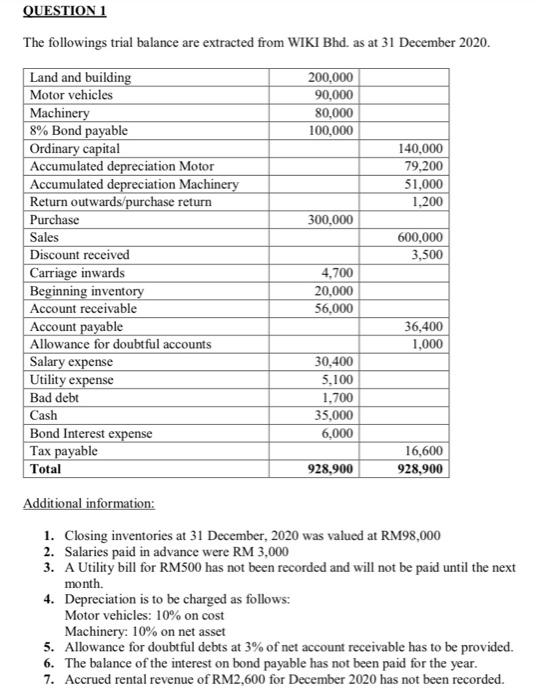

QUESTION 1 The followings trial balance are extracted from WIKI Bhd. as at 31 December 2020. Land and building 200,000 Motor vehicles 90,000 Machinery 80,000 8% Bond payable 100,000 Ordinary capital 140,000 Accumulated depreciation Motor 79,200 Accumulated depreciation Machinery 51,000 Return outwards/purchase return 1,200 Purchase 300,000 Sales 600,000 Discount received 3,500 Carriage inwards 4,700 Beginning inventory 20,000 Account receivable 56,000 Account payable 36,400 Allowance for doubtful accounts 1,000 Salary expense 30,400 Utility expense 5.100 Bad debt 1.700 Cash 35,000 Bond Interest expense 6,000 Tax payable 16,600 Total 928,900 928,900 Additional information: 1. Closing inventories at 31 December, 2020 was valued at RM98.000 2. Salaries paid in advance were RM 3,000 3. A Utility bill for RM500 has not been recorded and will not be paid until the next month. 4. Depreciation is to be charged as follows: Motor vehicles: 10% on cost Machinery: 10% on net asset 5. Allowance for doubtful debts at 3% of net account receivable has to be provided. 6. The balance of the interest on bond payable has not been paid for the year. 7. Accrued rental revenue of RM2,600 for December 2020 has not been recorded. Required: (a) Prepare an Income statement for the year ended 31 December, 2020 (12 marks) (b) Prepare the statement of Financial position as at 31 December, 2020. (13 marks) Total: 25 marks QUESTION 1 The followings trial balance are extracted from WIKI Bhd. as at 31 December 2020. Land and building 200,000 Motor vehicles 90,000 Machinery 80,000 8% Bond payable 100,000 Ordinary capital 140,000 Accumulated depreciation Motor 79,200 Accumulated depreciation Machinery 51,000 Return outwards/purchase return 1,200 Purchase 300,000 Sales 600,000 Discount received 3,500 Carriage inwards 4,700 Beginning inventory 20,000 Account receivable 56,000 Account payable 36,400 Allowance for doubtful accounts 1,000 Salary expense 30,400 Utility expense 5.100 Bad debt 1.700 Cash 35,000 Bond Interest expense 6,000 Tax payable 16,600 Total 928,900 928,900 Additional information: 1. Closing inventories at 31 December, 2020 was valued at RM98.000 2. Salaries paid in advance were RM 3,000 3. A Utility bill for RM500 has not been recorded and will not be paid until the next month. 4. Depreciation is to be charged as follows: Motor vehicles: 10% on cost Machinery: 10% on net asset 5. Allowance for doubtful debts at 3% of net account receivable has to be provided. 6. The balance of the interest on bond payable has not been paid for the year. 7. Accrued rental revenue of RM2,600 for December 2020 has not been recorded. Required: (a) Prepare an Income statement for the year ended 31 December, 2020 (12 marks) (b) Prepare the statement of Financial position as at 31 December, 2020. (13 marks) Total: 25 marks