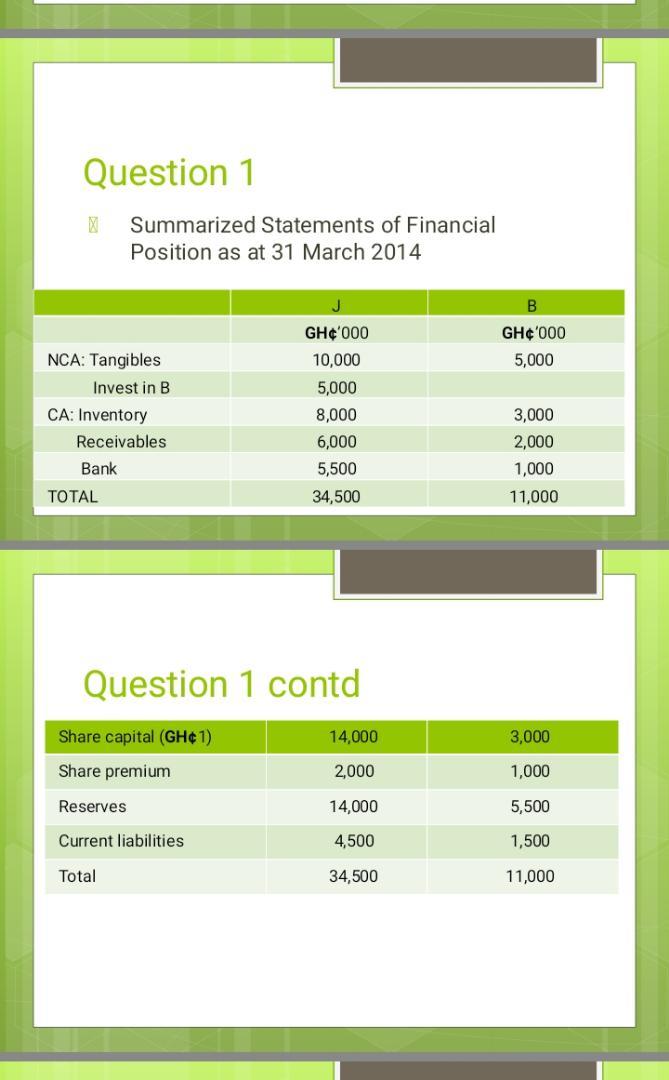

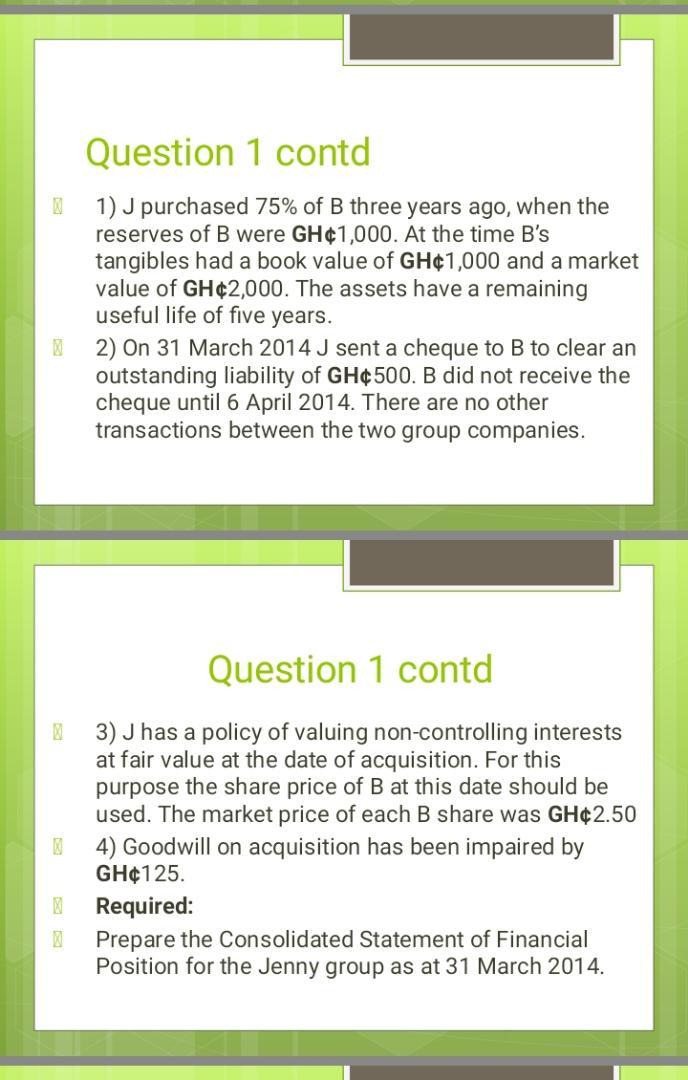

Question 1 Summarized Statements of Financial Position as at 31 March 2014 B GH'000 5,000 NCA: Tangibles Invest in B CA: Inventory Receivables Bank TOTAL GH'000 10,000 5,000 8,000 6,000 5,500 34,500 3,000 2,000 1,000 11,000 Question 1 contd Share capital (GH1) 14,000 3,000 Share premium 2,000 1,000 Reserves 14,000 5,500 Current liabilities 4,500 1,500 Total 34,500 11,000 Question 1 contd 1) J purchased 75% of B three years ago, when the reserves of B were GH1,000. At the time B's tangibles had a book value of GH1,000 and a market value of GH2,000. The assets have a remaining useful life of five years. 2) On 31 March 2014 J sent a cheque to B to clear an outstanding liability of GH500. B did not receive the cheque until 6 April 2014. There are no other transactions between the two group companies. Question 1 contd 3) J has a policy of valuing non-controlling interests at fair value at the date of acquisition. For this purpose the share price of B at this date should be used. The market price of each B share was GH2.50 4) Goodwill on acquisition has been impaired by GH125. Required: Prepare the Consolidated Statement of Financial Position for the Jenny group as at 31 March 2014. Question 1 Summarized Statements of Financial Position as at 31 March 2014 B GH'000 5,000 NCA: Tangibles Invest in B CA: Inventory Receivables Bank TOTAL GH'000 10,000 5,000 8,000 6,000 5,500 34,500 3,000 2,000 1,000 11,000 Question 1 contd Share capital (GH1) 14,000 3,000 Share premium 2,000 1,000 Reserves 14,000 5,500 Current liabilities 4,500 1,500 Total 34,500 11,000 Question 1 contd 1) J purchased 75% of B three years ago, when the reserves of B were GH1,000. At the time B's tangibles had a book value of GH1,000 and a market value of GH2,000. The assets have a remaining useful life of five years. 2) On 31 March 2014 J sent a cheque to B to clear an outstanding liability of GH500. B did not receive the cheque until 6 April 2014. There are no other transactions between the two group companies. Question 1 contd 3) J has a policy of valuing non-controlling interests at fair value at the date of acquisition. For this purpose the share price of B at this date should be used. The market price of each B share was GH2.50 4) Goodwill on acquisition has been impaired by GH125. Required: Prepare the Consolidated Statement of Financial Position for the Jenny group as at 31 March 2014