Answered step by step

Verified Expert Solution

Question

1 Approved Answer

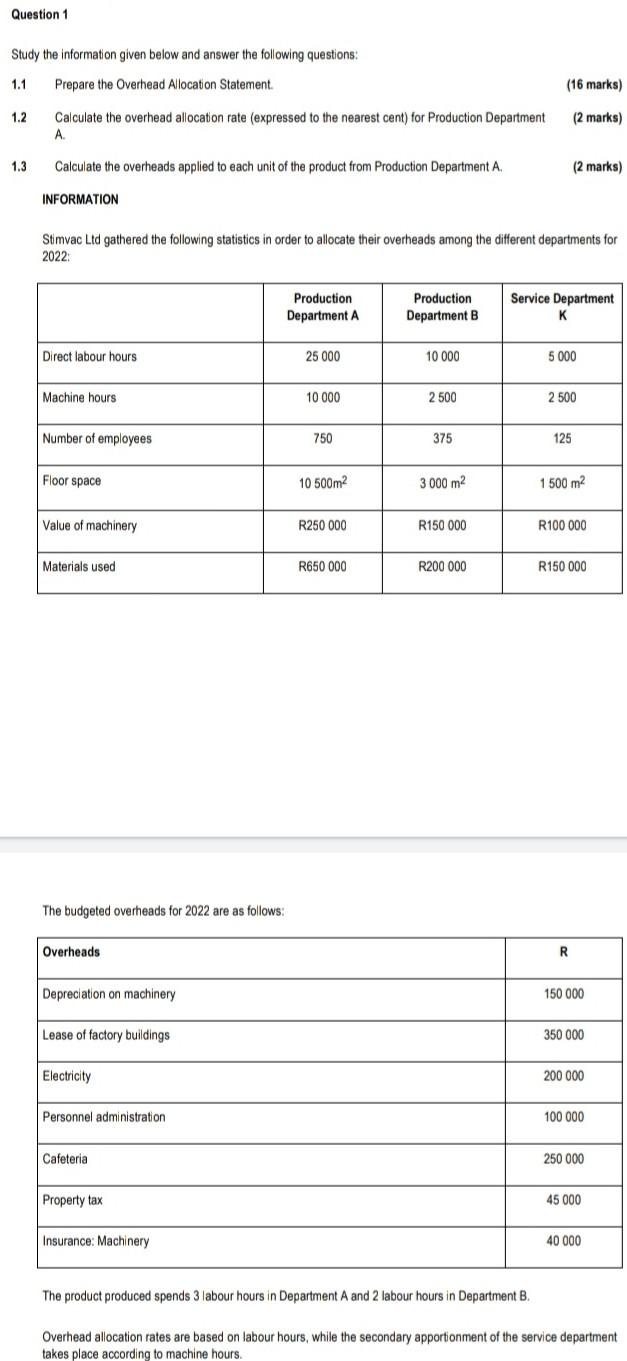

Question 1 Study the information given below and answer the following questions: 1.1 Prepare the Overhead Allocation Statement. (16 marks) 1.2 Calculate the overhead

Question 1 Study the information given below and answer the following questions: 1.1 Prepare the Overhead Allocation Statement. (16 marks) 1.2 Calculate the overhead allocation rate (expressed to the nearest cent) for Production Department (2 marks) A. 1.3 Calculate the overheads applied to each unit of the product from Production Department A. INFORMATION (2 marks) Stimvac Ltd gathered the following statistics in order to allocate their overheads among the different departments for 2022: Production Department A Production Department B Service Department K Direct labour hours 25 000 10 000 5 000 Machine hours 10 000 2500 2 500 Number of employees 750 375 125 Floor space 10 500m 3 000 m 1 500 m Value of machinery R250 000 R150 000 R100 000 Materials used R650 000 R200 000 R150 000 The budgeted overheads for 2022 are as follows: Overheads Depreciation on machinery Lease of factory buildings Electricity Personnel administration Cafeteria Property tax Insurance: Machinery R 150 000 350 000 200 000 100 000 250 000 45 000 40 000 The product produced spends 3 labour hours in Department A and 2 labour hours in Department B. Overhead allocation rates are based on labour hours, while the secondary apportionment of the service department takes place according to machine hours.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started