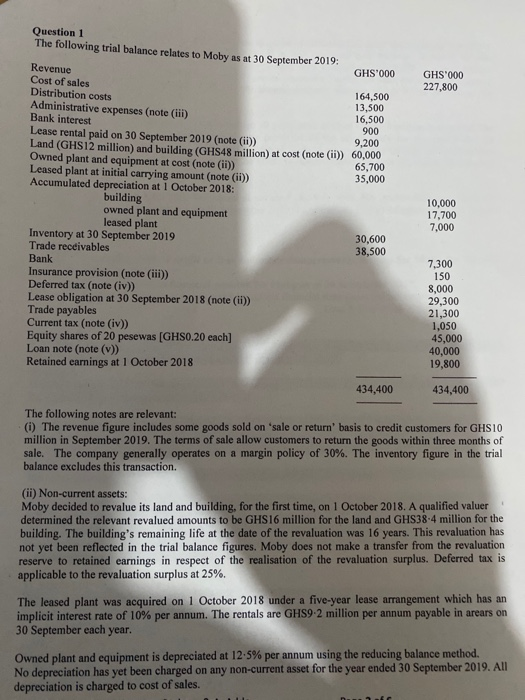

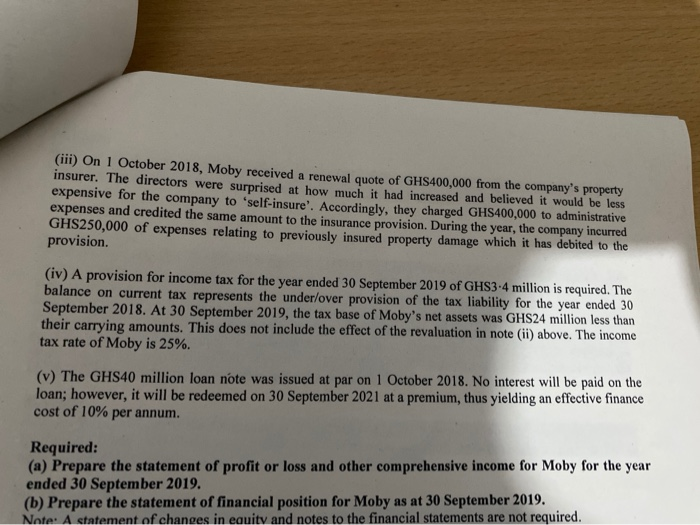

Question 1 The following trial balance relates to Moby as at 30 September 2019: Revenue GHS'000 GHS'000 Cost of sales 227,800 Distribution costs 164,500 Administrative expenses (note (iii) 13,500 Bank interest 16,500 900 Lease rental paid on 30 September 2019 (note (ii)) 9,200 Land (GHS12 million) and building (GHS48 million) at cost (note (ii) 60,000 Owned plant and equipment at cost (note (ii)) Leased plant at initial carrying amount (note (ii)) 65,700 35,000 Accumulated depreciation at 1 October 2018: building 10,000 owned plant and equipment 17,700 leased plant 7,000 Inventory at 30 September 2019 30,600 Trade receivables 38,500 Bank 7,300 Insurance provision (note (iii)) 150 Deferred tax (note (iv)) 8,000 Lease obligation at 30 September 2018 (note (ii)) 29,300 Trade payables 21,300 Current tax (note (iv)) 1,050 Equity shares of 20 pesewas [GHS0.20 each] 45,000 Loan note (note (v)) 40,000 Retained earnings at 1 October 2018 19,800 434,400 434,400 The following notes are relevant: () The revenue figure includes some goods sold on 'sale or return' basis to credit customers for GHS10 million in September 2019. The terms of sale allow customers to return the goods within three months of sale. The company generally operates on a margin policy of 30%. The inventory figure in the trial balance excludes this transaction. (ii) Non-current assets: Moby decided to revalue its land and building, for the first time, on 1 October 2018. A qualified valuer determined the relevant revalued amounts to be GHS16 million for the land and GHS38-4 million for the building. The building's remaining life at the date of the revaluation was 16 years. This revaluation has not yet been reflected in the trial balance figures. Moby does not make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Deferred tax is applicable to the revaluation surplus at 25%. The leased plant was acquired on 1 October 2018 under a five-year lease arrangement which has an implicit interest rate of 10% per annum. The rentals are GHS9.2 million per annum payable in arears on 30 September each year. Owned plant and equipment is depreciated at 12.5% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 2019. All depreciation is charged to cost of sales. (iii) On 1 October 2018, Moby received a renewal quote of GHS400,000 from the company's property insurer. The directors were surprised at how much it had increased and believed it would be less expensive for the company to 'self-insure'. Accordingly, they charged GHS400,000 to administrative expenses and credited the same amount to the insurance provision. During the year, the company incurred GHS250,000 of expenses relating to previously insured property damage which it has debited to the provision. (iv) A provision for income tax for the year ended 30 September 2019 of GHS3-4 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2018. At 30 September 2019, the tax base of Moby's net assets was GHS24 million less than their carrying amounts. This does not include the effect of the revaluation in note (ii) above. The income tax rate of Moby is 25%. (v) The GHS40 million loan note was issued at par on 1 October 2018. No interest will be paid on the loan; however, it will be redeemed on 30 September 2021 at a premium, thus yielding an effective finance cost of 10% per annum. