Answered step by step

Verified Expert Solution

Question

1 Approved Answer

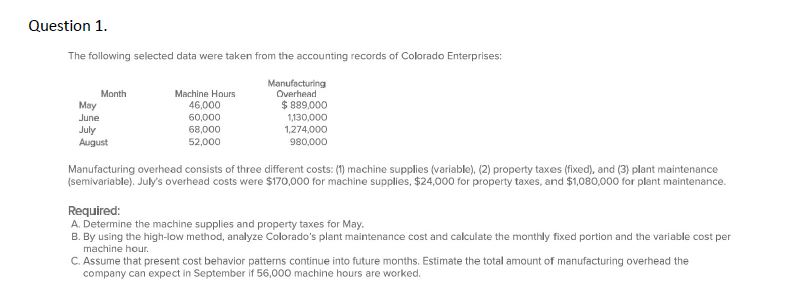

Question 1. The following selected data were taken from the accounting records of Colorado Enterprises: Month May June July August Machine Hours Manufacturing Overhead

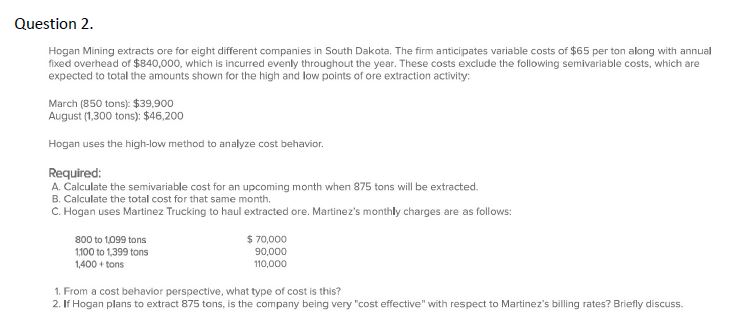

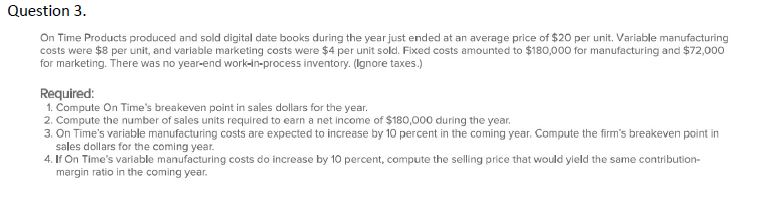

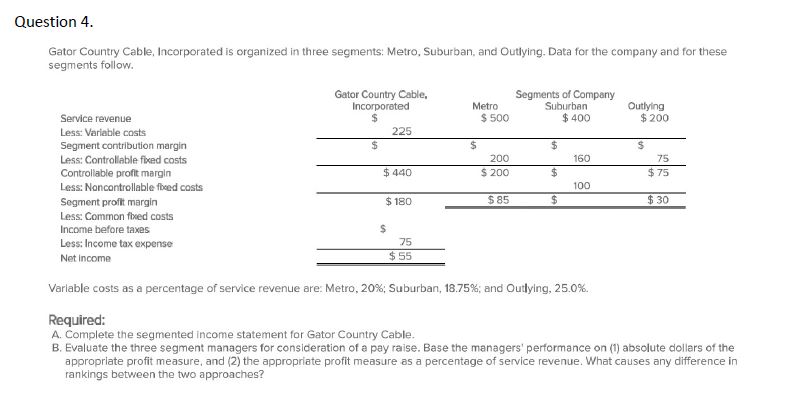

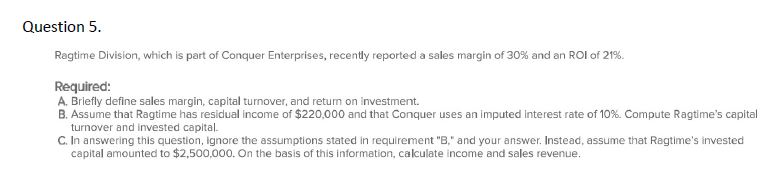

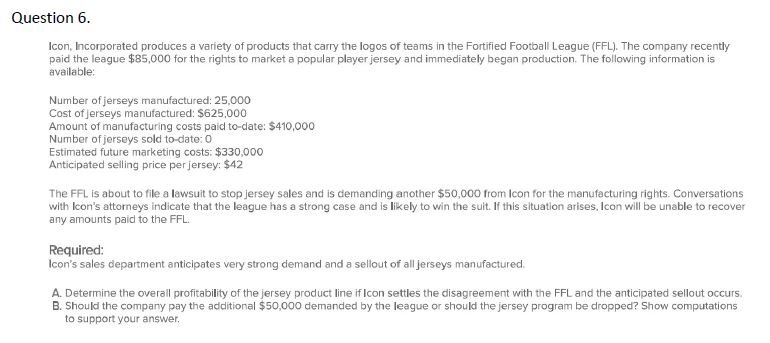

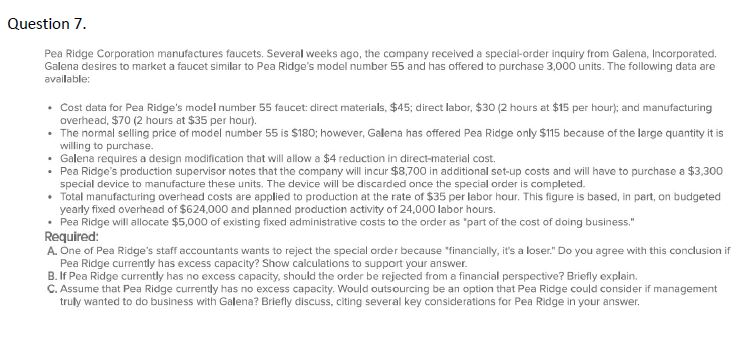

Question 1. The following selected data were taken from the accounting records of Colorado Enterprises: Month May June July August Machine Hours Manufacturing Overhead 46,000 $889,000 60,000 68,000 52,000 1,130,000 1,274,000 980,000 Manufacturing overhead consists of three different costs: (1) machine supplies (variable), (2) property taxes (fixed), and (3) plant maintenance (semivariable). July's overhead costs were $170,000 for machine supplies, $24,000 for property taxes, and $1,080,000 for plant maintenance. Required: A. Determine the machine supplies and property taxes for May. B. By using the high-low method, analyze Colorado's plant maintenance cost and calculate the monthly fixed portion and the variable cost per machine hour. C. Assume that present cost behavior patterns continue into future months. Estimate the total amount of manufacturing overhead the company can expect in September if 56,000 machine hours are worked. Question 2. Hogan Mining extracts ore for eight different companies in South Dakota. The firm anticipates variable costs of $65 per ton along with annual fixed overhead of $840,000, which is incurred evenly throughout the year. These costs exclude the following semivariable costs, which are expected to total the amounts shown for the high and low points of ore extraction activity: March (850 tons): $39,900 August (1,300 tons): $46,200 Hogan uses the high-low method to analyze cost behavior. Required: A. Calculate the semivariable cost for an upcoming month when 875 tons will be extracted. B. Calculate the total cost for that same month. C. Hogan uses Martinez Trucking to haul extracted ore. Martinez's monthly charges are as follows: 800 to 1,099 tons 1,100 to 1,399 tons 1,400 + tons $70,000 90,000 110,000 1. From a cost behavior perspective, what type of cost is this? 2. If Hogan plans to extract 875 tons, is the company being very "cost effective" with respect to Martinez's billing rates? Briefly discuss. Question 3. On Time Products produced and sold digital date books during the year just ended at an average price of $20 per unit. Variable manufacturing costs were $8 per unit, and variable marketing costs were $4 per unit sold. Fixed costs amounted to $180,000 for manufacturing and $72,000 for marketing. There was no year-end work-in-process inventory. (Ignore taxes.) Required: 1. Compute On Time's breakeven point in sales dollars for the year. 2. Compute the number of sales units required to earn a net income of $180,000 during the year. 3. On Time's variable manufacturing costs are expected to increase by 10 per cent in the coming year. Compute the firm's breakeven point in sales dollars for the coming year. 4. If On Time's variable manufacturing costs do increase by 10 percent, compute the selling price that would yield the same contribution- margin ratio in the coming year. Question 4. Gator Country Cable, Incorporated is organized in three segments: Metro, Suburban, and Outlying. Data for the company and for these segments follow. Service revenue Less: Variable costs Segment contribution margin Less: Controllable fixed costs Controllable profit margin Less: Noncontrollable fixed costs Segment profit margin Less: Common fixed costs Income before taxes Less: Income tax expense Net income Gator Country Cable, Incorporated Metro Segments of Company Suburban Outlying $ $ 500 $ 400 $200 225 $ $ $ 200 160 75 $440 $ 200 $ $75 100 $ 180 $85 $ $30 $ 75 $55 Variable costs as a percentage of service revenue are: Metro, 20%; Suburban, 18.75%; and Outlying, 25.0%. Required: A. Complete the segmented income statement for Gator Country Cable. B. Evaluate the three segment managers for consideration of a pay raise. Base the managers' performance on (1) absolute dollars of the appropriate profit measure, and (2) the appropriate profit measure as a percentage of service revenue. What causes any difference in rankings between the two approaches? Question 5. Ragtime Division, which is part of Conquer Enterprises, recently reported a sales margin of 30% and an ROI of 21%. Required: A. Briefly define sales margin, capital turnover, and return on investment. B. Assume that Ragtime has residual income of $220,000 and that Conquer uses an imputed interest rate of 10% Compute Ragtime's capital turnover and invested capital. C. In answering this question, ignore the assumptions stated in requirement "B," and your answer. Instead, assume that Ragtime's invested capital amounted to $2,500,000. On the basis of this information, calculate income and sales revenue. Question 6. Icon, Incorporated produces a variety of products that carry the logos of teams in the Fortified Football League (FFL). The company recently paid the league $85,000 for the rights to market a popular player jersey and immediately began production. The following information is available: Number of jerseys manufactured: 25,000 Cost of jerseys manufactured: $625,000 Amount of manufacturing costs paid to-date: $410,000 Number of jerseys sold to-date: 0 Estimated future marketing