Answered step by step

Verified Expert Solution

Question

1 Approved Answer

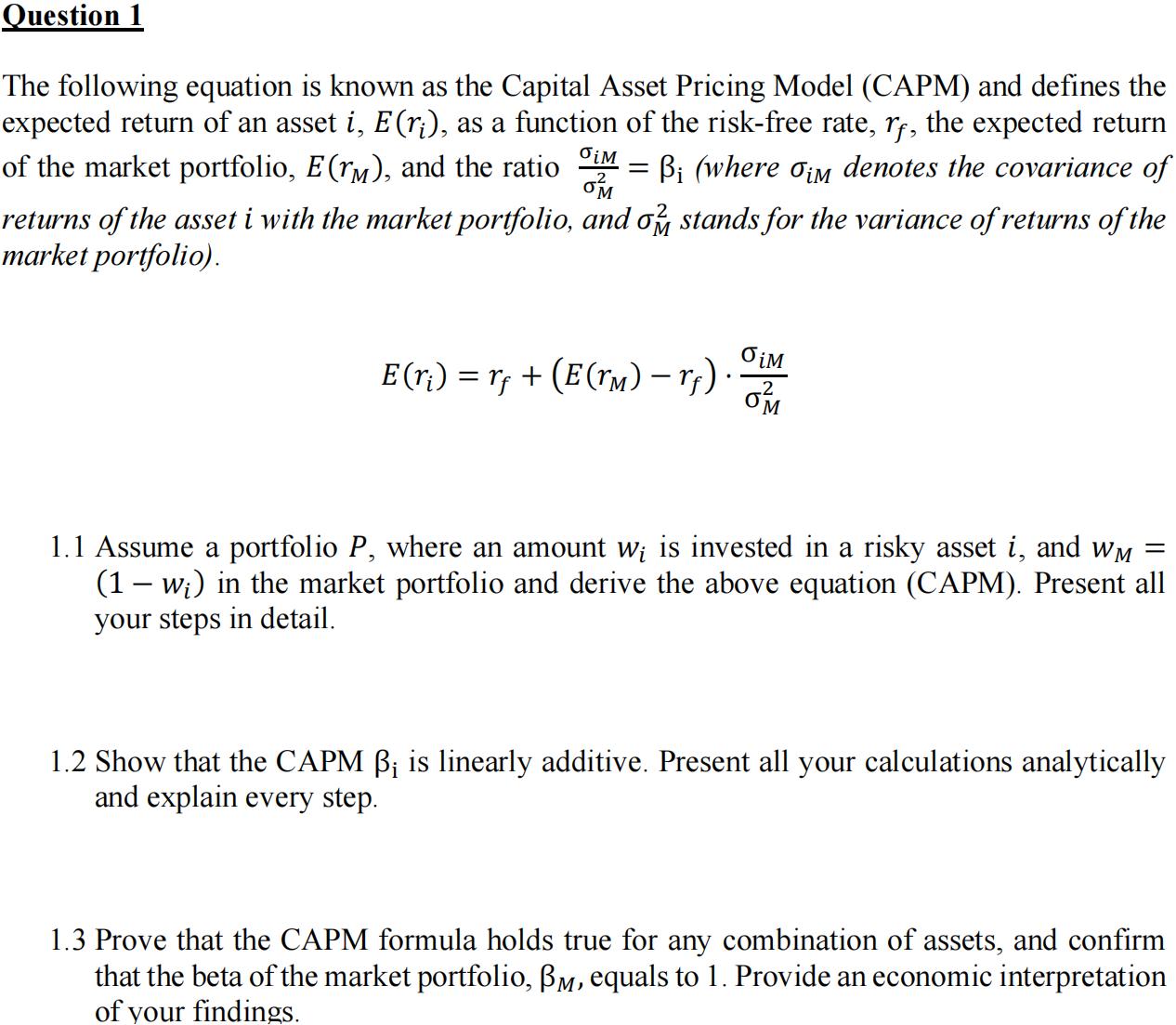

Question 1 The following equation is known as the Capital Asset Pricing Model (CAPM) and defines the expected return of an asset i, E(ri),

Question 1 The following equation is known as the Capital Asset Pricing Model (CAPM) and defines the expected return of an asset i, E(ri), as a function of the risk-free rate, rf, the expected return of the market portfolio, E(r), and the ratio Bi (where im denotes the covariance of iM = returns of the asset i with the market portfolio, and stands for the variance of returns of the market portfolio). E(ri) = rf + (E(rm) -rf) O . = 1.1 Assume a portfolio P, where an amount w; is invested in a risky asset i, and WM (1w;) in the market portfolio and derive the above equation (CAPM). Present all your steps in detail. 1.2 Show that the CAPM B is linearly additive. Present all your calculations analytically and explain every step. 1.3 Prove that the CAPM formula holds true for any combination of assets, and confirm that the beta of the market portfolio, , equals to 1. Provide an economic interpretation of your findings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started