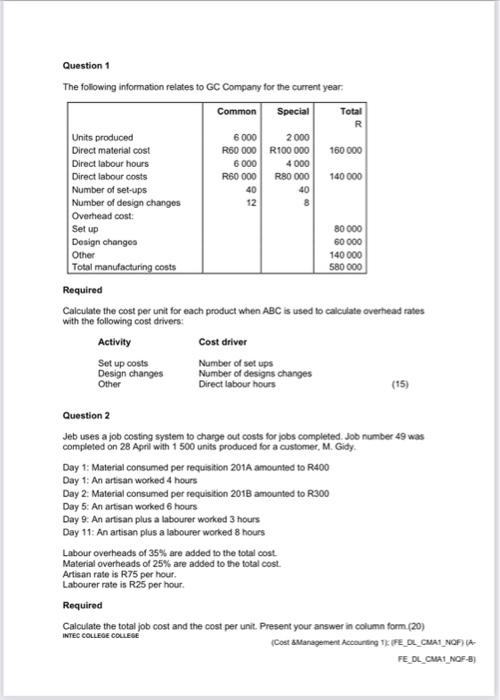

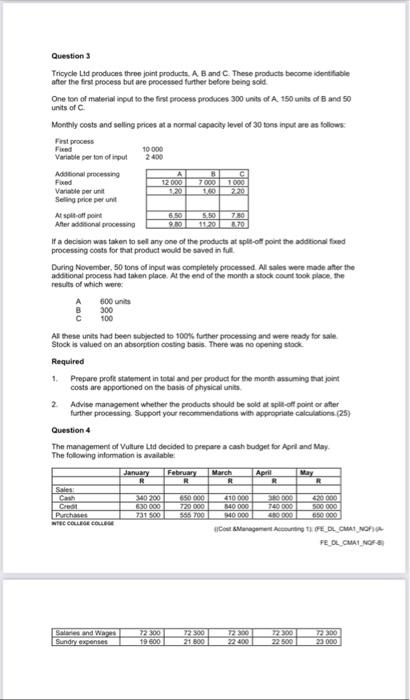

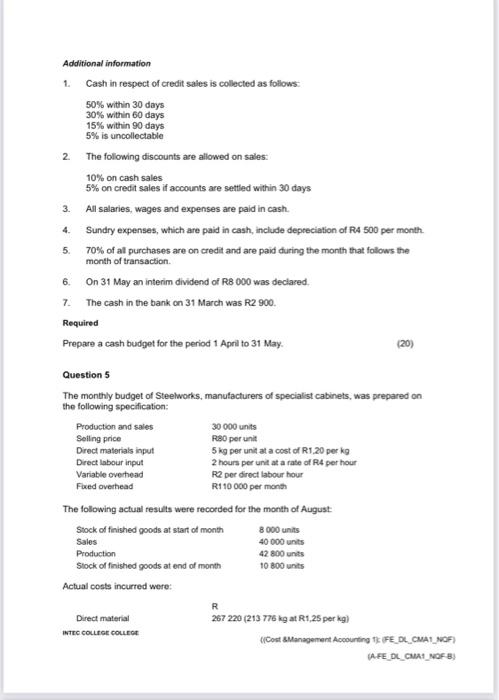

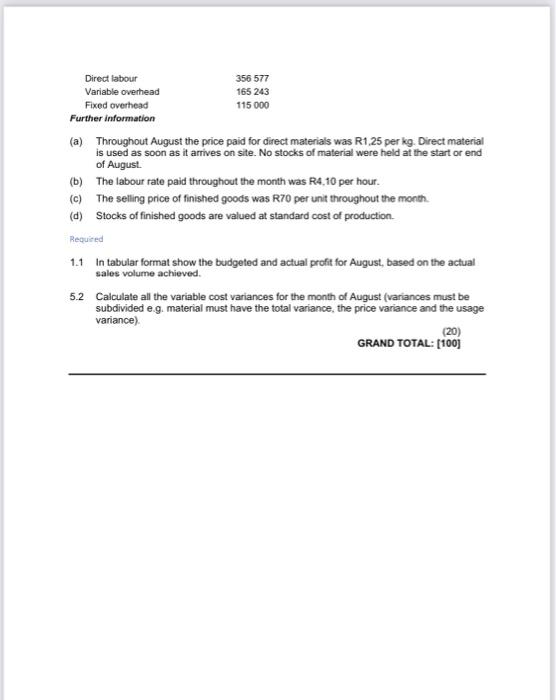

Question 1 The following information relates to GC Company for the current year: Required Calculate the cost per unit for each product when \\( A B C \\) is used to calculate overhead rates with the following cost drivers: (15) Question 2 Jeb uses a job costing system to charge out costs for jobs completed. Job number 49 was completed on 28 Apnil with 1500 units produced for a customer, M. Gidy. Day 1: Material consumed per requisition 201A amounted to R400 Day 1: An artisan worked 4 hours Day 2: Material consumed per requisition 2018 amounted to \\( R 300 \\) Day 5: An artisan woeked 6 hours Day 9: An artsan plus a labourer worked 3 hours Day 11: An artisan plus a labourer worked 8 hours Labour overheads of \35 are added to the total cost. Material overheads of \25 are added to the total cost. Artisan rate is R75 per hour. Labourer rate is R25 per hour. Required Question 3 Tricycle Lid peoduces three joint productn. A. B and C. These products become identifable after the frst process but are processed further before being sold One ton of matecial inpen to the first process produces 300 units of A. 150 unils of \\( B \\) and 50 units of \\( C \\). Morthly costs and selling prices at a normal capacity level of 30 tons input are as follow: If a decision was taken to sel any one of the products at split-off point the addionsi floed processing costs for that product would be saved in ful. During November, 50 tons of input was completoly processed. All sales were made ather the addional process had taken place. At the end of the month a stock count fook place, the resicts of which were: \\[ \\begin{array}{ll} \\text { A } & 600 \\text { unita } \\\\ \\text { B } & 300 \\\\ \\text { C } & 100 \\end{array} \\] Al these unis