Answered step by step

Verified Expert Solution

Question

1 Approved Answer

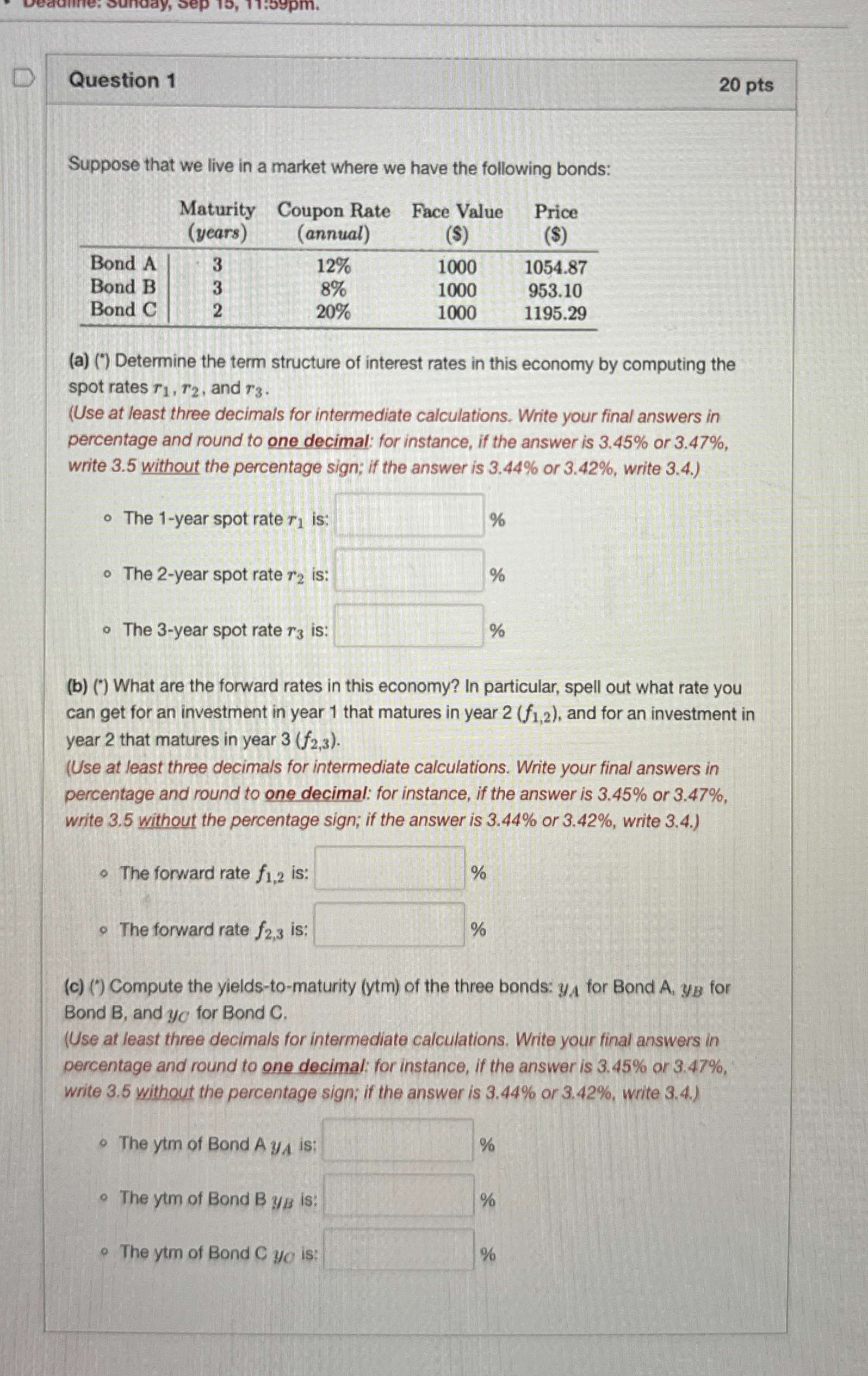

Question 1 Suppose that we live in a market where we have the following bonds: ( a ) ( ) Determine the term structure

Question

Suppose that we live in a market where we have the following bonds:

a Determine the term structure of interest rates in this economy by computing the

spot rates and

Use at least three decimals for intermediate calculations. Write your final answers in

percentage and round to one decimal: for instance, if the answer is or

write without the percentage sign; if the answer is or write

The year spot rate is:

The year spot rate is:

The year spot rate is

b What are the forward rates in this economy? In particular, spell out what rate you

can get for an investment in year that matures in year and for an investment in

year that matures in year

Use at least three decimals for intermediate calculations. Write your final answers in

percentage and round to one decimal: for instance, if the answer is or

write without the percentage sign; if the answer is or write

The forward rate is:

The forward rate is:

c Compute the yieldstomaturity ytm of the three bonds: for Bond for

Bond B and for Bond C

Use at least three decimals for intermediate calculations. Write your final answers in

percentage and round to one decimal: for instance, if the answer is or

write without the percentage sign; if the answer is or write

The ytm of Bond is:

The ytm of Bond is:

The ytm of Bond is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started