Answered step by step

Verified Expert Solution

Question

1 Approved Answer

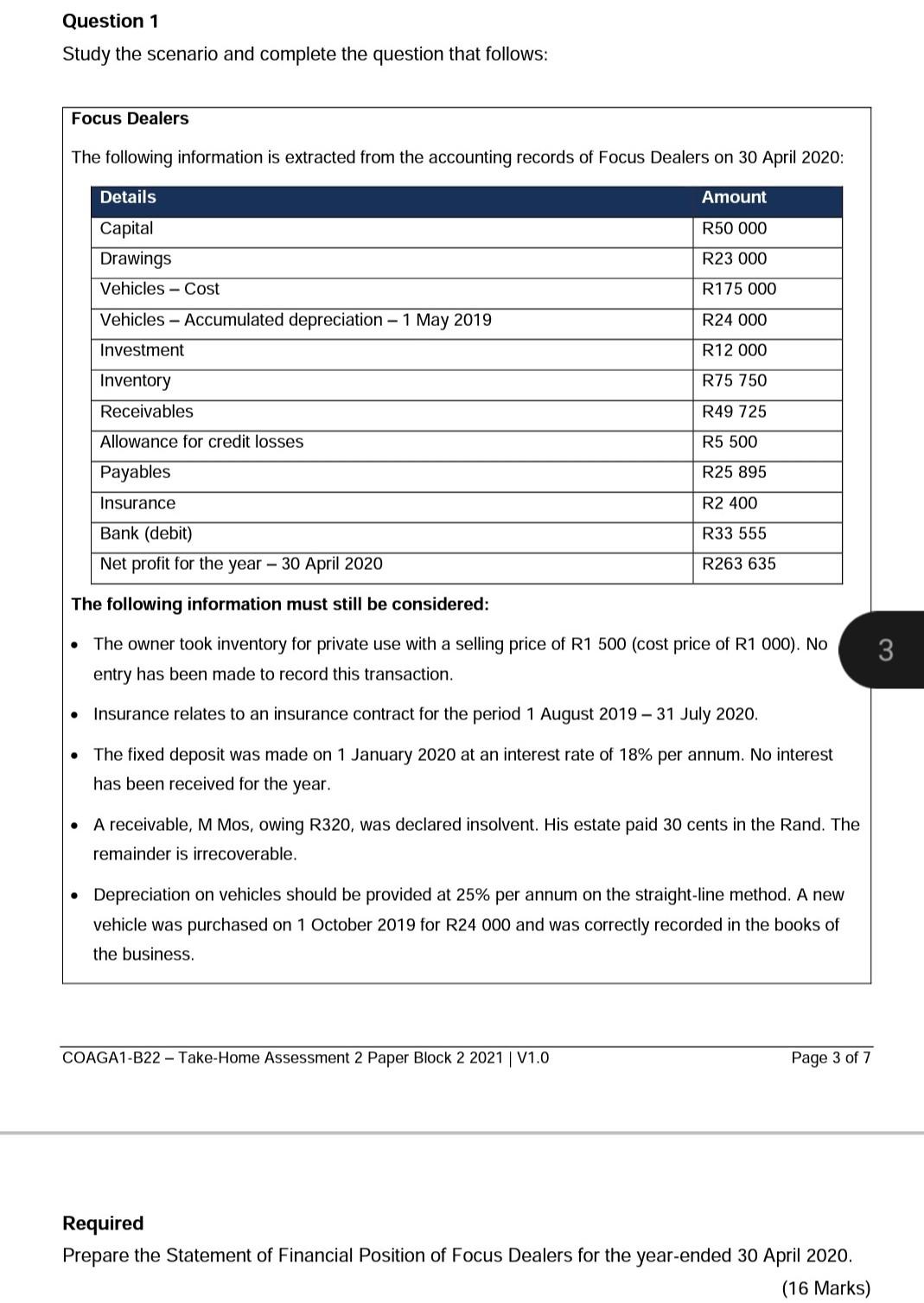

Question 1 Study the scenario and complete the question that follows: Focus Dealers The following information is extracted from the accounting records of Focus Dealers

Question 1 Study the scenario and complete the question that follows: Focus Dealers The following information is extracted from the accounting records of Focus Dealers on 30 April 2020: Amount R50 000 Details Capital Drawings Vehicles - Cost R23 000 R175 000 Vehicles - Accumulated depreciation - 1 May 2019 R24 000 Investment R12 000 R75 750 Inventory Receivables R49 725 Allowance for credit losses R5 500 Payables R25 895 Insurance R2 400 R33 555 Bank (debit) Net profit for the year - 30 April 2020 R263 635 The following information must still be considered: . The owner took inventory for private use with a selling price of R1 500 (cost price of R1 000). No entry has been made to record this transaction. 3 Insurance relates to an insurance contract for the period 1 August 2019 - 31 July 2020. . The fixed deposit was made on 1 January 2020 at an interest rate of 18% per annum. No interest has been received for the year. . A receivable, M Mos, owing R320, was declared insolvent. His estate paid 30 cents in the Rand. The remainder is irrecoverable. Depreciation on vehicles should be provided at 25% per annum on the straight-line method. A new vehicle was purchased on 1 October 2019 for R24 000 and was correctly recorded in the books of the business. COAGA1-B22 - Take-Home Assessment 2 Paper Block 2 2021 | V1.0 Page 3 of 7 Required Prepare the Statement of Financial Position of Focus Dealers for the year-ended 30 April 2020. (16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started