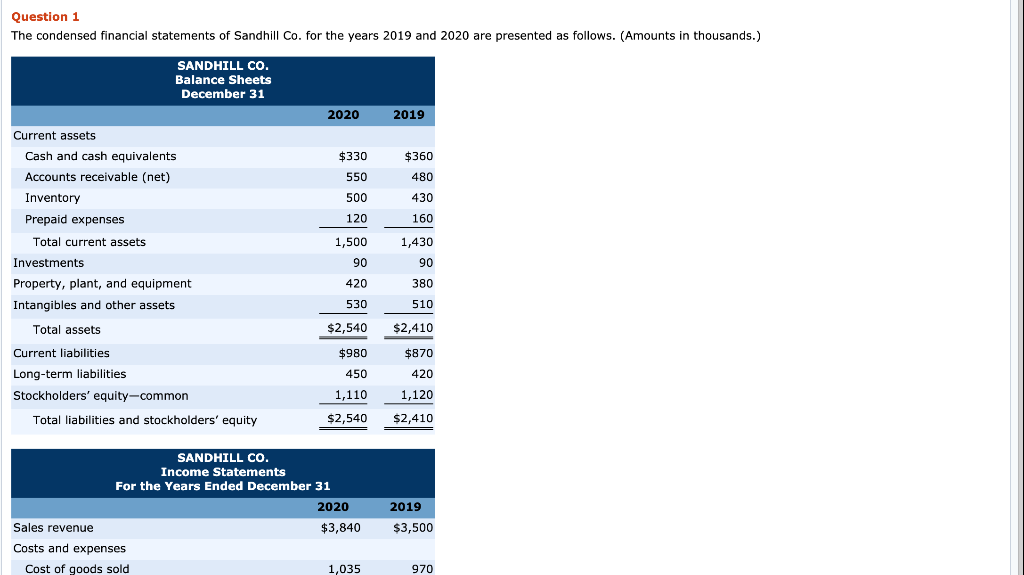

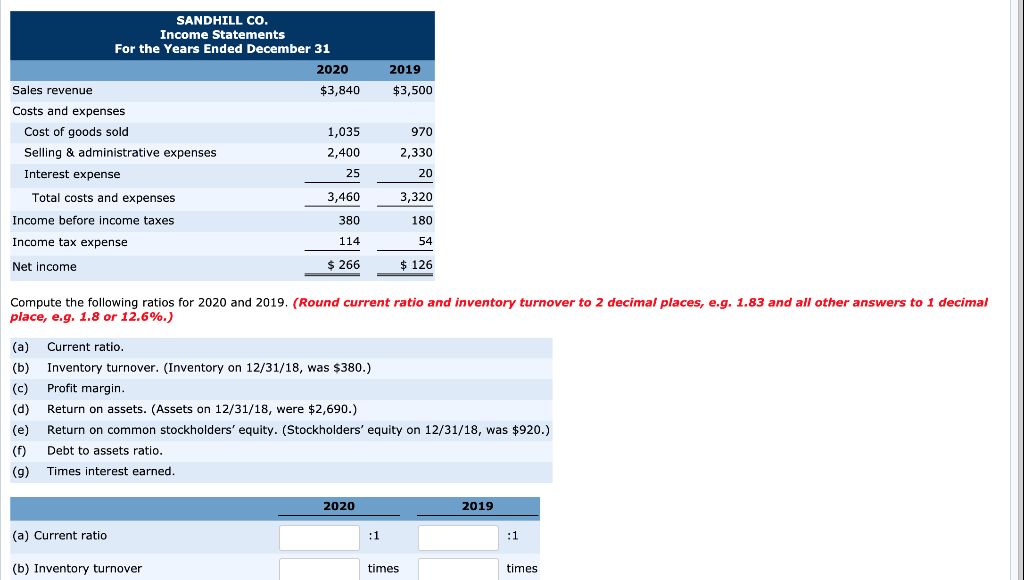

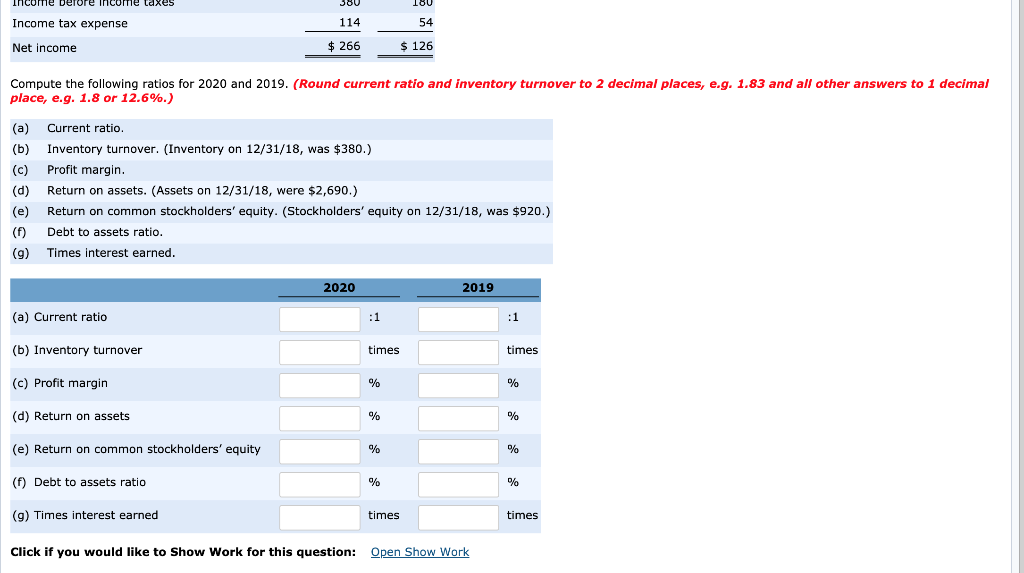

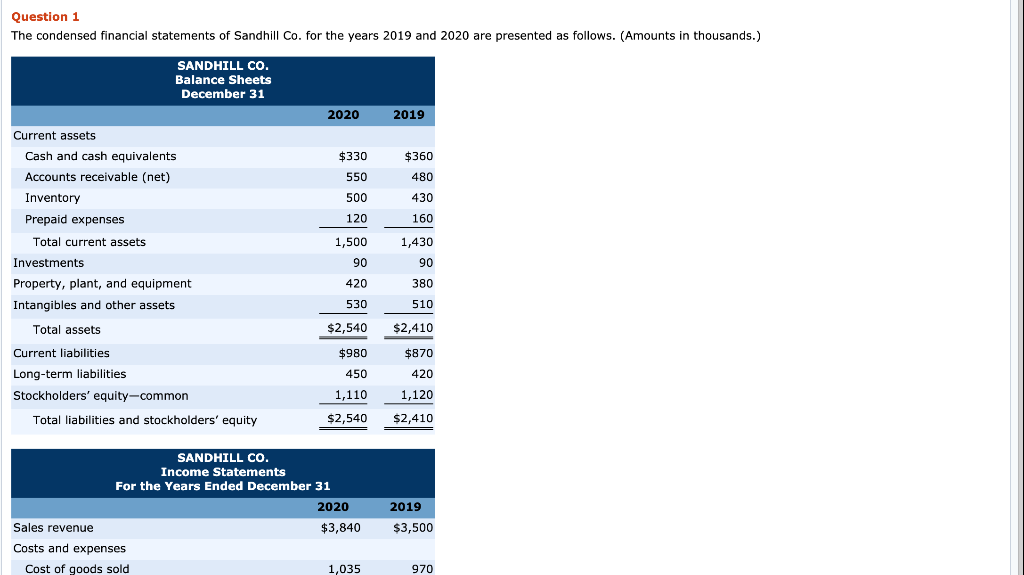

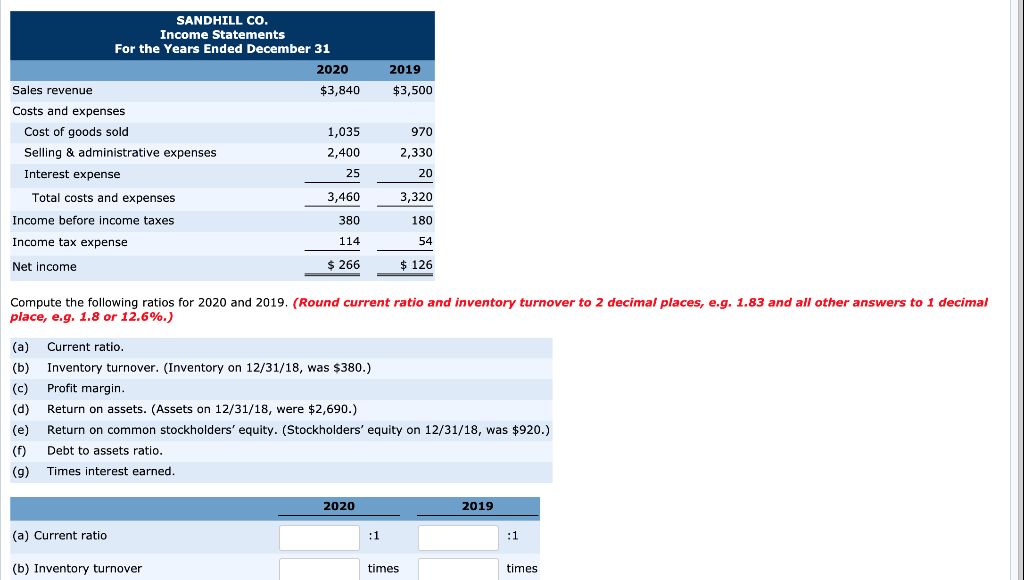

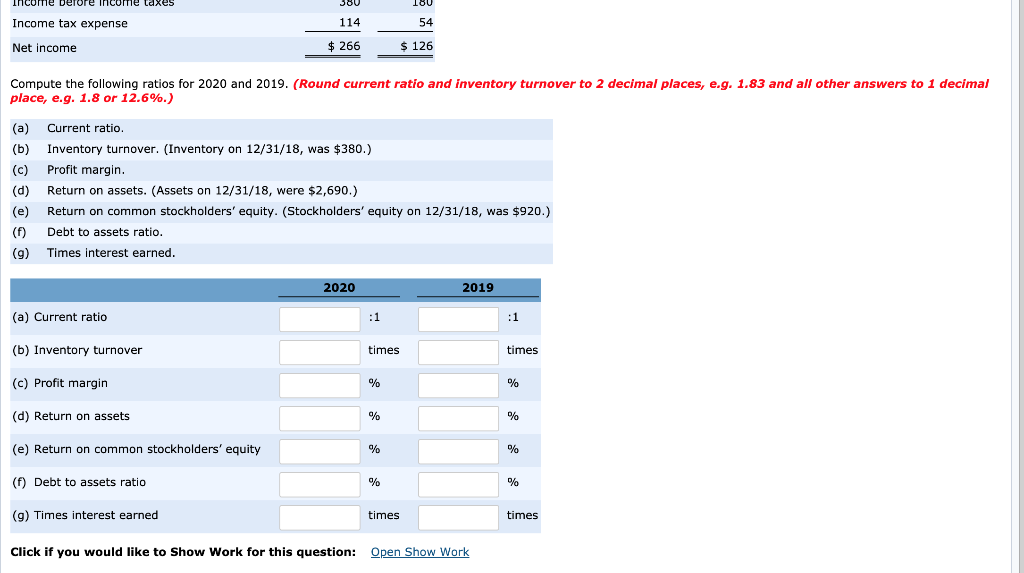

Question 1 The condensed financial statements of Sandhill Co. for the years 2019 and 2020 are presented as follows. (Amounts in thousands.) SANDHILL CO. Balance Sheets December 31 2020 2019 $360 $330 550 500 480 430 Current assets Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments Property, plant, and equipment Intangibles and other assets 120 160 1,500 1,430 90 90 420 380 530 510 $2,540 $2,410 Total assets Current liabilities Long-term liabilities Stockholders' equity-common Total liabilities and stockholders' equity $980 450 $870 420 1,110 1,120 $2,540 $2,410 2019 SANDHILL CO. Income Statements For the Years Ended December 