costs: $330,000 Anticipated selling price per jersey: $42 The FFL is about to file a lawsuit to stop jersey sales and is demanding another $50,000 from Icon for the manufacturing rights. Conversations with Icon's attorneys indicate that the league has a strong case and is likely to win the suit. If this situation arises, Icon will be unable to recover any amounts paid to the FFL. Required: Icon's sales department anticipates very strong demand and a sellout of all jerseys manufactured. A. Determine the overall profitability of the jersey product line if Icon settles the disagreement with the FFL and the anticipated sellout occurs. B. Should the company pay the additional $50,000 demanded by the league or should the jersey program be dropped? Show computations to support your answer. Question 7. Pea Ridge Corporation manufactures faucets. Several weeks ago, the company received a special-order inquiry from Galena, Incorporated. Galena desires to market a faucet similar to Pea Ridge's model number 55 and has offered to purchase 3,000 units. The following data are available: Cost data for Pea Ridge's model number 55 faucet: direct materials, $45; direct labor, $30 (2 hours at $15 per hour); and manufacturing overhead, $70 (2 hours at $35 per hour). The normal selling price of model number 55 is $180; however, Galena has offered Pea Ridge only $115 because of the large quantity it is willing to purchase. Galena requires a design modification that will allow a $4 reduction in direct-material cost. Pea Ridge's production supervisor notes that the company will incur $8,700 in additional set-up costs and will have to purchase a $3,300 special device to manufacture these units. The device will be discarded once the special order is completed. Total manufacturing overhead costs are applied to production at the rate of $35 per labor hour. This figure is based, in part, on budgeted yearly fixed overhead of $624,000 and planned production activity of 24,000 labor hours. Pea Ridge will allocate $5,000 of existing fixed administrative costs to the order as "part of the cost of doing business." Required: A. One of Pea Ridge's staff accountants wants to reject the special order because "financially, it's a loser." Do you agree with this conclusion if Pea Ridge currently has excess capacity? Show calculations to support your answer. B. If Pea Ridge currently has no excess capacity, should the order be rejected from a financial perspective? Briefly explain. C. Assume that Pea Ridge currently has no excess capacity. Would outsourcing be an option that Pea Ridge could consider if management truly wanted to do business with Galena? Briefly discuss, citing several key considerations for Pea Ridge in your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started