Question

Question 1 T2125 - part 3B - line 3H - part 3C - line 8299 - part 4 - line 4A (all same value) Question

Question 1

T2125

- part 3B - line 3H

- part 3C - line 8299

- part 4 - line 4A

(all same value)

Question 2

T2125 - part 7 - line 7H

subtotal of business-use-of-home expenses

Question 3

T2125 - part 7 - line 7I

personal portion of the business-use-of-home expenses

Question 4

T2125 - part 7 - line 7J

business portion of business-use-of-home expenses

Question 4 options:

Question 5

T2125 - Area A - Table for CCA claim

Note: all columns that are not answers submitted below have a value of ZERO

Enter values, in order, for columns listed below:

Column 1, 3, 7, 10, 12, 15, 16, 17, 18, 19

Question 6

T2125 - part 5 - line 9946

Anna's net income from her self-employment

Question 7

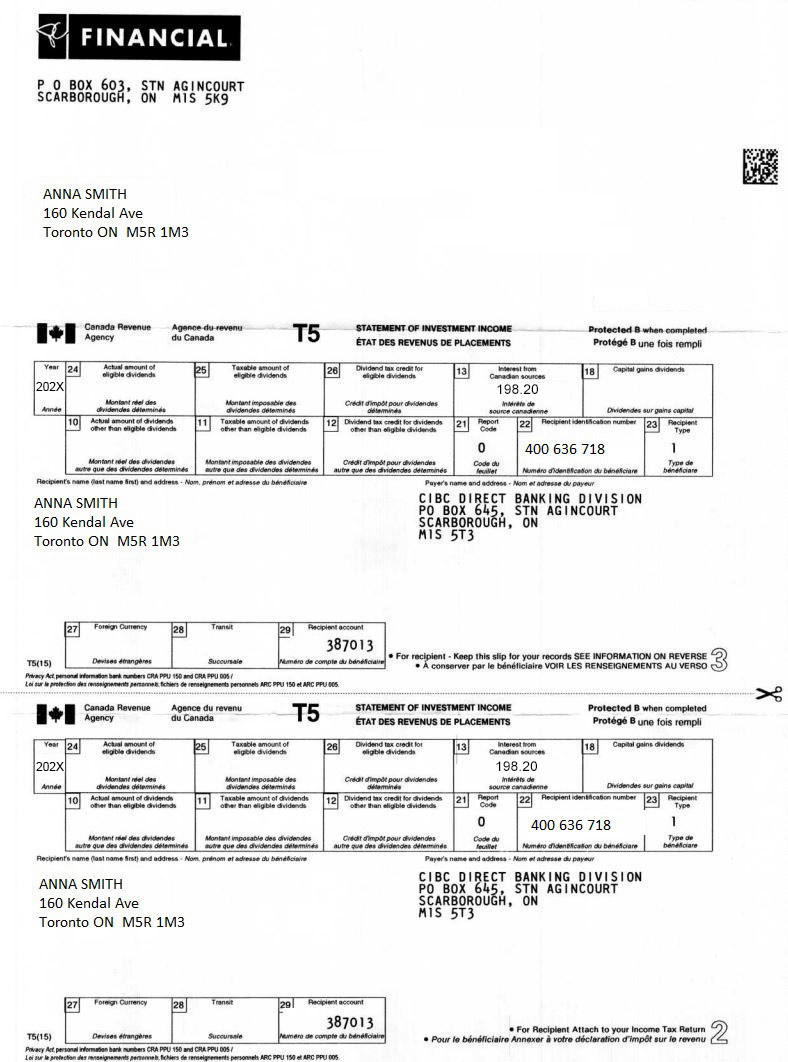

Federal Worksheet - Line 12100 Interest and Other Investment Income - line 11

This is the amount of interest income from her T5 that Anna will be taxed on

Question 8

T1 - step 2 - line 31

This is Anna's total income

Question 9

T1 - step 3 - line 34

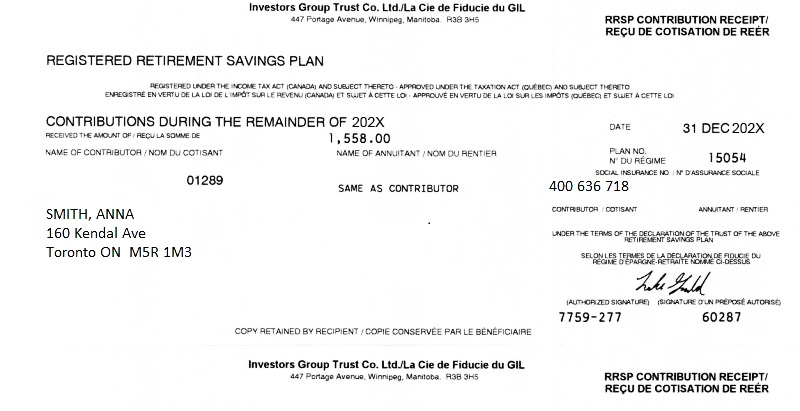

This is the allowable RRSP deduction Anna can claim, according to the Schedule 7 form

Question 10

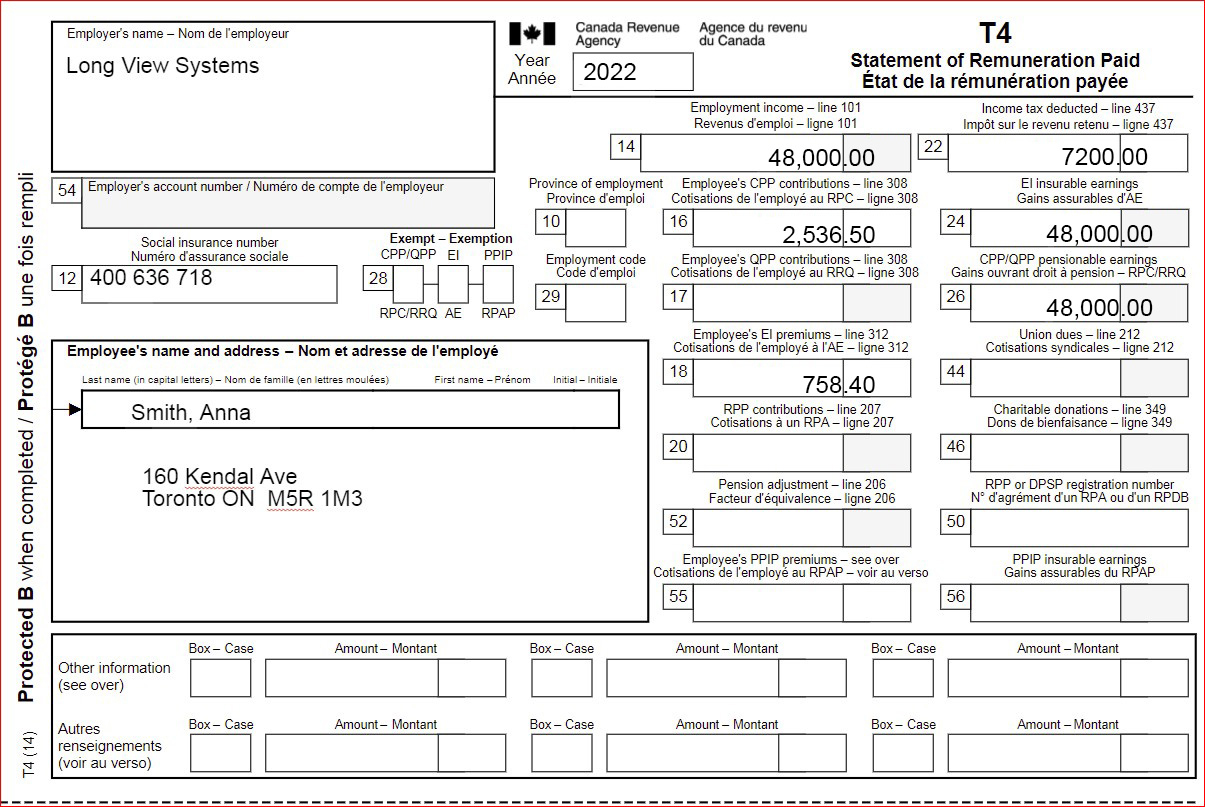

S8 - part 3 - line 7 OR 9

The amount of CPP contributions Anna is able to claim as a tax credit

(the amount she has already paid OR the amount she is correctly required to pay - whichever is less)

