Answered step by step

Verified Expert Solution

Question

1 Approved Answer

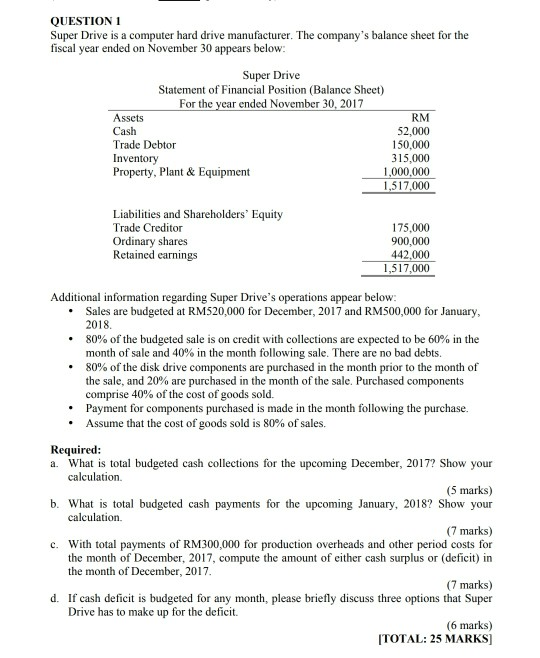

QUESTION 1 Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below: Super

QUESTION 1 Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below: Super Drive Statement of Financial Position (Balance Sheet) For the year ended November 30, 2017 Assets RM Cash 52.000 Trade Debtor 150,000 Inventory 315,000 Property, Plant & Equipment 1,000,000 1,517,000 Liabilities and Shareholders' Equity Trade Creditor Ordinary shares Retained earnings 175.000 900,000 442,000 1,517,000 Additional information regarding Super Drive's operations appear below: Sales are budgeted at RM520,000 for December, 2017 and RM500,000 for January, 2018 . 80% of the budgeted sale is on credit with collections are expected to be 60% in the month of sale and 40% in the month following sale. There are no bad debts. 80% of the disk drive components are purchased in the month prior to the month of the sale, and 20% are purchased in the month of the sale. Purchased components comprise 40% of the cost of goods sold. Payment for components purchased is made in the month following the purchase Assume that the cost of goods sold is 80% of sales. Required: a. What is total budgeted cash collections for the upcoming December, 2017? Show your calculation (5 marks) b. What is total budgeted cash payments for the upcoming January, 2018? Show your calculation (7 marks) c. With total payments of RM300,000 for production overheads and other period costs for the month of December, 2017, compute the amount of either cash surplus or (deficit) in the month of December, 2017 (7 marks) d. If cash deficit is budgeted for any month, please briefly discuss three options that Super Drive has to make up for the deficit. (6 marks) [TOTAL: 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started