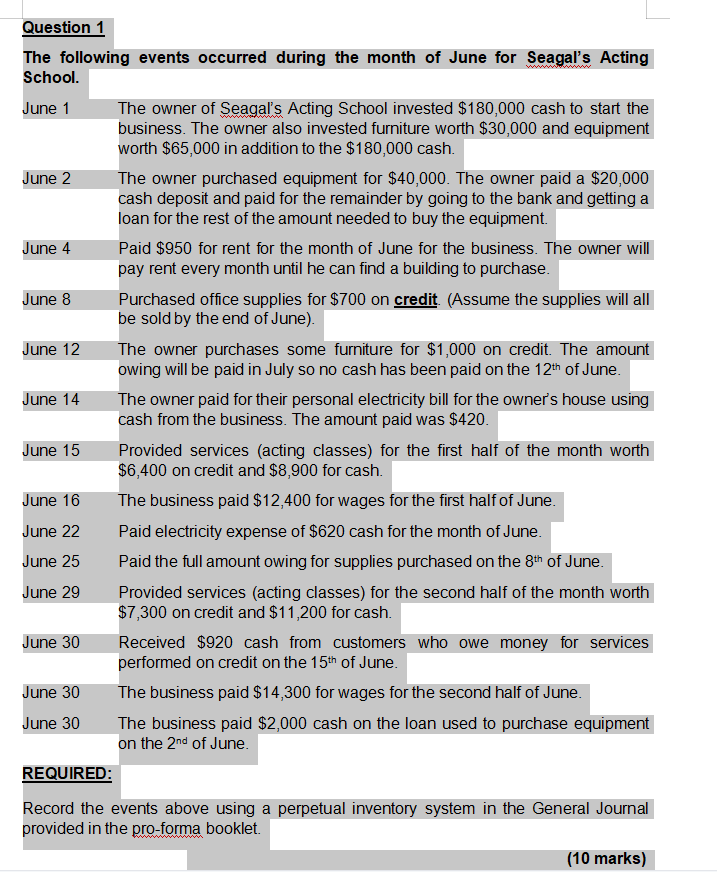

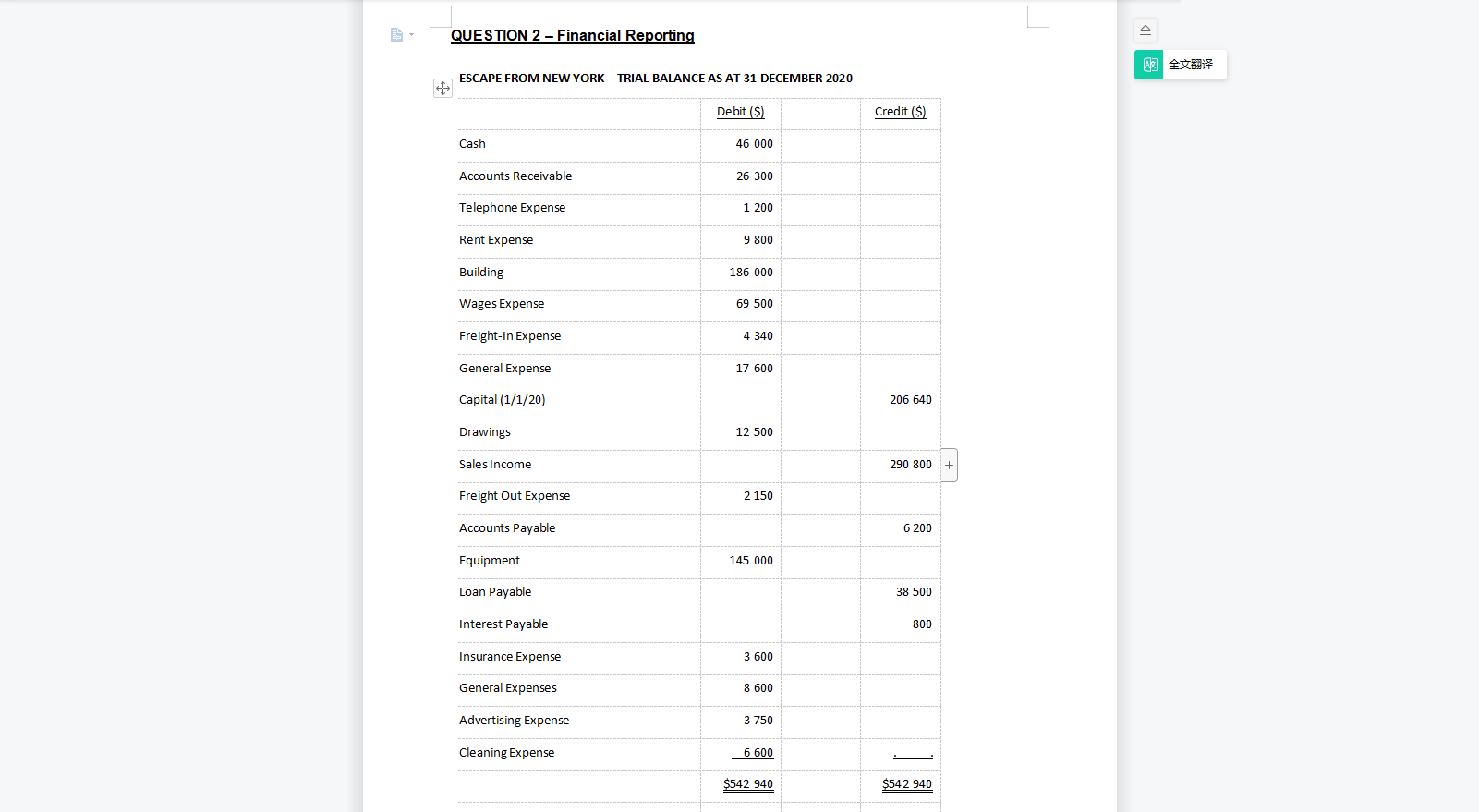

Question 1 The following events occurred during the month of June for Seagal's Acting School. June 1 The owner of Seagal's Acting School invested $180,000 cash to start the business. The owner also invested furniture worth $30,000 and equipment worth $65,000 in addition to the $180,000 cash. June 2 The owner purchased equipment for $40,000. The owner paid a $20,000 cash deposit and paid for the remainder by going to the bank and getting a loan for the rest of the amount needed to buy the equipment. June 4 Paid $950 for rent for the month of June for the business. The owner will pay rent every month until he can find a building to purchase. June 8 Purchased office supplies for $700 on credit. (Assume the supplies will all be sold by the end of June). June 12 The owner purchases some furniture for $1,000 on credit. The amount owing will be paid in July so no cash has been paid on the 12th of June. June 14 The owner paid for their personal electricity bill for the owner's house using cash from the business. The amount paid was $420. June 15 Provided services (acting classes) for the first half of the month worth $6,400 on credit and $8,900 for cash. June 16 The business paid $12,400 for wages for the first half of June. June 22 Paid electricity expense of $620 cash for the month of June. June 25 Paid the full amount owing for supplies purchased on the 8th of