Question 11

S8 - Part 3 - line 8 OR 10

This is the amount of "enhanced CPP contributions" Anna may have paid. This will be counted as a deduction.

Question 12

S8 - part 5b - line 44

The additional amount of CPP contributions Anna owes on her self-employment income

Question 13

S8 - part 5b - line 51

This is the employee portion of her self-employment CPP expense that Anna recieves as a tax credit

Question 14

S8 - part 5b - line 54

The tax break Anna will receive to compensate for the employer portion of her CPP contributions on self-employment income

(usually an employer pays half and the employee pays the other half - if you are self-employed the government treats the employer half like a business expense and doesn't tax you on it, therefore it's a deduction)

Question 15

T1 - step 4 - line 66

This is Anna's taxable income

Question 16

T1 - step 5: part A - line 73

Anna's tax payable based on her taxable income

Question 17

S13 - line 9

The amount of additional EI premiums Anna owes on her self-employment income

Question 18

T1 - Step 5 - part B - line 104 and 111

Question 19

T1 - step 5 - part B - line 115

Anna's total federal non-refundable tax credits

Question 20

S9 - line 23

The amount of her charitable donation that Anna can claim federally

Question 21

T1 - step 5: part C - line 123, 131 and 139

(all values the same)

Net federal tax - total amount of tax that Anna owes the federal government

Question 22

ON428 - Part A - line 8

Amount of tax payable provincially according to Anna's taxable income

Question 23

ON428 - Part B - line 35 and 44

Question 24

ON428 - Part B - line 50

Total Ontario non-refundable tax credits

Question 25

ON428 - Part C - lines 55, 61, 62, 73, 83, 84 and 88

(all same value)

Question 26

ON428 - Part C - line 90

Net provincial tax - total amount of tax that Anna owes the provincial government

Question 27

ON-BEN - link provided at top of page

This simple form is only an application to be considered for the Ontario Trillium Benefit. However, by following the link provided at the top of that page and answering a few questions about Anna that we already know the answers to, we can find the estimated that Anna qualifies for.

What is Anna's total estimated benefit amount?

Question 28

T1 - Step 6 - line 145

This is Anna's total tax payable - the total amount of tax that Anna owes for this year

but there are still some final amounts to be accounted for, such as taxes already paid...

Question 29

T1 - Step 7 - line 163

final credits counted against the tax you owe (or result in taxes owed), including taxes already paid

Question 30

T1 - Step 7 - line 48400 OR 48500

What is Anna's final Refund amount that she will be receiving from the government? OR

What is Anna's final balance that she owes to the government?

(note: the questions are intentionally phrased so that either way the answer should be a positive number)

