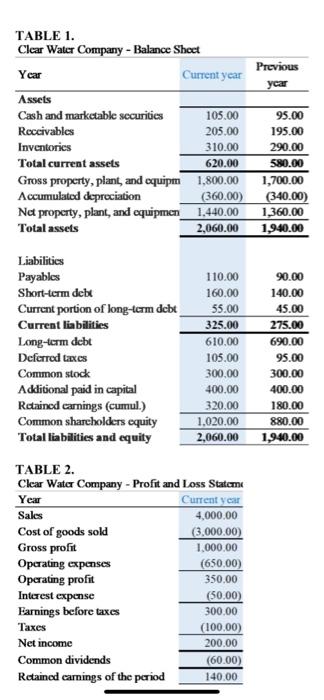

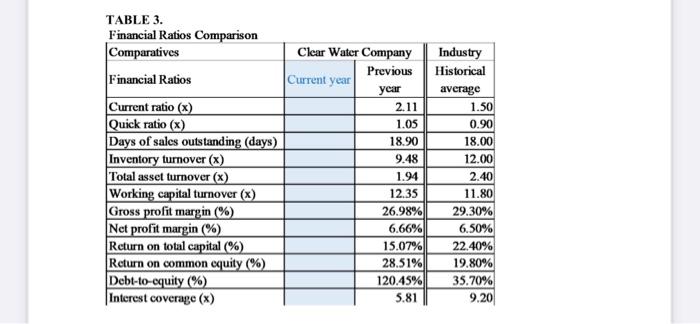

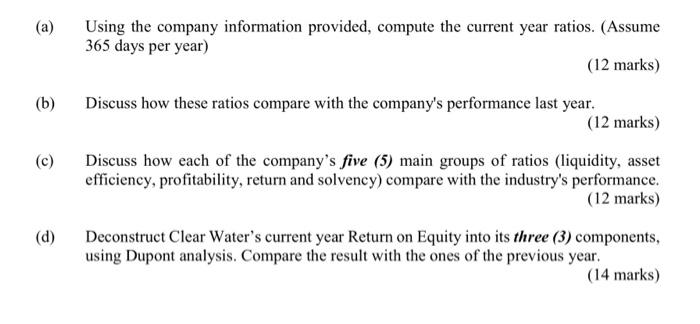

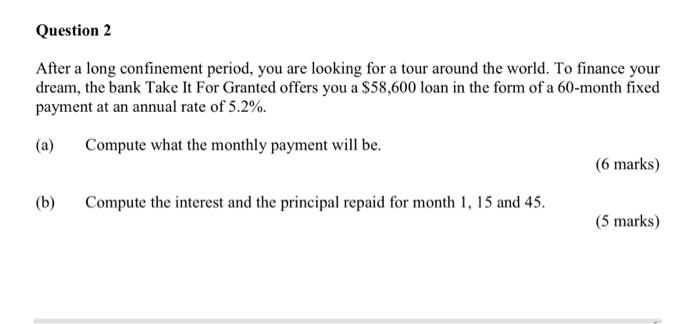

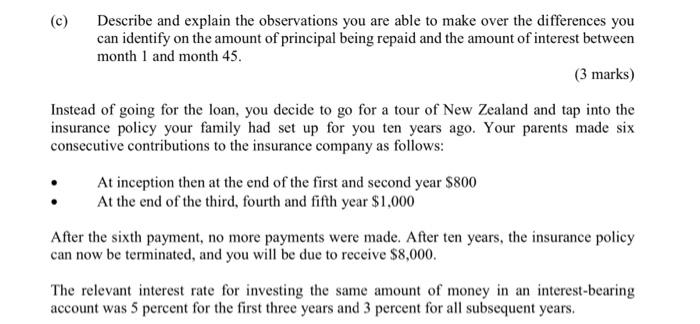

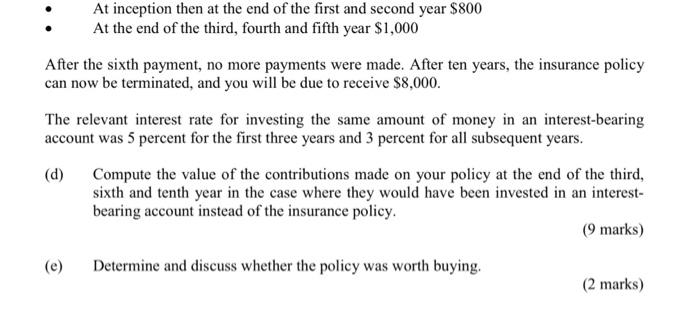

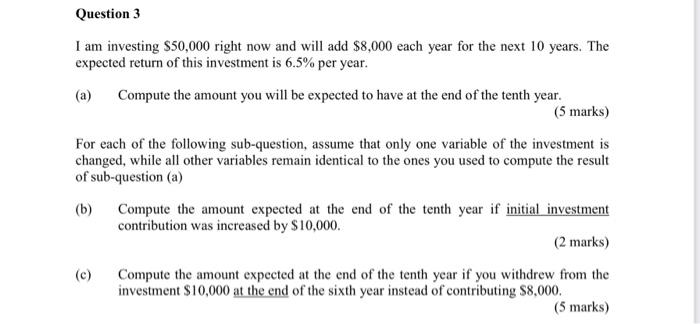

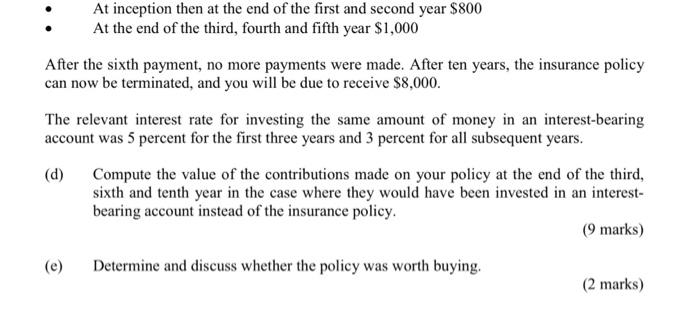

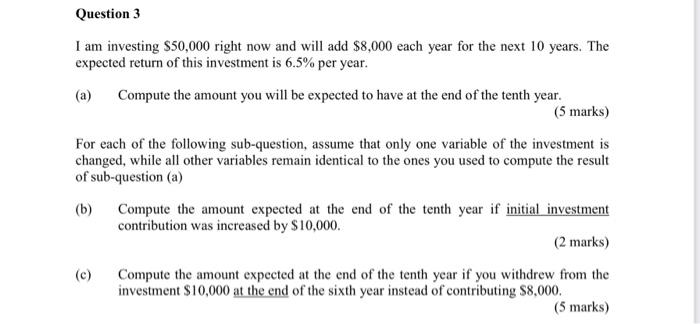

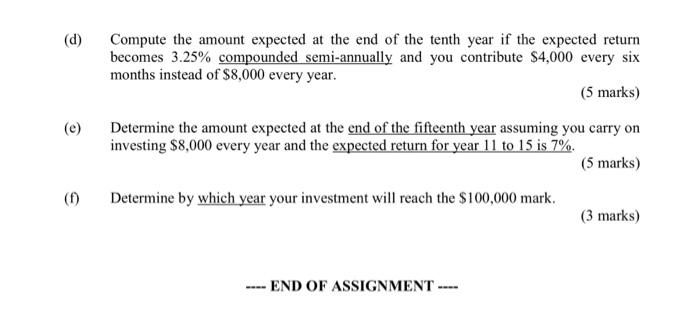

Question 1 The balance sheet and income statement for Clear Water Company are shown below. They represent the financials of the company for both the current year and the previous year. TABLE 1. Clear Water Company - Balance Sheet Previous Year Current year year Assets Cash and marketable securities 105.00 95.00 Receivables 205.00 195.00 Inventories 310.00 290.00 Total current assets 620.00 580.00 Gross property, plant, and equipm 1,800.00 1,700.00 Accumulated depreciation (360.00) (340.00) Na property, plant, and equipmen_1.440.00 1,360.00 Total assets 2,060.00 1,940.00 Liabilities Payables Short-term debt Current portion of long-term debt Current liabilities Long-term dcbt Deferred taxes Common stock Additional paid in capital Retained carnings (cumul.) Common shareholders equity Total liabilities and equity 110.00 160.00 55.00 325.00 610.00 105.00 300,00 400.00 320.00 1.020,00 2,060.00 90.00 140.00 45.00 275.00 690.00 95.00 300.00 400.00 180.00 880.00 1,940.00 TABLE 2. Clear Water Company - Profit and Loss Stateme Year Current year Sales 4,000.00 Cost of goods sold (3.000.00) Gross profit 1,000.00 Operating expenses (650,00) Operating profit 350,00 Interest expense (50,00) Earnings before taxes 300,00 Taxes (100,00) Net income 200.00 Common dividends (60.00) Retained camnings of the period 140.00 TABLE 3. Financial Ratios Comparison Comparatives Clear Water Company Previous Financial Ratios Current year year Current ratio (x) 2.11 Quick ratio (x) 1.05 Days of sales outstanding (days) 18.90 Inventory turnover (x) 9.48 Total asset turnover (x) 1.94 Working capital turnover (x) 12.35 Gross profit margin (%) 26.98% Net profit margin (%) 6.66% Return on total capital (%) 15.07% Return on common equity (%) 28.51% Debt-to-equity (%) 120.45% Interest coverage (x) 5.81 Industry Historical average 1.50 0.90 18.00 12.00 2.40 11.80 29.30% 6.50% 22.40% 19.80% 35.70% 9.20 (a) Using the company information provided, compute the current year ratios. (Assume 365 days per year) (12 marks) (b) Discuss how these ratios compare with the company's performance last year. (12 marks) Discuss how each of the