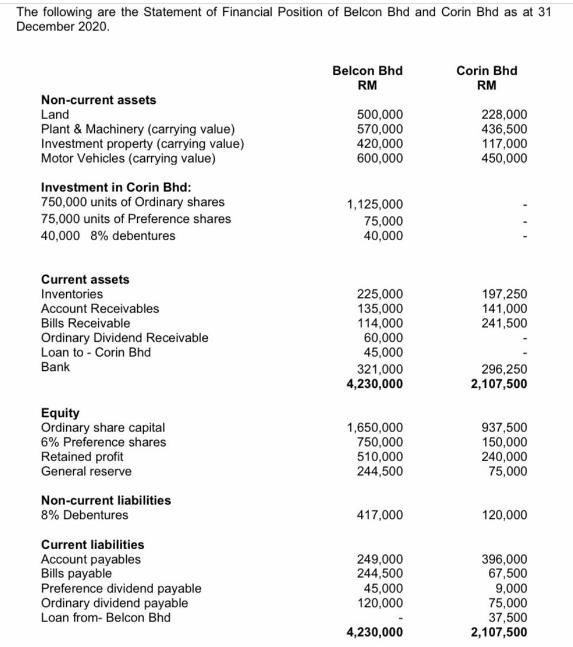

The following are the Statement of Financial Position of Belcon Bhd and Corin Bhd as at 31 December 2020. Belcon Bhd Corin Bhd RM