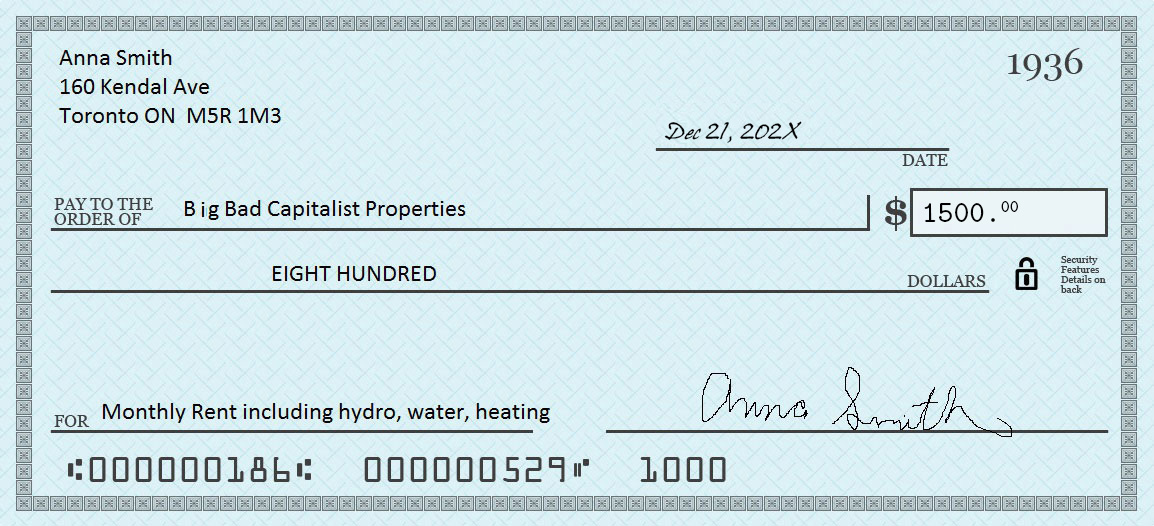

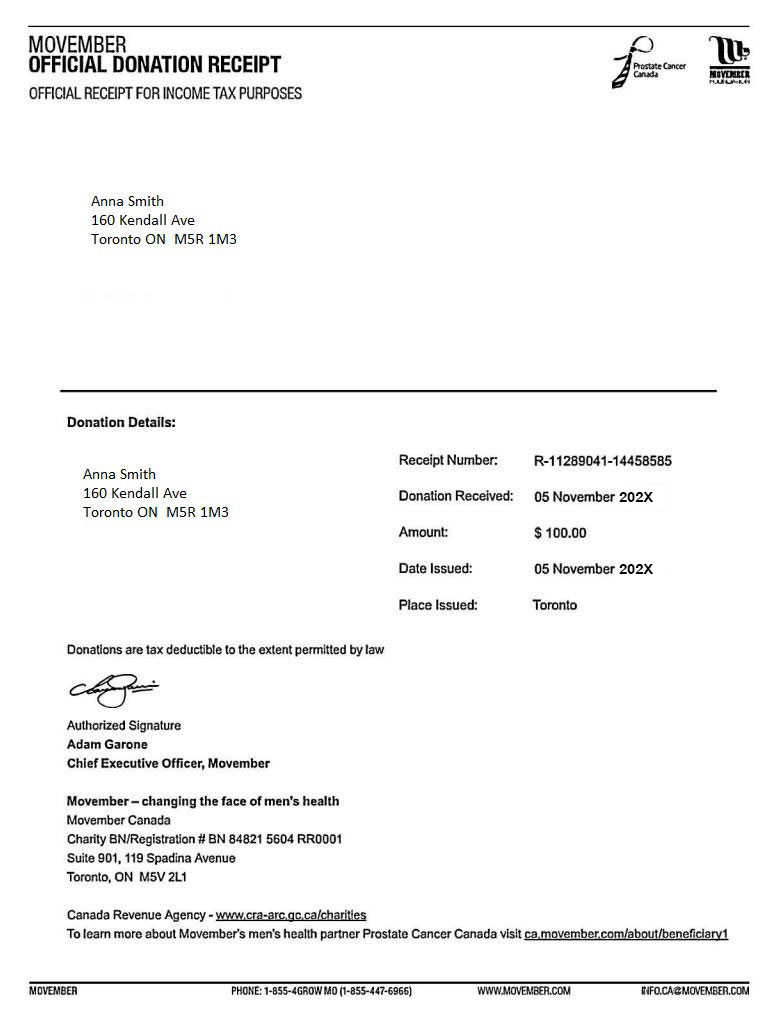

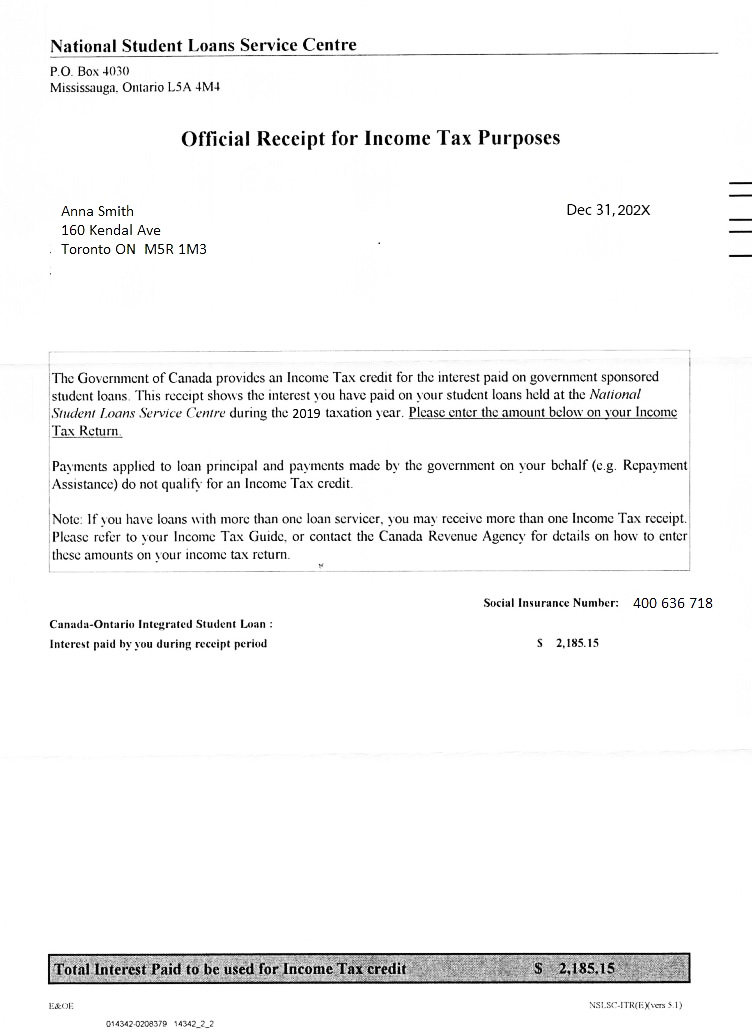

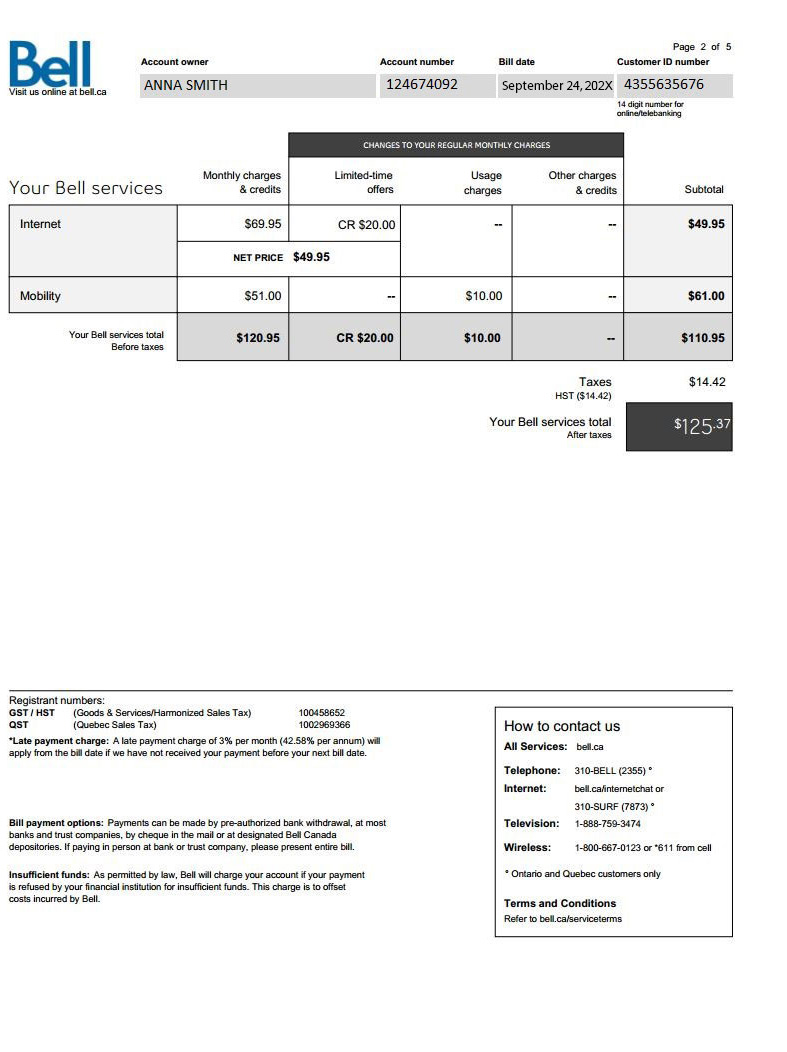

P 0 BOX 603, STN AGINCOURT SCARBOROUGH; ON MIS 5KG ANNA SMITH 160 Kendal Ave Toronto ON M5R 1 M3 T5(15 - For Reciplent Attach to your income Tax Return - Pour le bnficiaire Annaxer al votre dctaration dmpt sur le revenu Anna Smith 160 Kendal Ave Toronto ON M5R 1M3 1936 Dec21,202x PAY TO THE B ig Bad Capitalist Properties EIGHT HUNDRED DOLLARS FOR Monthly Rent including hydro, water, heating REGISTERED RETIREMENT SAVINGS PLAN Anna Smith Dec 31,202x 160 Kendal Ave Toronto ON M5R 1 M3 The Government of Canada provides an Income Tax credit for the interest paid on government sponsored student loans. This receipt shows the interest you have paid on your student loans held at the National Siudent Loans Service Centre during the 2019 taxation year. Please enter the amount below on your Income Tax Return. Payments applied to loan principal and payments made by the government on your behalf (e.g. Repayment Assistance) do not qualify for an Income Tax credit. Note: If you have loans with more