Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 The Finance Manager of Mekar Indah Bhd proposes two risky securities and risk-free securities for investment consideration which are currently traded at the

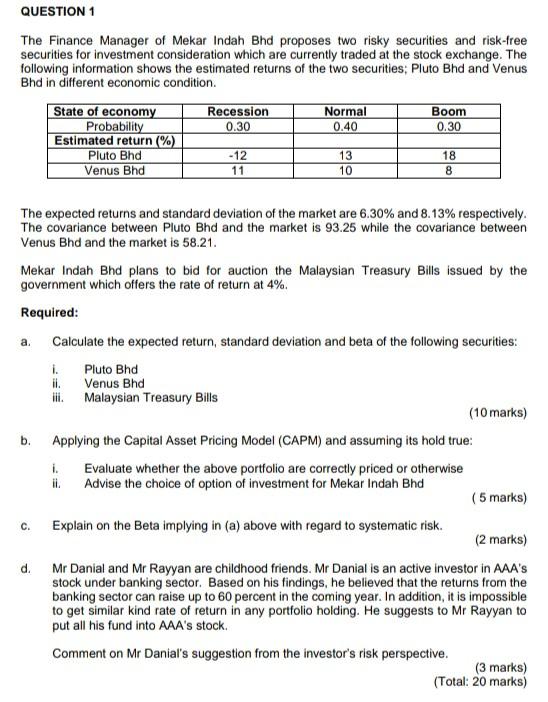

QUESTION 1 The Finance Manager of Mekar Indah Bhd proposes two risky securities and risk-free securities for investment consideration which are currently traded at the stock exchange. The following information shows the estimated returns of the two securities; Pluto Bhd and Venus Bhd in different economic condition. State of economy Recession Normal Boom Probability 0.30 0.40 0.30 Estimated return (%) Pluto Bhd -12 13 18 Venus Bhd 11 10 8 b. The expected returns and standard deviation of the market are 6.30% and 8.13% respectively. The covariance between Pluto Bhd and the market is 93.25 while the covariance between Venus Bhd and the market is 58.21. Mekar Indah Bhd plans to bid for auction the Malaysian Treasury Bills issued by the government which offers the rate of return at 4%. Required: a Calculate the expected return, standard deviation and beta of the following securities: i. Pluto Bhd ii. Venus Bhd iii. Malaysian Treasury Bills (10 marks) Applying the Capital Asset Pricing Model (CAPM) and assuming its hold true: i. Evaluate whether the above portfolio are correctly priced or otherwise Advise the choice of option of investment for Mekar Indah Bhd (5 marks) Explain on the Beta implying in (a) above with regard to systematic risk. (2 marks) d. Mr Danial and Mr Rayyan are childhood friends. Mr Danial is an active investor in AAA's stock under banking sector. Based on his findings, he believed that the returns from the banking sector can raise up to 60 percent in the coming year. In addition, it is impossible to get similar kind rate of return in any portfolio holding. He suggests to Mr Rayyan to put all his fund into AAA's stock. Comment on Mr Danial's suggestion from the investor's risk perspective. (3 marks) (Total: 20 marks) c. QUESTION 1 The Finance Manager of Mekar Indah Bhd proposes two risky securities and risk-free securities for investment consideration which are currently traded at the stock exchange. The following information shows the estimated returns of the two securities; Pluto Bhd and Venus Bhd in different economic condition. State of economy Recession Normal Boom Probability 0.30 0.40 0.30 Estimated return (%) Pluto Bhd -12 13 18 Venus Bhd 11 10 8 b. The expected returns and standard deviation of the market are 6.30% and 8.13% respectively. The covariance between Pluto Bhd and the market is 93.25 while the covariance between Venus Bhd and the market is 58.21. Mekar Indah Bhd plans to bid for auction the Malaysian Treasury Bills issued by the government which offers the rate of return at 4%. Required: a Calculate the expected return, standard deviation and beta of the following securities: i. Pluto Bhd ii. Venus Bhd iii. Malaysian Treasury Bills (10 marks) Applying the Capital Asset Pricing Model (CAPM) and assuming its hold true: i. Evaluate whether the above portfolio are correctly priced or otherwise Advise the choice of option of investment for Mekar Indah Bhd (5 marks) Explain on the Beta implying in (a) above with regard to systematic risk. (2 marks) d. Mr Danial and Mr Rayyan are childhood friends. Mr Danial is an active investor in AAA's stock under banking sector. Based on his findings, he believed that the returns from the banking sector can raise up to 60 percent in the coming year. In addition, it is impossible to get similar kind rate of return in any portfolio holding. He suggests to Mr Rayyan to put all his fund into AAA's stock. Comment on Mr Danial's suggestion from the investor's risk perspective. (3 marks) (Total: 20 marks) c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started