Answered step by step

Verified Expert Solution

Question

1 Approved Answer

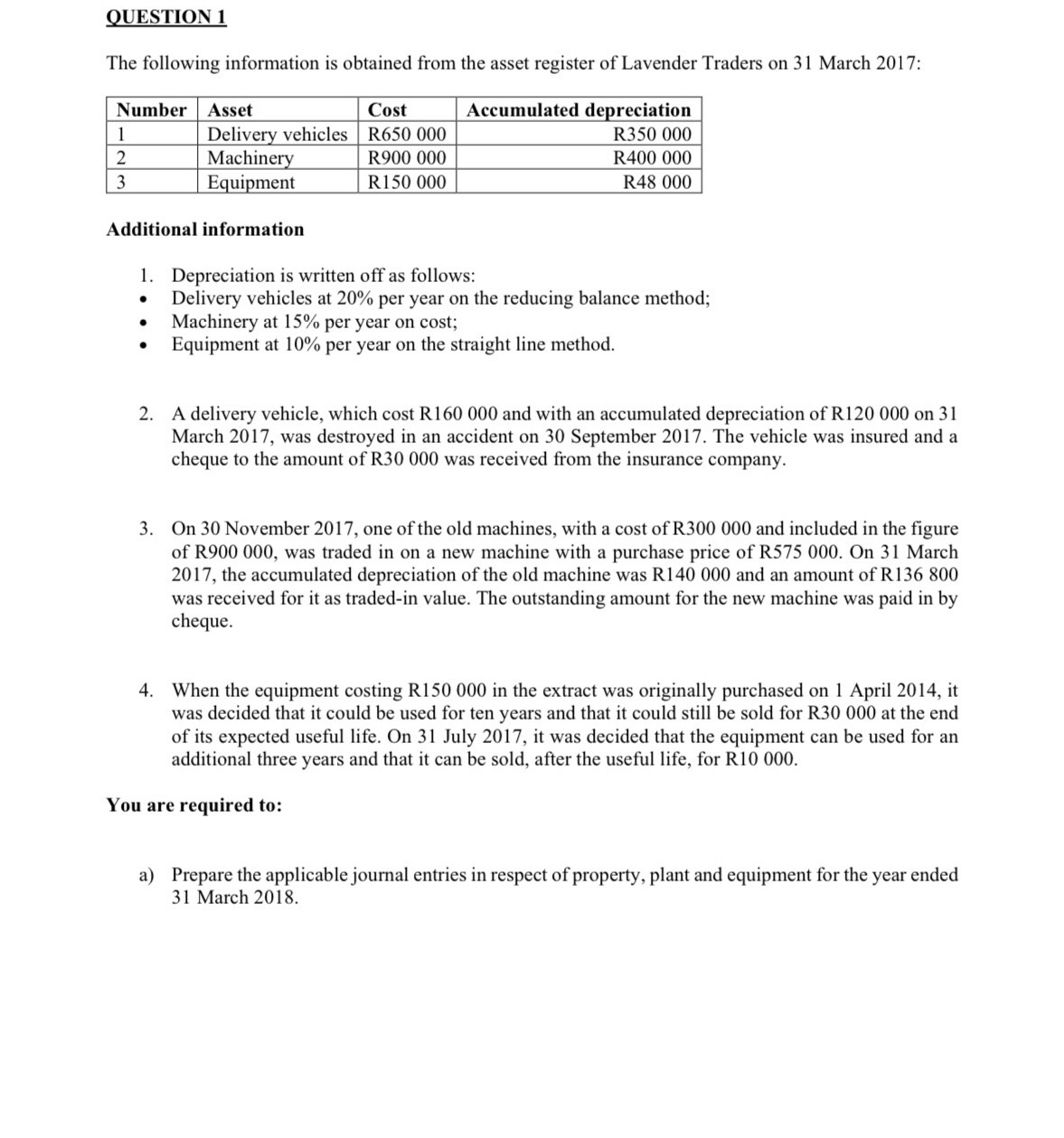

QUESTION 1 The following information is obtained from the asset register of Lavender Traders on 3 1 March 2 0 1 7 : table

QUESTION

The following information is obtained from the asset register of Lavender Traders on March :

tableNumberAsset,Cost,Accumulated depreciationDelivery vehicles,RRMachinery,RREquipment,RR

Additional information

Depreciation is written off as follows:

Delivery vehicles at per year on the reducing balance method;

Machinery at per year on cost;

Equipment at per year on the straight line method.

A delivery vehicle, which cost R and with an accumulated depreciation of R on March was destroyed in an accident on September The vehicle was insured and a cheque to the amount of R was received from the insurance company.

On November one of the old machines, with a cost of R and included in the figure of R was traded in on a new machine with a purchase price of R On March the accumulated depreciation of the old machine was R and an amount of R was received for it as tradedin value. The outstanding amount for the new machine was paid in by cheque.

When the equipment costing R in the extract was originally purchased on April it was decided that it could be used for ten years and that it could still be sold for R at the end of its expected useful life. On July it was decided that the equipment can be used for an additional three years and that it can be sold, after the useful life, for R

You are required to:

a Prepare the applicable journal entries in respect of property, plant and equipment for the year ended March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started