had been wbjected to \100 further processing and were mady for sale. Stock is valued on an absorption costing basis. There was no opening stock. Required 1. Prepare profe stalement in total and per product for the morth assuming that joint costs are apportioned on the basis of physical units. 2. Advise manapement whether the peoducts should be sold at spla-off point or affer further processing. Support your tecommendasions wh approsinate calcalabors (25) Question 4 The management of Vulure Lid decided to prepare a cash budget for Aprl and May. The folowing information is avalable. FE. D. CuAt_rica. Additional information 1. Cash in respect of credit sales is collected as follows: \50 within 30 days \30 within 60 days \15 within 90 days \5 is uncollectable 2. The following discounts are allowed on sales: \10 on cash sales \5 on credit sales if accounts are settled within 30 days 3. All salaries, wages and expenses are paid in cash. 4. Sundry expenses, which are paid in cash, include depreciation of R4 500 per month. 5. \70 of al purchases are on credit and are paid during the month that follows the month of transaction. 6. On 31 May an interim dividend of R8 000 was declared. 7. The cash in the bank on 31 March was R2 900 . Required Prepare a cash budget for the period 1 April to 31 May. (20) Question 5 The monthly budget of Steelworks, manufacturers of specialist cabinets, was prepared on the following specification: The following actual resuls were recorded for the month of August: (a) Throughout August the price paid for direct materials was R1,25 per kg. Direct material is used as soon as it arrives on site. No stocks of material were held at the start or end of August. (b) The labour rate paid throughout the month was R4,10 per hour. (c) The selling price of finished goods was R70 per unit throughout the month. (d) Stocks of finished goods are valued at standard cost of production