Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The accountant of Ungu Berhad, James, is on medical leave for two months. You are asked to complete some of the tasks that

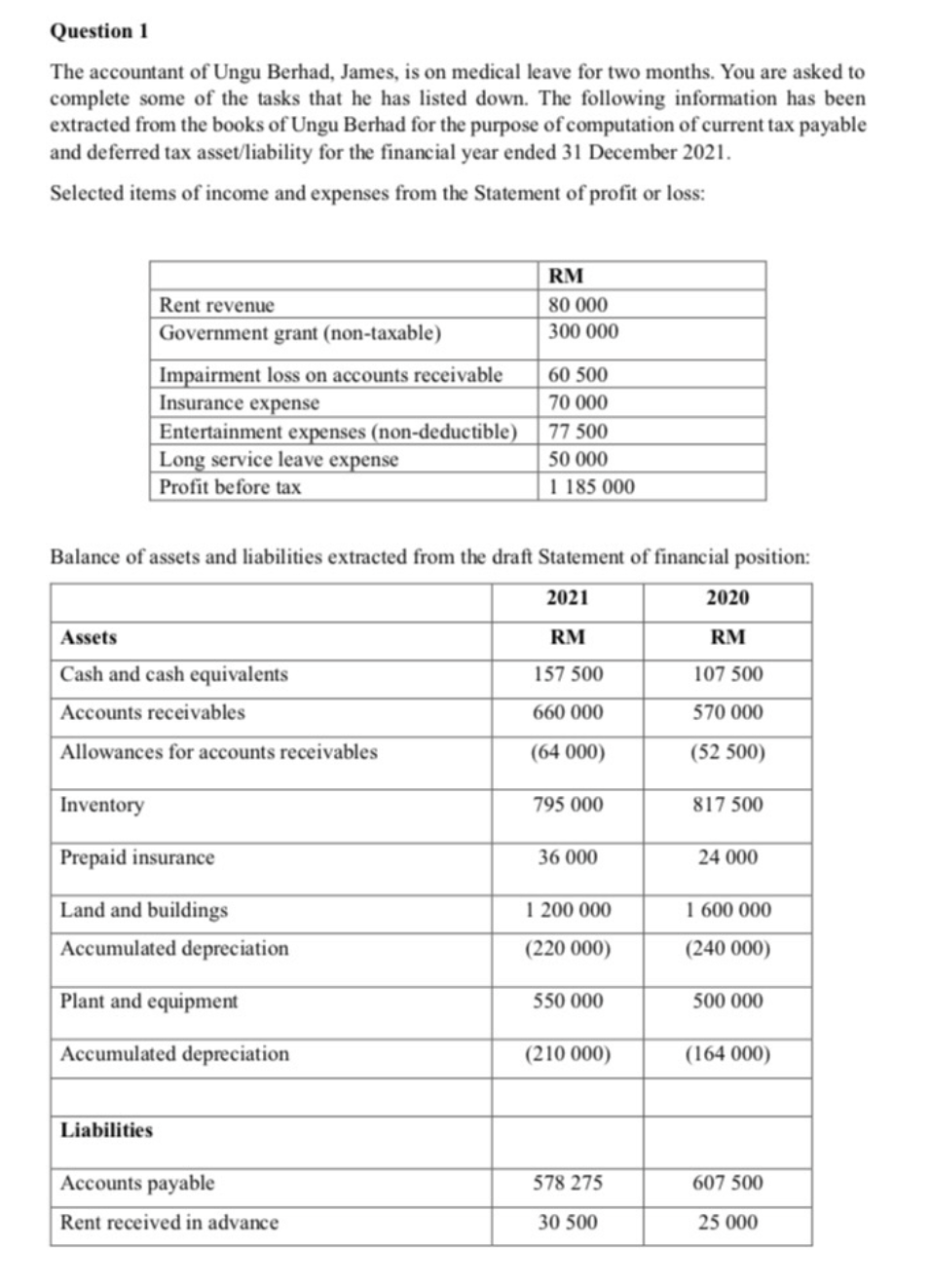

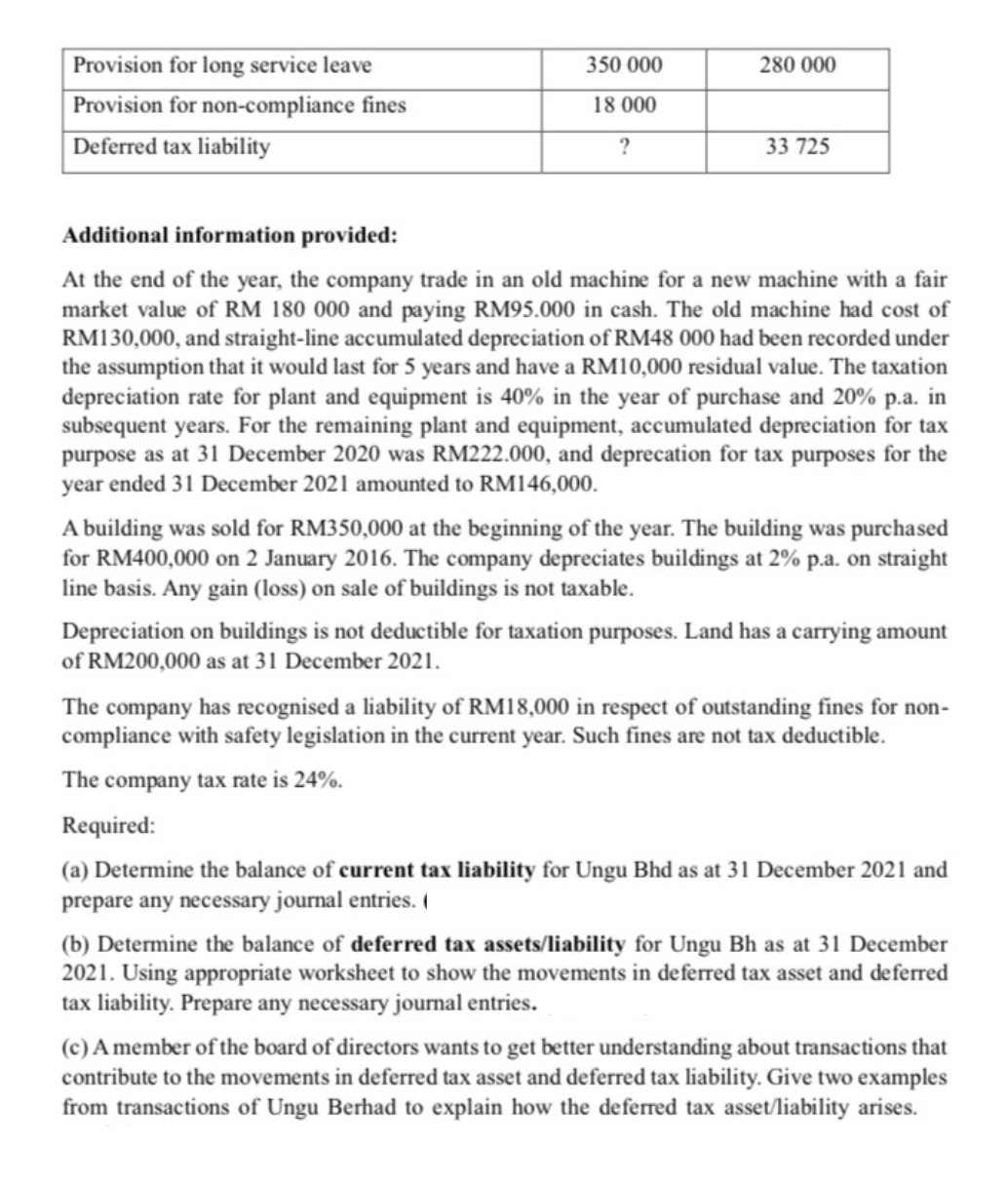

Question 1 The accountant of Ungu Berhad, James, is on medical leave for two months. You are asked to complete some of the tasks that he has listed down. The following information has been extracted from the books of Ungu Berhad for the purpose of computation of current tax payable and deferred tax asset/liability for the financial year ended 31 December 2021. Selected items of income and expenses from the Statement of profit or loss: Balance of assets and liabilities extracted from the draft Statement of financial position: Additional information provided: At the end of the year, the company trade in an old machine for a new machine with a fair market value of RM 180000 and paying RM95.000 in cash. The old machine had cost of RM130,000, and straight-line accumulated depreciation of RM48 000 had been recorded under the assumption that it would last for 5 years and have a RM10,000 residual value. The taxation depreciation rate for plant and equipment is 40% in the year of purchase and 20% p.a. in subsequent years. For the remaining plant and equipment, accumulated depreciation for tax purpose as at 31 December 2020 was RM222.000, and deprecation for tax purposes for the year ended 31 December 2021 amounted to RM146,000. A building was sold for RM350,000 at the beginning of the year. The building was purchased for RM400,000 on 2 January 2016 . The company depreciates buildings at 2% p.a. on straight line basis. Any gain (loss) on sale of buildings is not taxable. Depreciation on buildings is not deductible for taxation purposes. Land has a carrying amount of RM200,000 as at 31 December 2021. The company has recognised a liability of RM18,000 in respect of outstanding fines for noncompliance with safety legislation in the current year. Such fines are not tax deductible. The company tax rate is 24%. Required: (a) Determine the balance of current tax liability for Ungu Bhd as at 31 December 2021 and prepare any necessary journal entries. 