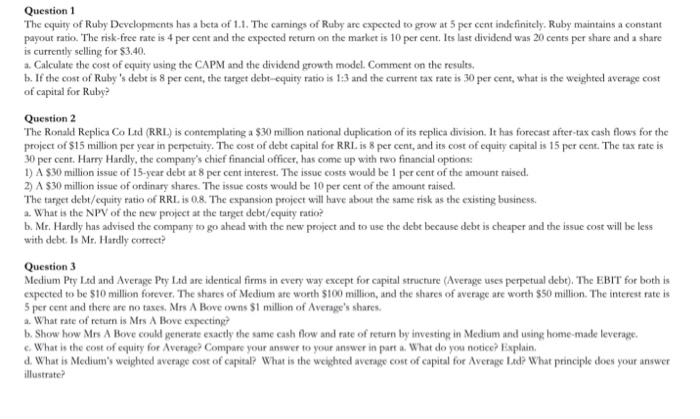

Question 1 The equity of Ruby Developments has a beta of 1.1. The camings of Ruby are expected to grow at 5 per cent indefinitely. Ruby maintains a constant yout ratio. The risk-free rate is 4 per cent and the expected return on the market is 10 per cent. Its last dividend was 20 cents per share and a share is currently selling for $3.40. a. Calculate the cost of equity using the CAPM and the dividend growth model. Comment on the results. b. If the cost of Ruby s debt is 8 per cent, the target debt equity ratio is 1:3 and the current tax rate is 30 per cent, what s the weighted average cost of capital for Ruby? Question 2 The Ronald Replica Co Ltd (RRI.) is contemplating a $30 million national duplication of its replica division. It has forecast after-tax cash flows for the project of $15 million per year in perpetuity. The cost of debt capital for RRI. is 8 per cent, and its cost of equity capital is 15 per cent. The tax rate is 30 per cent. Harry Hardly, the company's chief financial officer, has come up with two financial options 1) A $30 million issue of 15-year debt at 8 per cent interest. The issue costs would be 1 per cent of the amount raised. 2) A $30 million issue of ordinary shares. The issue costs would be 10 per cent of the amount raised. The target debt/equity ratio of RRI. is 0.8. The expansion project will have about the same risk as the existing business a. What is the NPV of the new project at the target debt/equity ratio b. Mr. Hardly has advised the company to go ahead with the new project and to use the debt because debt is cheaper and the issue cost will be less with debt. Is Mr. Hardly correct? Question 3 Medium Pty Ltd and Average Pty Ltd are identical firms in every way except for capital structure(Average uses perpetual debt). The EBIT for both is expected to be $10 million forever. The shares of Medium are worth $100 million, and the shares of average are worth $50 million. The interest rate is 5 per cent and there are no taxes. Mrs A Bove owns $1 million of Average's shares a. What rate of return is Mrs A Bove expecting? b. Show how Mrs A Bove could generate exactly the same cash flow and rate of return by investing in Medium and using home-made leverage E. What is the cost of equity for Average? Compare your answer to your answer in part a. What do you notice? Esplain. d. What is Medium's weighted average cost of capitalP What is the weighted average cost of capital for Average Lad? What principle does your answer illustrate