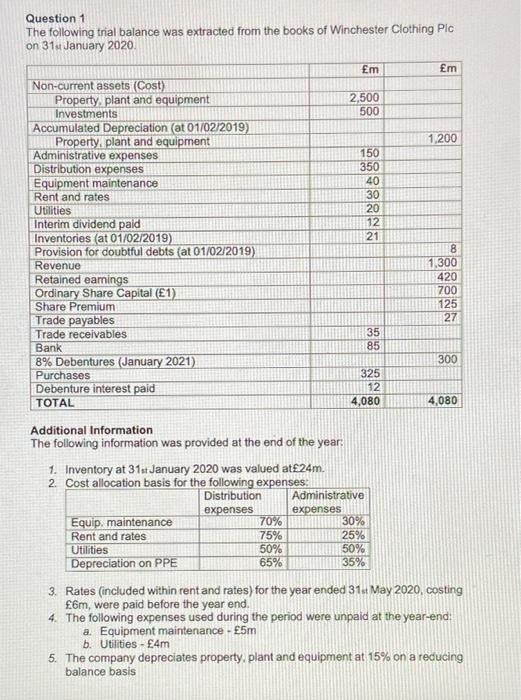

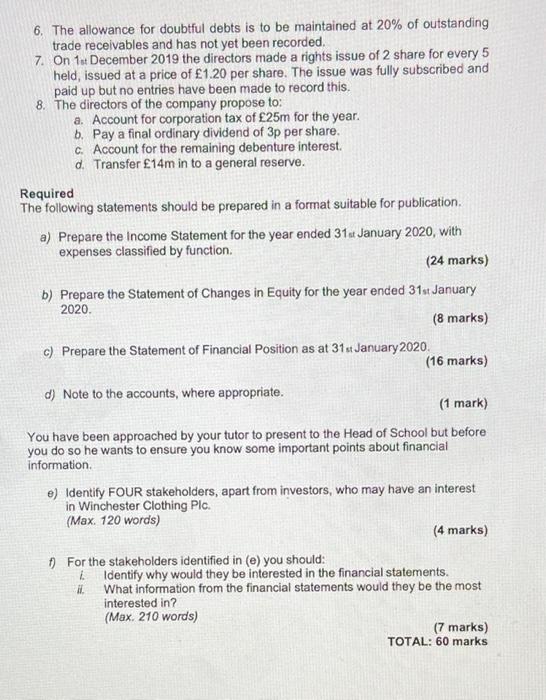

Question 1 The following trial balance was extracted from the books of Winchester Clothing Plc on 31 January 2020 m m 2,500 500 1,200 150 350 40 30 20 12 21 Non-current assets (Cost) Property plant and equipment Investments Accumulated Depreciation (at 01/02/2019) Property, plant and equipment Administrative expenses Distribution expenses Equipment maintenance Rent and rates Utilities Interim dividend paid Inventories (at 01/02/2019) Provision for doubtful debts (at 01/02/2019) Revenue Retained earnings Ordinary Share Capital (1) Share Premium Trade payables Trade receivables Bank 8% Debentures (January 2021) Purchases Debenture interest paid TOTAL 8 1.300 420 700 125 27 35 85 300 325 12 4,080 4,080 Additional Information The following information was provided at the end of the year. 1. Inventory at 31st January 2020 was valued at24m. 2. Cost allocation basis for the following expenses: Distribution Administrative expenses expenses Equip, maintenance 70% 30% Rent and rates 75% 25% Utilities 50% 50% Depreciation on PPE 65% 35% 3. Rates (included within rent and rates) for the year ended 31 May 2020, costing 6m, were paid before the year end. 4. The following expenses used during the period were unpaid at the year-end a. Equipment maintenance - 5m b. Utilities - 4m 5. The company depreciates property, plant and equipment at 15% on a reducing balance basis 6. The allowance for doubtful debts is to be maintained at 20% of outstanding trade receivables and has not yet been recorded. 7. On 1. December 2019 the directors made a rights issue of 2 share for every 5 held, issued at a price of 1.20 per share. The issue was fully subscribed and paid up but no entries have been made to record this. 8. The directors of the company propose to: a. Account for corporation tax of 25m for the year. b. Pay a final ordinary dividend of 3p per share. c. Account for the remaining debenture interest d. Transfer 14m in to a general reserve. Required The following statements should be prepared in a format suitable for publication a) Prepare the income Statement for the year ended 31st January 2020, with expenses classified by function (24 marks) b) Prepare the Statement of Changes in Equity for the year ended 31st January 2020 (8 marks) C) Prepare the Statement of Financial Position as at 31st January 2020 (16 marks) d) Note to the accounts, where appropriate. (1 mark) You have been approached by your tutor to present to the Head of School but before you do so he wants to ensure you know some important points about financial information e) Identify FOUR stakeholders, apart from investors, who may have an interest in Winchester Clothing Plc. (Max. 120 words) (4 marks) For the stakeholders identified in (e) you should: Identify why would they be interested in the financial statements. H. What information from the financial statements would they be the most interested in? (Max 210 words) (7 marks) TOTAL: 60 marks