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Moby for the year ended 30 September 2019. (b) Prepare the statement of financial position for Moby as at 30 September 2019. Note: A statement of changes in eauity and notes to the financial statements are not required. Question 1 The following trial balance relates to Moby as at 30 September 2019: Revenue GHS'000 GHS'000 Cost of sales 227,800 Distribution costs 164,500 Administrative expenses (note (iii) 13,500 Bank interest 16,500 900 Lease rental paid on 30 September 2019 (note (ii)) 9,200 Land (GHS12 million) and building (GHS48 million) at cost (note (ii) 60,000 Owned plant and equipment at cost (note (ii)) Leased plant at initial carrying amount (note (ii)) 65,700 35,000 Accumulated depreciation at 1 October 2018: building 10,000 owned plant and equipment 17,700 leased plant 7,000 Inventory at 30 September 2019 30,600 Trade receivables 38,500 Bank 7,300 Insurance provision (note (iii)) 150 Deferred tax (note (iv)) 8,000 Lease obligation at 30 September 2018 (note (ii)) 29,300 Trade payables 21,300 Current tax (note (iv)) 1,050 Equity shares of 20 pesewas [GHS0.20 each] 45,000 Loan note (note (v)) 40,000 Retained earnings at 1 October 2018 19,800 434,400 434,400 The following notes are relevant: () The revenue figure includes some goods sold on 'sale or return' basis to credit customers for GHS10 million in September 2019. The terms of sale allow customers to return the goods within three months of sale. The company generally operates on a margin policy of 30%. The inventory figure in the trial balance excludes this transaction. (ii) Non-current assets: Moby decided to revalue its land and building, for the first time, on 1 October 2018. A qualified valuer determined the relevant revalued amounts to be GHS16 million for the land and GHS38-4 million for the building. The building's remaining life at the date of the revaluation was 16 years. This revaluation has not yet been reflected in the trial balance figures. Moby does not make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Deferred tax is applicable to the revaluation surplus at 25%. The leased plant was acquired on 1 October 2018 under a five-year lease arrangement which has an implicit interest rate of 10% per annum. The rentals are GHS9.2 million per annum payable in arears on 30 September each year. Owned plant and equipment is depreciated at 12.5% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 2019. All depreciation is charged to cost of sales. (iii) On 1 October 2018, Moby received a renewal quote of GHS400,000 from the company's property insurer. The directors were surprised at how much it had increased and believed it would be less expensive for the company to 'self-insure'. Accordingly, they charged GHS400,000 to administrative expenses and credited the same amount to the insurance provision. During the year, the company incurred GHS250,000 of expenses relating to previously insured property damage which it has debited to the provision. (iv) A provision for income tax for the year ended 30 September 2019 of GHS3-4 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2018. At 30 September 2019, the tax base of Moby's net assets was GHS24 million less than their carrying amounts. This does not include the effect of the revaluation in note (ii) above. The income tax rate of Moby is 25%. (v) The GHS40 million loan note was issued at par on 1 October 2018. No interest will be paid on the loan; however, it will be redeemed on 30 September 2021 at a premium, thus yielding an effective finance cost of 10% per annum. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Moby for the year ended 30 September 2019. (b) Prepare the statement of financial position for Moby as at 30 September 2019. Note: A statement of changes in eauity and notes to the financial statements are not required