June. June 29 Provided services (acting classes) for the second half of the month worth $7,300 on credit and $11,200 for cash. June 30 Received $920 cash from customers who owe money for services performed on credit on the 15th of June. June 30 The business paid $14,300 for wages for the second half of June. June 30 The business paid $2,000 cash on the loan used to purchase equipment on the 2nd of June. REQUIRED: Record the events above using a perpetual inventory system in the General Journal provided in the pro-forma booklet. (10 marks)QUESTION 2 - Financial Reporting ESCAPE FROM NEW YORK - TRIAL BALANCE AS AT 31 DECEMBER 2020 Debit (S) Credit ($) Cash 46 000 Accounts Receivable 26 300 Telephone Expense 1 200 Rent Expense 9 800 Building 186 000 Wages Expense 69 500 Freight-In Expense 4 340 General Expense 17 600 Capital (1/1/20) 206 640 Drawings 12 500 Sales Income 290 800 it Freight Out Expense 2 150 Accounts Payable 6 200 Equipment 145 000 Loan Payable 38 500 Interest Payable 800 Insurance Expense 3 600 General Expenses 8 600 Advertising Expense 3 750 Cleaning Expense 6 600 $542 940 $542 940\f\fRequirements: L a. Prepare an Income Statement for the year ended 31st December 2020. (5 marks) b. Prepare a Statement of Changes in Equity for the period and a balance sheet as at 31st December 2020. (5 marks)Balance Sheet As at 31/12/20 + +Income Statement For the Year Ending 31(121'20 Statement of Changes in Equity!r For the Year Ending 31f12f20