company's five (5) main groups of ratios (liquidity, asset efficiency, profitability, return and solvency) compare with the industry's performance. (12 marks) Deconstruct Clear Water's current year Return on Equity into its three (3) components, using Dupont analysis. Compare the result with the ones of the previous year. (14 marks) Question 2 After a long confinement period, you are looking for a tour around the world. To finance your dream, the bank Take It For Granted offers you a $58,600 loan in the form of a 60-month fixed payment at an annual rate of 5.2%. (a) Compute what the monthly payment will be. (6 marks) (b) Compute the interest and the principal repaid for month 1, 15 and 45. (5 marks) (c) Describe and explain the observations you are able to make over the differences you can identify on the amount of principal being repaid and the amount of interest between month 1 and month 45. (3 marks) Instead of going for the loan, you decide to go for a tour of New Zealand and tap into the insurance policy your family had set up for you ten years ago. Your parents made six consecutive contributions to the insurance company as follows: : At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. (d) Compute the value of the contributions made on your policy at the end of the third, sixth and tenth year in the case where they would have been invested in an interest- bearing account instead of the insurance policy. (9 marks) Determine and discuss whether the policy was worth buying. (2 marks) (e) Question 3 I am investing $50,000 right now and will add $8,000 each year for the next 10 years. The expected return of this investment is 6.5% per year. Compute the amount you will be expected to have at the end of the tenth year. (5 marks) For each of the following sub-question, assume that only one variable of the investment is changed, while all other variables remain identical to the ones you used to compute the result of sub-question (a) (b) Compute the amount expected at the end of the tenth year if initial investment contribution was increased by $10,000. (2 marks) (c) Compute the amount expected at the end of the tenth year if you withdrew from the investment $10,000 at the end of the sixth year instead of contributing S8,000. (5 marks) (d) Compute the amount expected at the end of the tenth year if the expected return becomes 3.25% compounded semi-annually and you contribute $4,000 every six months instead of $8,000 every year. (5 marks) Determine the amount expected at the end of the fifteenth year