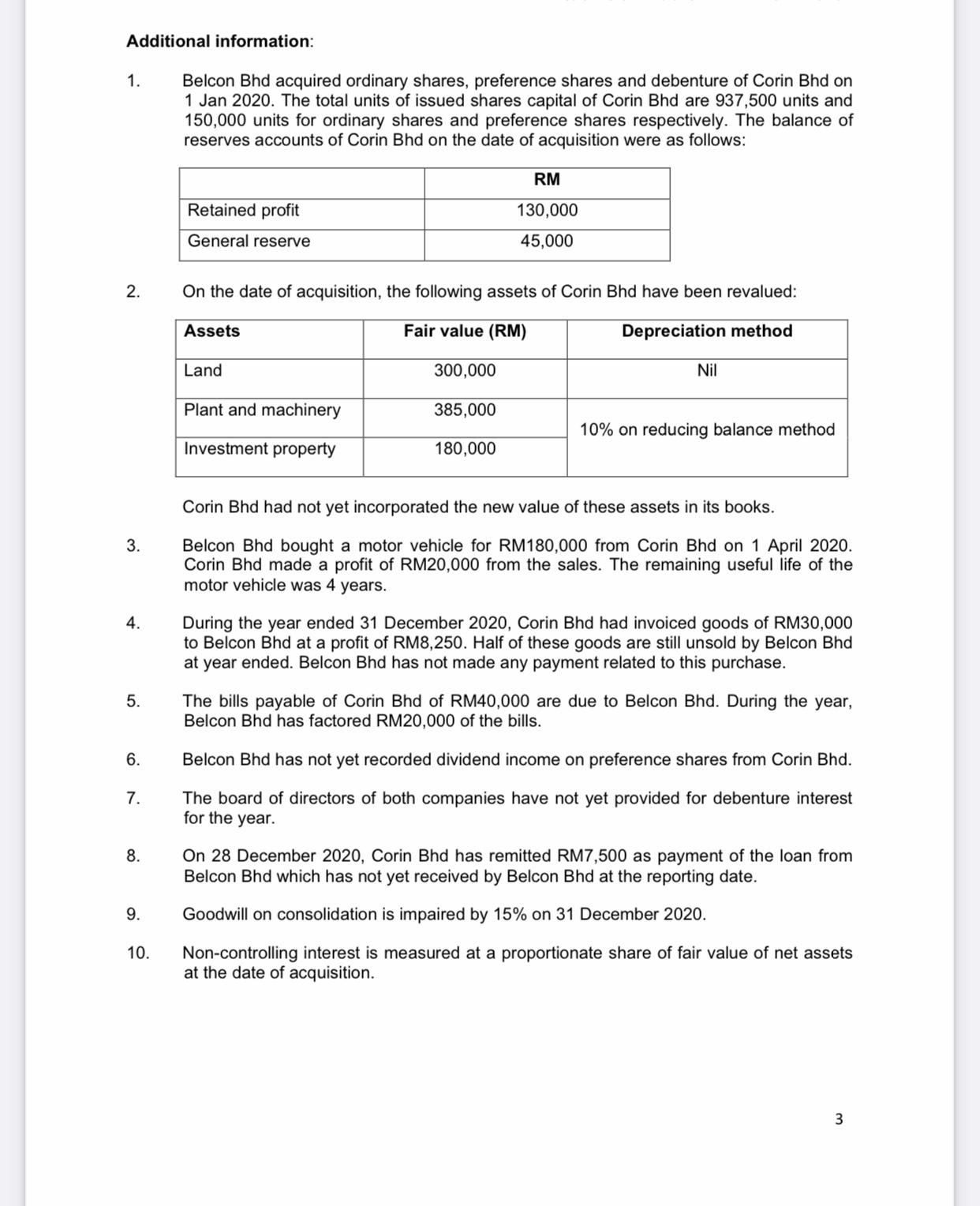

The following are the Statement of Financial Position of Belcon Bhd and Corin Bhd as at 31 December 2020. Belcon Bhd Corin Bhd RM RM Non-current assets Land 500,000 570,000 420,000 600,000 228,000 436,500 117,000 450,000 Plant & Machinery (carrying value) Investment property (carrying value) Motor Vehicles (carrying value) Investment in Corin Bhd: 750,000 units of Ordinary shares 75,000 units of Preference shares 1,125,000 75,000 40,000 40,000 8% debentures Current assets Inventories Account Receivables Bills Receivable Ordinary Dividend Receivable Loan to - Corin Bhd 225,000 135,000 114,000 60,000 45,000 197,250 141,000 241,500 Bank 321,000 4,230,000 296,250 2,107,500 Equity Ordinary share capital 6% Preference shares Retained profit General reserve 1,650,000 750,000 510,000 937,500 150,000 240,000 75,000 244,500 Non-current liabilities 8% Debentures 417,000 120,000 Current liabilities Account payables Bills payable Preference dividend payable Ordinary dividend payable Loan from- Belcon Bhd 249,000 244,500 45,000 120,000 396,000 67,500 9,000 75,000 37,500 2,107,500 4,230,000 Additional information: Belcon Bhd acquired ordinary shares, preference shares and debenture of Corin Bhd on 1 Jan 2020. The total units of issued shares capital of Corin Bhd are 937,500 units and 150,000 units for ordinary shares and preference shares respectively. The balance of reserves accounts of Corin Bhd on the date of acquisition were as follows: 1. RM Retained profit 130,000 General reserve 45,000 2. On the date of acquisition, the following assets of Corin Bhd have been revalued: Assets Fair value (RM) Depreciation method Land 300,000 Nil Plant and machinery 385,000 10% on reducing balance method Investment property 180,000 Corin Bhd had not yet incorporated the new value of these assets in its books. Belcon Bhd bought a motor vehicle for RM180,000 from Corin Bhd on 1 April 2020. Corin Bhd made a profit of RM20,000 from the sales. The remaining useful life of the motor vehicle was 4 years. 3. During the year ended 31 December 2020, Corin Bhd had invoiced goods of RM30,000 to Belcon Bhd at a profit of RM8,250. Half of these goods are still unsold by Belcon Bhd at year ended. Belcon Bhd has not made any payment related to this purchase. 4. The bills payable of Corin Bhd of RM40,000 are due to Belcon Bhd. During the year, Belcon Bhd has factored RM20,000 of the bills. 5. 6. Belcon Bhd has not yet recorded dividend income on preference shares from Corin Bhd. The board of directors of both companies have not yet provided for debenture interest for the year. 7. On 28 December 2020, Corin Bhd has remitted RM7,500 as payment of the loan from Belcon Bhd which has not yet received by Belcon Bhd at the reporting date. 8. 9. Goodwill on consolidation is impaired by 15% on 31 December 2020. Non-controlling interest is measured at a proportionate share of fair value of net assets at the date of acquisition. 10. 3 Required: Calculate the goodwill or bargain purchase arising from the acquisition of Corin Bhd by Belcon Bhd. . (10 marks) b. Record the journal entries to recognise goodwill or bargain purchase on consolidation (where applicable) for the acquisition of ordinary shares in Corin Bhd by Belcon Bhd on the date of acquisition. (10 marks) Prepare the Consolidated Statement of Financial Position of Belcon Bhd's group as at 31 December 2020. Show all workings. C. (60 marks) (Total: 80 marks) END OF QUESTION PAPER

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A CALCULATION OF GOODWILL GOODWILL PURCHASE CONSIDERATION NET ASSETS PARTIAL GOODWILL PURCHASE CONSI...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635fff14d1c09_231405.pdf

180 KBs PDF File

635fff14d1c09_231405.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started