Answered step by step

Verified Expert Solution

Question

1 Approved Answer

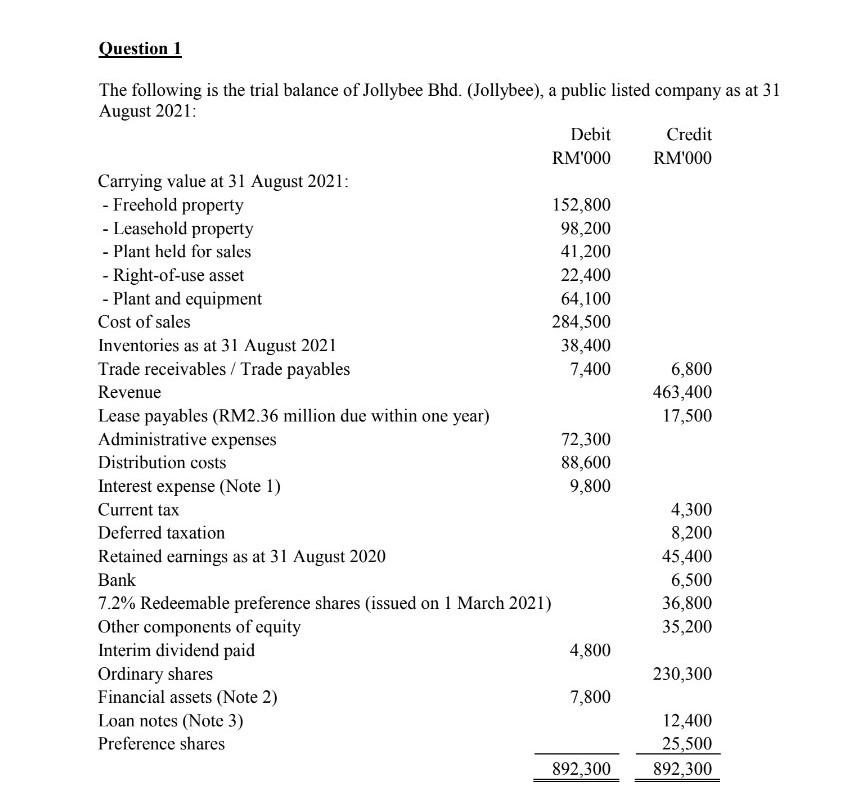

Question 1 The following is the trial balance of Jollybee Bhd. (Jollybee), a public listed company as at 31 August 2021: Carrying value at

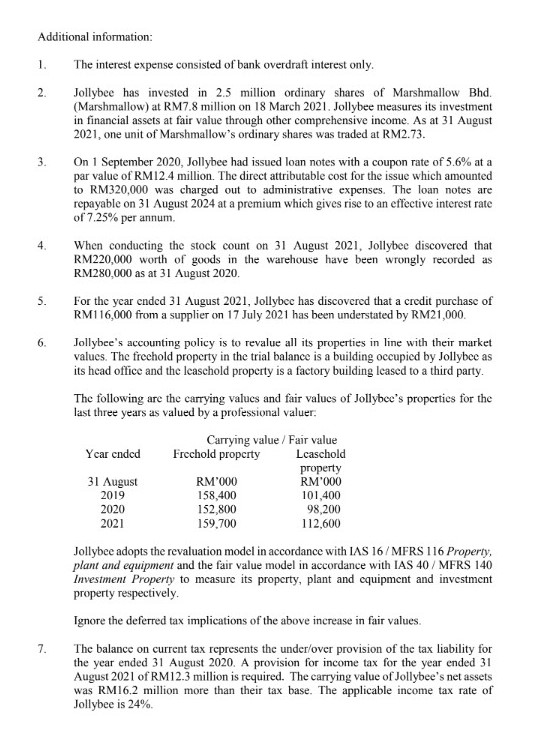

Question 1 The following is the trial balance of Jollybee Bhd. (Jollybee), a public listed company as at 31 August 2021: Carrying value at 31 August 2021: - Freehold property - Leasehold property - Plant held for sales - Right-of-use asset - Plant and equipment Cost of sales Inventories as at 31 August 2021 Trade receivables / Trade payables Revenue Lease payables (RM2.36 million due within one year) Administrative expenses Distribution costs Ordinary shares Financial assets (Note 2) Debit RM'000 Interest expense (Note 1) Current tax Deferred taxation Retained earnings as at 31 August 2020 Bank 7.2% Redeemable preference shares (issued on 1 March 2021) Other components of equity Interim dividend paid Loan notes (Note 3) Preference shares 152,800 98,200 41,200 22,400 64,100 284,500 38,400 7,400 72,300 88,600 9,800 4,800 7,800 892,300 Credit RM'000 6,800 463,400 17,500 4,300 8,200 45,400 6,500 36,800 35,200 230,300 12,400 25,500 892,300 Additional information: 1. 2. 3. 4. 5. 6. 7. The interest expense consisted of bank overdraft interest only. Jollybee has invested in 2.5 million ordinary shares of Marshmallow Bhd. (Marshmallow) at RM7.8 million on 18 March 2021. Jollybee measures its investment in financial assets at fair value through other comprehensive income. As at 31 August 2021, one unit of Marshmallow's ordinary shares was traded at RM2.73. On 1 September 2020, Jollybee had issued loan notes with a coupon rate of 5.6% at a par value of RM12.4 million. The direct attributable cost for the issue which amounted to RM320,000 was charged out to administrative expenses. The loan notes are repayable on 31 August 2024 at a premium which gives rise to an effective interest rate of 7.25% per annum. When conducting the stock count on 31 August 2021, Jollybee discovered that RM220,000 worth of goods in the warehouse have been wrongly recorded as RM280,000 as at 31 August 2020. For the year ended 31 August 2021, Jollybee has discovered that a credit purchase of RM116,000 from a supplier on 17 July 2021 has been understated by RM21,000. Jollybee's accounting policy is to revalue all its properties in line with their market values. The freehold property in the trial balance is a building occupied by Jollybee as its head office and the leasehold property is a factory building leased to a third party. The following are the carrying values and fair values of Jollybee's properties for the last three years as valued by a professional valuer: Year ended 31 August 2019 2020 2021 Carrying value / Fair value Freehold property Leasehold RM'000 158,400 152,800 159,700 property RM'000 101,400 98,200 112,600 Jollybee adopts the revaluation model in accordance with IAS 16/MFRS 116 Property, plant and equipment and the fair value model in accordance with IAS 40/MFRS 140 Investment Property to measure its property, plant and equipment and investment property respectively. Ignore the deferred tax implications of the above increase in fair values. The balance on current tax represents the under/over provision of the tax liability for the year ended 31 August 2020. A provision for income tax for the year ended 31 August 2021 of RM12.3 million is required. The carrying value of Jollybee's net assets was RM16.2 million more than their tax base. The applicable income tax rate of Jollybee is 24%. Required: Prepare for Jollybee Bhd. the statement of profit or loss and other comprehensive income and statement of changes in equity for the year ended 31 August 2021 and the statement of financial position as at that date in accordance with approved accounting standards. [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss and Other Comprehensive Income for Jollybee Bhd for the Year Ended 31 Au...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started