Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following data were taken from the books of Gordon for the year to 31 December 2015. RM Inventory as at 1 January

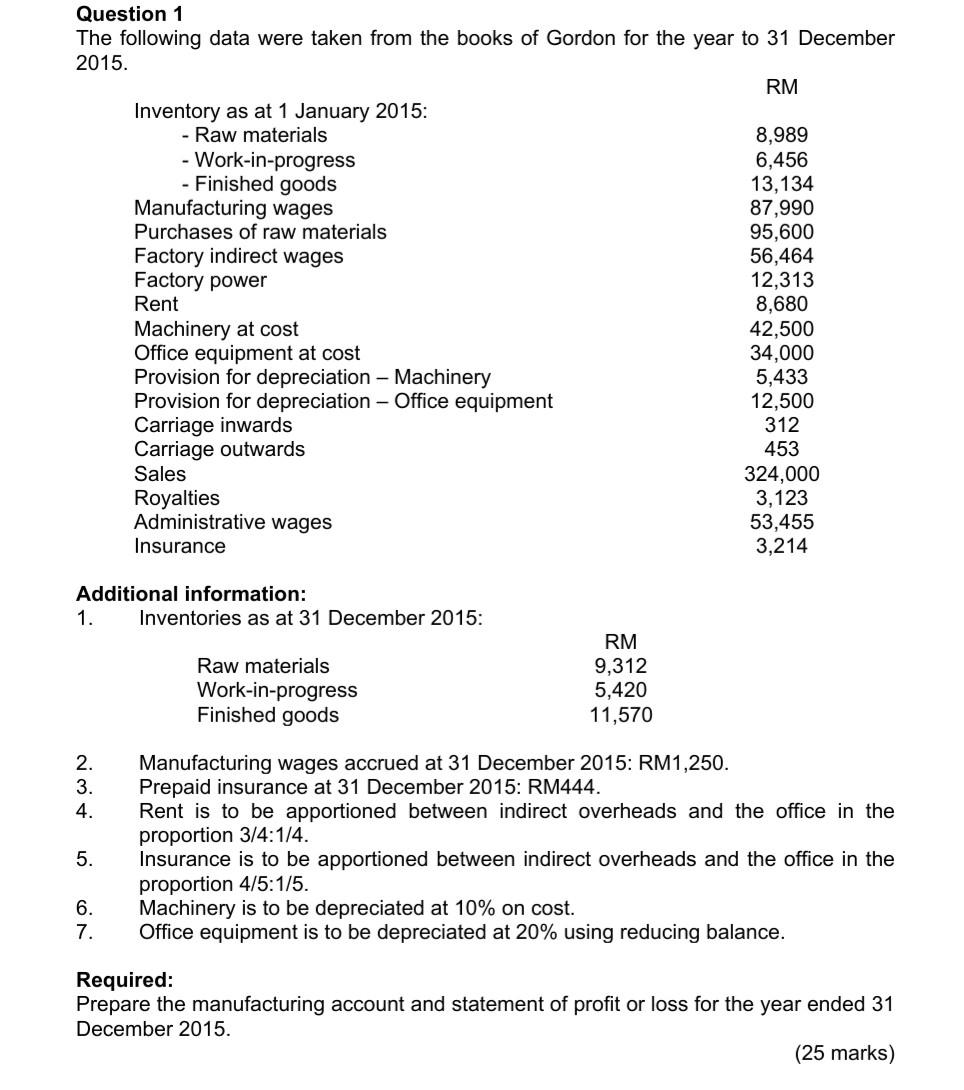

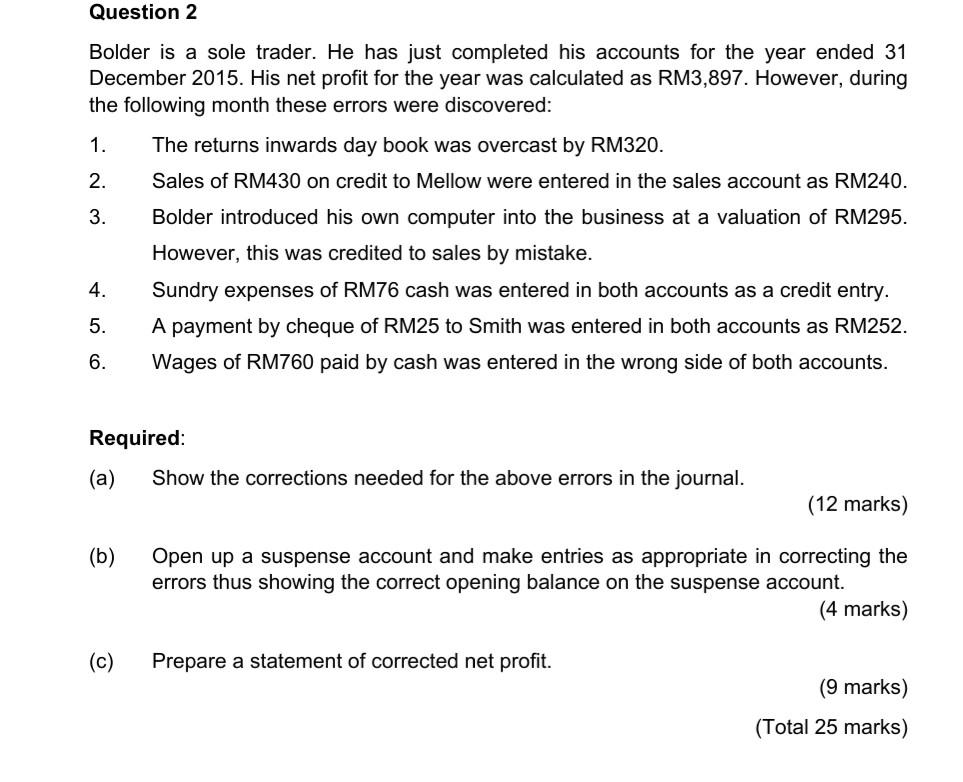

Question 1 The following data were taken from the books of Gordon for the year to 31 December 2015. RM Inventory as at 1 January 2015: - Raw materials 8,989 - Work-in-progress 6,456 - Finished goods 13,134 Manufacturing wages 87,990 Purchases of raw materials 95,600 Factory indirect wages 56,464 Factory power 12,313 Rent 8,680 Machinery at cost 42,500 Office equipment at cost 34,000 Provision for depreciation - Machinery 5,433 Provision for depreciation - Office equipment 12,500 Carriage inwards 312 Carriage outwards 453 Sales 324,000 Royalties 3,123 Administrative wages 53,455 Insurance 3,214 Additional information: 1. Inventories as at 31 December 2015: Raw materials Work-in-progress Finished goods RM 9,312 5,420 11,570 2. 3. 4. 5. Manufacturing wages accrued at 31 December 2015: RM1,250. Prepaid insurance at 31 December 2015: RM444. Rent is to be apportioned between indirect overheads and the office in the proportion 3/4:1/4. Insurance is to be apportioned between indirect overheads and the office in the proportion 4/5:1/5. Machinery is to be depreciated at 10% on cost. Office equipment is to be depreciated at 20% using reducing balance. 6. 7. Required: Prepare the manufacturing account and statement of profit or loss for the year ended 31 December 2015. (25 marks) Question 2 Bolder is a sole trader. He has just completed his accounts for the year ended 31 December 2015. His net profit for the year was calculated as RM3,897. However, during the following month these errors were discovered: 1. The returns inwards day book was overcast by RM320. 2. Sales of RM430 on credit to Mellow were entered in the sales account as RM240. 3. Bolder introduced his own computer into the business at a valuation of RM295. However, this was credited to sales by mistake. 4. Sundry expenses of RM76 cash was entered in both accounts as a credit entry. 5. A payment by cheque of RM25 to Smith was entered in both accounts as RM252. 6. Wages of RM760 paid by cash was entered in the wrong side of both accounts. Required: (a) Show the corrections needed for the above errors in the journal. (12 marks) (b) Open up a suspense account and make entries as appropriate in correcting the errors thus showing the correct opening balance on the suspense account. (4 marks) (c) Prepare a statement of corrected net profit. (9 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started