1 (b) Determine the balance of deferred tax assets/liability for Ungu Bh as at 31 December 2021. Using appropriate worksheet to show the movements in deferred tax asset and deferred tax liability. Prepare any necessary journal entries. (c) A member of the board of directors wants to get better understanding about transactions that contribute to the movements in deferred tax asset and deferred tax liability. Give two examples from transactions of Ungu Berhad to explain how the deferred tax asset/liability arises. Question 1 The accountant of Ungu Berhad, James, is on medical leave for two months. You are asked to complete some of the tasks that he has listed down. The following information has been extracted from the books of Ungu Berhad for the purpose of computation of current tax payable and deferred tax asset/liability for the financial year ended 31 December 2021. Selected items of income and expenses from the Statement of profit or loss: Balance of assets and liabilities extracted from the draft Statement of financial position: Additional information provided: At the end of the year, the company trade in an old machine for a new machine with a fair market value of RM 180000 and paying RM95.000 in cash. The old machine had cost of RM130,000, and straight-line accumulated depreciation of RM48 000 had been recorded under the assumption that it would last for 5 years and have a RM10,000 residual value. The taxation depreciation rate for plant and equipment is 40% in the year of purchase and 20% p.a. in subsequent years. For the remaining plant and equipment, accumulated depreciation for tax purpose as at 31 December 2020 was RM222.000, and deprecation for tax purposes for the year ended 31 December 2021 amounted to RM146,000. A building was sold for RM350,000 at the beginning of the year. The building was purchased for RM400,000 on 2 January 2016 . The company depreciates buildings at 2% p.a. on straight line basis. Any gain (loss) on sale of buildings is not taxable. Depreciation on buildings is not deductible for taxation purposes. Land has a carrying amount of RM200,000 as at 31 December 2021. The company has recognised a liability of RM18,000 in respect of outstanding fines for noncompliance with safety legislation in the current year. Such fines are not tax deductible. The company tax rate is 24%. Required: (a) Determine the balance of current tax liability for Ungu Bhd as at 31 December 2021 and prepare any necessary journal entries. 1 (b) Determine the balance of deferred tax assets/liability for Ungu Bh as at 31 December 2021. Using appropriate worksheet to show the movements in deferred tax asset and deferred tax liability. Prepare any necessary journal entries. (c) A member of the board of directors wants to get better understanding about transactions that contribute to the movements in deferred tax asset and deferred tax liability. Give two examples from transactions of Ungu Berhad to explain how the deferred tax asset/liability arises

