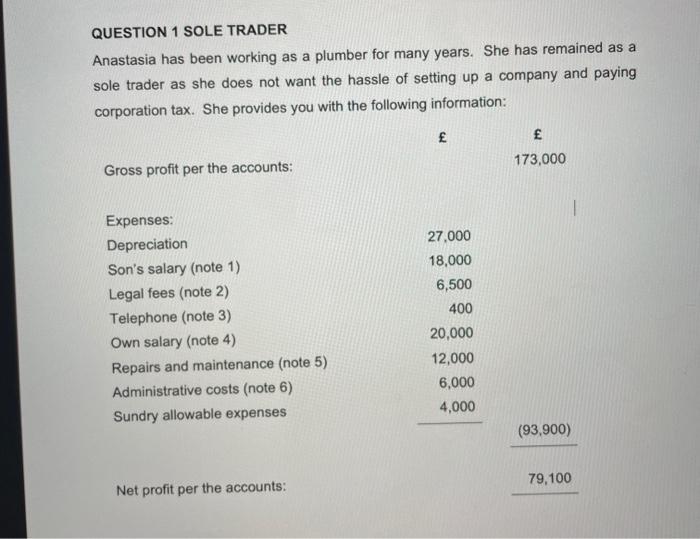

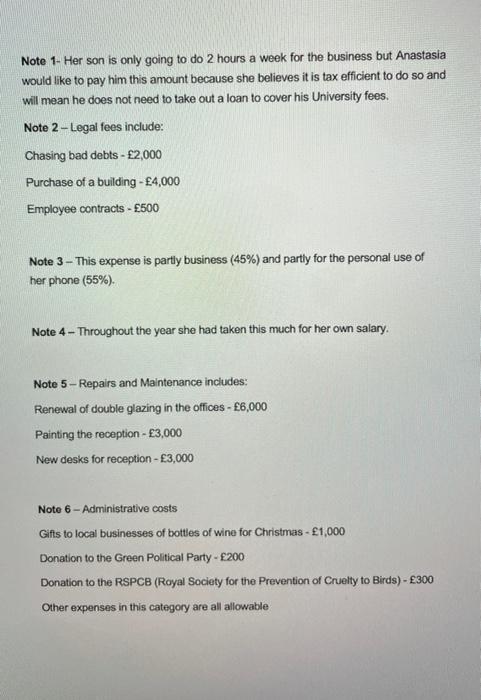

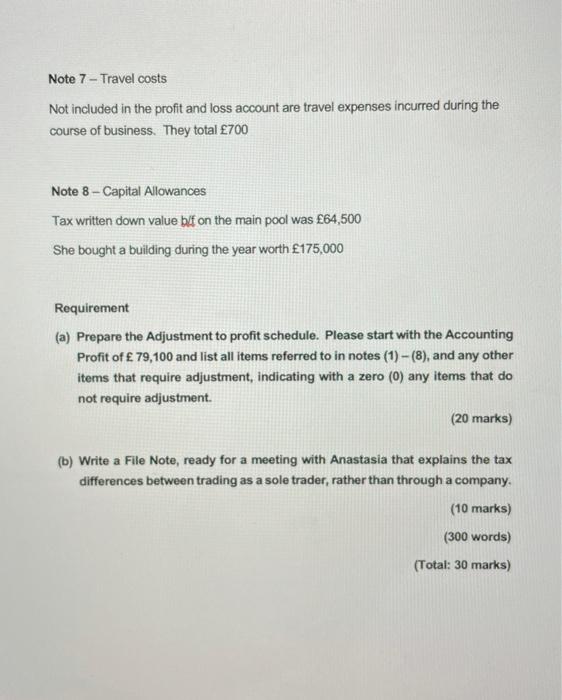

QUESTION 1 SOLE TRADER Anastasia has been working as a plumber for many years. She has remained as a sole trader as she does not want the hassle of setting up a company and paying corporation tax. She provides you with the following information: 173,000 Gross profit per the accounts: 1 Expenses: Depreciation Son's salary (note 1) Legal fees (note 2) Telephone (note 3) Own salary (note 4) Repairs and maintenance (note 5) Administrative costs (note 6) Sundry allowable expenses 27,000 18,000 6,500 400 20,000 12,000 6,000 4,000 (93,900) 79,100 Net profit per the accounts: Note 1- Her son is only going to do 2 hours a week for the business but Anastasia would like to pay him this amount because she believes it is tax efficient to do so and will mean he does not need to take out a loan to cover his University fees. Note 2 -Legal fees include: Chasing bad debts - 2,000 Purchase of a building - 4,000 Employee contracts - 500 Note 3 - This expense is partly business (45%) and partly for the personal use of her phone (55%). Note 4 - Throughout the year she had taken this much for her own salary. Note 5 - Repairs and Maintenance includes: Renewal of double glazing in the offices - 6,000 Painting the reception - 3,000 New desks for reception - 3,000 Note 6 - Administrative costs Gifts to local businesses of bottles of wine for Christmas - 1,000 Donation to the Green Political Party - 200 Donation to the RSPCB (Royal Society for the Prevention of Cruelty to Birds) - 300 Other expenses in this category are all allowable Note 7 - Travel costs Not included in the profit and loss account are travel expenses incurred during the course of business. They total 700 Note 8 - Capital Allowances Tax written down value bif on the main pool was 64,500 She bought a building during the year worth 175,000 Requirement (a) Prepare the Adjustment to profit schedule. Please start with the Accounting Profit of 79,100 and list all items referred to in notes (1)-(8), and any other items that require adjustment, indicating with a zero (0) any items that do not require adjustment (20 marks) (b) Write a File Note, ready for a meeting with Anastasia that explains the tax differences between trading as a sole trader, rather than through a company. (10 marks) (300 words) (Total: 30 marks)