assuming you carry on investing $8,000 every year and the expected return for year 11 to 15 is 7%. (5 marks) Determine by which year your investment will reach the $100,000 mark. (3 marks) END OF ASSIGNMENT ---- Question 1 The balance sheet and income statement for Clear Water Company are shown below. They represent the financials of the company for both the current year and the previous year. TABLE 1. Clear Water Company - Balance Sheet Previous Year Current year year Assets Cash and marketable securities 105.00 95.00 Receivables 205.00 195.00 Inventories 310.00 290.00 Total current assets 620.00 580.00 Gross property, plant, and equipm 1,800.00 1,700.00 Accumulated depreciation (360.00) (340.00) Na property, plant, and equipmen_1.440.00 1,360.00 Total assets 2,060.00 1,940.00 Liabilities Payables Short-term debt Current portion of long-term debt Current liabilities Long-term dcbt Deferred taxes Common stock Additional paid in capital Retained carnings (cumul.) Common shareholders equity Total liabilities and equity 110.00 160.00 55.00 325.00 610.00 105.00 300,00 400.00 320.00 1.020,00 2,060.00 90.00 140.00 45.00 275.00 690.00 95.00 300.00 400.00 180.00 880.00 1,940.00 TABLE 2. Clear Water Company - Profit and Loss Stateme Year Current year Sales 4,000.00 Cost of goods sold (3.000.00) Gross profit 1,000.00 Operating expenses (650,00) Operating profit 350,00 Interest expense (50,00) Earnings before taxes 300,00 Taxes (100,00) Net income 200.00 Common dividends (60.00) Retained camnings of the period 140.00 TABLE 3. Financial Ratios Comparison Comparatives Clear Water Company Previous Financial Ratios Current year year Current ratio (x) 2.11 Quick ratio (x) 1.05 Days of sales outstanding (days) 18.90 Inventory turnover (x) 9.48 Total asset turnover (x) 1.94 Working capital turnover (x) 12.35 Gross profit margin (%) 26.98% Net profit margin (%) 6.66% Return on total capital (%) 15.07% Return on common equity (%) 28.51% Debt-to-equity (%) 120.45% Interest coverage (x) 5.81 Industry Historical average 1.50 0.90 18.00 12.00 2.40 11.80 29.30% 6.50% 22.40% 19.80% 35.70% 9.20 (a) Using the company information provided, compute the current year ratios. (Assume 365 days per year) (12 marks) (b) Discuss how these ratios compare with the company's performance last year. (12 marks) Discuss how each of the company's five (5) main groups of ratios (liquidity, asset efficiency, profitability, return and solvency) compare with the industry's performance. (12 marks) Deconstruct Clear Water's current year Return on