Question 1 The accountant of Ungu Berhad, James, is on medical leave for two months. You are asked to complete some of the tasks that he has listed down. The following information has been extracted from the books of Ungu Berhad for the purpose of computation of current tax payable and deferred tax asset/liability for the financial year ended 31 December 2021. Selected items of income and expenses from the Statement of profit or loss: Balance of assets and liabilities extracted from the draft Statement of financial position: Additional information provided: At the end of the year, the company trade in an old machine for a new machine with a fair market value of RM 180000 and paying RM95.000 in cash. The old machine had cost of RM130,000, and straight-line accumulated depreciation of RM48 000 had been recorded under the assumption that it would last for 5 years and have a RM10,000 residual value. The taxation depreciation rate for plant and equipment is 40% in the year of purchase and 20% p.a. in subsequent years. For the remaining plant and equipment, accumulated depreciation for tax purpose as at 31 December 2020 was RM222.000, and deprecation for tax purposes for the year ended 31 December 2021 amounted to RM146,000. A building was sold for RM350,000 at the beginning of the year. The building was purchased for RM400,000 on 2 January 2016 . The company depreciates buildings at 2% p.a. on straight line basis. Any gain (loss) on sale of buildings is not taxable. Depreciation on buildings is not deductible for taxation purposes. Land has a carrying amount of RM200,000 as at 31 December 2021. The company has recognised a liability of RM18,000 in respect of outstanding fines for noncompliance with safety legislation in the current year. Such fines are not tax deductible. The company tax rate is 24%. Required: (a) Determine the balance of current tax liability for Ungu Bhd as at 31 December 2021 and prepare any necessary journal entries. 1 (b) Determine the balance of deferred tax assets/liability for Ungu Bh as at 31 December 2021. Using appropriate worksheet to show the movements in deferred tax asset and deferred tax liability. Prepare any necessary journal entries. (c) A member of the board of directors wants to get better understanding about transactions that contribute to the movements in deferred tax asset and deferred tax liability. Give two examples from transactions of Ungu Berhad to explain how the deferred tax