31 2020 Sales revenue $3,840 Costs and expenses Cost of goods sold 1,035 $3,500 970 2019 $3,500 970 SANDHILL CO. Income Statements For the Years Ended December 31 2020 Sales revenue $3,840 Costs and expenses Cost of goods sold 1,035 Selling & administrative expenses 2,400 Interest expense 25 Total costs and expenses 3,460 Income before income taxes 380 Income tax expense 114 Net income $ 266 2,330 20 3,320 180 54 $ 126 Compute the following ratios for 2020 and 2019. (Round current ratio and inventory turnover to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 12.6%) (a) Current ratio. (b) Inventory turnover. (Inventory on 12/31/18, was $380.) (c) Profit margin. (d) Return on assets. (Assets on 12/31/18, were $2,690.) (e) Return on common stockholders' equity. (Stockholders' equity on 12/31/18, was $920.) (6) Debt to assets ratio. (9) Times interest earned. 2020 2019 (a) Current ratio :1 :1 (b) Inventory turnover times times Incomie berore incorrie taxes 380 180 Income tax expense 114 54 Net income $ 266 $ 126 Compute the following ratios for 2020 and 2019. (Round current ratio and inventory turnover to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 12.6%.) (a) (b) (c) (d) (e) () (9) Current ratio. Inventory turnover. (Inventory on 12/31/18, was $380.) Profit margin. Return on assets. (Assets on 12/31/18, were $2,690.) Return on common stockholders' equity. (Stockholders' equity on 12/31/18, was $920.) Debt to assets ratio. Times interest earned. 2020 2019 (a) Current ratio :1 :1 (b) Inventory turnover times times (c) Profit margin % % (d) Return on assets % % (e) Return on common stockholders' equity % % (f) Debt to assets ratio % % (g) Times interest earned times times Click if you would like to Show Work for this question: Open Show Work