Equity into its three (3) components, using Dupont analysis. Compare the result with the ones of the previous year. (14 marks) Question 2 After a long confinement period, you are looking for a tour around the world. To finance your dream, the bank Take It For Granted offers you a $58,600 loan in the form of a 60-month fixed payment at an annual rate of 5.2%. (a) Compute what the monthly payment will be. (6 marks) (b) Compute the interest and the principal repaid for month 1, 15 and 45. (5 marks) (c) Describe and explain the observations you are able to make over the differences you can identify on the amount of principal being repaid and the amount of interest between month 1 and month 45. (3 marks) Instead of going for the loan, you decide to go for a tour of New Zealand and tap into the insurance policy your family had set up for you ten years ago. Your parents made six consecutive contributions to the insurance company as follows: : At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. (d) Compute the value of the contributions made on your policy at the end of the third, sixth and tenth year in the case where they would have been invested in an interest- bearing account instead of the insurance policy. (9 marks) Determine and discuss whether the policy was worth buying. (2 marks) (e) Question 3 I am investing $50,000 right now and will add $8,000 each year for the next 10 years. The expected return of this investment is 6.5% per year. Compute the amount you will be expected to have at the end of the tenth year. (5 marks) For each of the following sub-question, assume that only one variable of the investment is changed, while all other variables remain identical to the ones you used to compute the result of sub-question (a) (b) Compute the amount expected at the end of the tenth year if initial investment contribution was increased by $10,000. (2 marks) (c) Compute the amount expected at the end of the tenth year if you withdrew from the investment $10,000 at the end of the sixth year instead of contributing S8,000. (5 marks) (d) Compute the amount expected at the end of the tenth year if the expected return becomes 3.25% compounded semi-annually and you contribute $4,000 every six months instead of $8,000 every year. (5 marks) Determine the amount expected at the end of the fifteenth year assuming you carry on investing $8,000 every year and the expected return for year 11 to 15 is 7%. (5 marks) Determine by which year your investment will reach the $100,000 mark. (3 marks) END OF ASSIGNMENT