asset/liability arises. Question 1 The accountant of Ungu Berhad, James, is on medical leave for two months. You are asked to complete some of the tasks that he has listed down. The following information has been extracted from the books of Ungu Berhad for the purpose of computation of current tax payable and deferred tax asset/liability for the financial year ended 31 December 2021. Selected items of income and expenses from the Statement of profit or loss: Balance of assets and liabilities extracted from the draft Statement of financial position: Additional information provided: At the end of the year, the company trade in an old machine for a new machine with a fair market value of RM 180000 and paying RM95.000 in cash. The old machine had cost of RM130,000, and straight-line accumulated depreciation of RM48 000 had been recorded under the assumption that it would last for 5 years and have a RM10,000 residual value. The taxation depreciation rate for plant and equipment is 40% in the year of purchase and 20% p.a. in subsequent years. For the remaining plant and equipment, accumulated depreciation for tax purpose as at 31 December 2020 was RM222.000, and deprecation for tax purposes for the year ended 31 December 2021 amounted to RM146,000. A building was sold for RM350,000 at the beginning of the year. The building was purchased for RM400,000 on 2 January 2016 . The company depreciates buildings at 2% p.a. on straight line basis. Any gain (loss) on sale of buildings is not taxable. Depreciation on buildings is not deductible for taxation purposes. Land has a carrying amount of RM200,000 as at 31 December 2021. The company has recognised a liability of RM18,000 in respect of outstanding fines for noncompliance with safety legislation in the current year. Such fines are not tax deductible. The company tax rate is 24%. Required: (a) Determine the balance of current tax liability for Ungu Bhd as at 31 December 2021 and prepare any necessary journal entries. 1 (b) Determine the balance of deferred tax assets/liability for Ungu Bh as at 31 December 2021. Using appropriate worksheet to show the movements in deferred tax asset and deferred tax liability. Prepare any necessary journal entries. (c) A member of the board of directors wants to get better understanding about transactions that contribute to the movements in deferred tax asset and deferred tax liability. Give two examples from transactions of Ungu Berhad to explain how the deferred tax asset/liability arises Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started