than one loan servicer, you may receive more than one Income Tax receipt. Please refer to your Income Tax Guide, or contact the Canada Revenue Agency for details on how to enter these amounts on your income tax return. Social Insurance Number: 400636718 Canada-Ontario Integrated Student Loan : Interest paid by you during receipt period S 2,185.15 Registrant numbers: \begin{tabular}{lll} GST / HST & (Goods \& Services/Harmonized Sales Tax) & 100458652 \\ QST & (Quebec Sales Tax) & 1002969366 \end{tabular} "Late payment charge: A late payment charge of 3% per month ( 42.58% per annum) will apply from the bill date if we have not received your payment before your next bill date. Bill payment options: Payments can be made by pre-authorized bank withdrawal, at most banks and trust companies, by cheque in the mail or at designated Bell Canada depositories. If paying in person at bank or trust company. please present entire bill. Insufficient funds: As permitted by law, Bell will charge your account if your payment is refused by your financial institution for insufficient funds. This charge is to offset costs incurred by Bell. MOVEMBER OFFICIAL DONATION RECEIPT OFFICIAL RECEIPT FOR INCOME TAX PURPOSES Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 Donation Details: Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 \begin{tabular}{ll} Receipt Number: & R-11289041-14458585 \\ Donation Received: & 05 November 202X \\ Amount: & $100.00 \\ Date Issued: & 05 November 202X \\ Place Issued: & Toronto \end{tabular} Donations are tax deductible to the extent permitted by law Authorized Signature Adam Garone Chief Executive Officer, Movember Movember - changing the face of men's health Movember Canada Charity BN/Registration \# BN 848215604 RR0001 Suite 901, 119 Spadina Avenue Toronto, ON M5V 2L1 mivosin Canada Revenue Agency - www,cra-arc,gc,ca/charities To learn more about Movember's men's health partner Prostate Cancer Canada visit ca,movember.com/about/beneficiary1 MOVEMBER PHONE: 1-855-4GROWMO (1-855-447-6966) WWW.MOVEMBER.COM IIFO.CAEMOVEMBER.COM BEST BUY \#938 Thousands of Possibilities, Get Yours First Pro Queensway, Etobicoke Store Phone \#:647-288-2300 Geek Squad Precinct \#:647-288-2305 Geek Squad Toll Free: 1-800-GEEKSQUAD Keep your receipt Val \#: 1470-0418- 093805047774/16/202X20:36 SALES

P 0 BOX 603, STN AGINCOURT SCARBOROUGH; ON MIS 5KG ANNA SMITH 160 Kendal Ave Toronto ON M5R 1 M3 T5(15 - For Reciplent Attach to your income Tax Return - Pour le bnficiaire Annaxer al votre dctaration dmpt sur le revenu Anna Smith 160 Kendal Ave Toronto ON M5R 1M3 1936 Dec21,202x PAY TO THE B ig Bad Capitalist Properties EIGHT HUNDRED DOLLARS FOR Monthly Rent including hydro, water, heating REGISTERED RETIREMENT SAVINGS PLAN Anna Smith Dec 31,202x 160 Kendal Ave Toronto ON M5R 1 M3 The Government of Canada provides an Income Tax credit for the interest paid on government sponsored student loans. This receipt shows the interest you have paid on your student loans held at the National Siudent Loans Service Centre during the 2019 taxation year. Please enter the amount below on your Income Tax Return. Payments applied to loan principal and payments made by the government on your behalf (e.g. Repayment Assistance) do not qualify for an Income Tax credit. Note: If you have loans with more than one loan servicer, you may receive more than one Income Tax receipt. Please refer to your Income Tax Guide, or contact the Canada Revenue Agency for details on how to enter these amounts on your income tax return. Social Insurance Number: 400636718 Canada-Ontario Integrated Student Loan : Interest paid by you during receipt period S 2,185.15 Registrant numbers: \begin{tabular}{lll} GST / HST & (Goods \& Services/Harmonized Sales Tax) & 100458652 \\ QST & (Quebec Sales Tax) & 1002969366 \end{tabular} "Late payment charge: A late payment charge of 3% per month ( 42.58% per annum) will apply from the bill date if we have not received your payment before your next bill date. Bill payment options: Payments can be made by pre-authorized bank withdrawal, at most banks and trust companies, by cheque in the mail or at designated Bell Canada depositories. If paying in person at bank or trust company. please present entire bill. Insufficient funds: As permitted by law, Bell will charge your account if your payment is refused by your financial institution for insufficient funds. This charge is to offset costs incurred by Bell. MOVEMBER OFFICIAL DONATION RECEIPT OFFICIAL RECEIPT FOR INCOME TAX PURPOSES Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 Donation Details: Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 \begin{tabular}{ll} Receipt Number: & R-11289041-14458585 \\ Donation Received: & 05 November 202X \\ Amount: & $100.00 \\ Date Issued: & 05 November 202X \\ Place Issued: & Toronto \end{tabular} Donations are tax deductible to the extent permitted by law Authorized Signature Adam Garone Chief Executive Officer, Movember Movember - changing the face of men's health Movember Canada Charity BN/Registration \# BN 848215604 RR0001 Suite 901, 119 Spadina Avenue Toronto, ON M5V 2L1 mivosin Canada Revenue Agency - www,cra-arc,gc,ca/charities To learn more about Movember's men's health partner Prostate Cancer Canada visit ca,movember.com/about/beneficiary1 MOVEMBER PHONE: 1-855-4GROWMO (1-855-447-6966) WWW.MOVEMBER.COM IIFO.CAEMOVEMBER.COM BEST BUY \#938 Thousands of Possibilities, Get Yours First Pro Queensway, Etobicoke Store Phone \#:647-288-2300 Geek Squad Precinct \#:647-288-2305 Geek Squad Toll Free: 1-800-GEEKSQUAD Keep your receipt Val \#: 1470-0418- 093805047774/16/202X20:36 SALES Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started